Over the years, investing in gold has gained immense popularity as a method for securing your financial future. In 2025, you’ll want to choose the right platform for your Gold IRA to ensure the best protection for your hard-earned assets. In this guide, we’ll explore the top tools and platforms that will help you make informed decisions, maximize your investments, and keep your finances safe from market fluctuations. Let’s dive in and find the perfect solution for your gold investment journey!

>>>>>>>>>Get Your Free Gold IRA Kit<<<<<<<<<<<

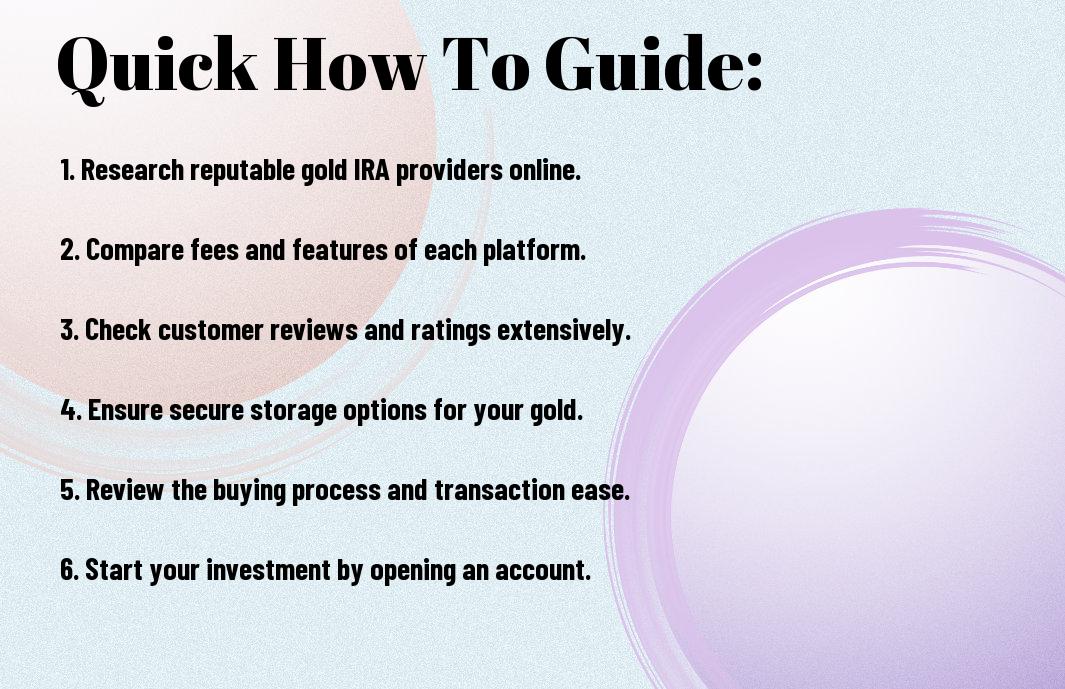

How to Choose the Right Gold IRA Tool

For anyone looking to invest in gold, selecting the right Gold IRA tool can significantly impact your long-term success and peace of mind. It’s necessary to evaluate various platforms by considering their features, fees, and customer service to ensure you make an informed decision that aligns with your financial goals.

Factors to Consider

You should think about several factors while choosing your Gold IRA tool. Focus on:

- Reputation of the platform

- Fees associated with transactions

- Investment options available

- Customer service accessibility

You must prioritize a platform that meets your needs and offers reliable support.

Tips for Evaluating Platforms

There’s no shortage of options when it comes to gold IRA platforms, so evaluating each one carefully is vital. Consider:

- Regulatory compliance

- Years in business

- Client reviews and testimonials

- Educational resources provided

Any choice you make should prioritize transparency and a commitment to your success.

Understanding the customization options and resources each platform offers can enhance your investment experience. Look for platforms that provide a user-friendly interface and personalized support. It’s also wise to explore physical asset storage and buyback programs that ensure the security of your investments. Novel features like mobile apps and data security measures can further enhance your experience. Any information you gather will serve to guide your decision, ensuring you invest wisely.

How to Set Up Your Gold IRA

Some individuals may find the process of setting up a Gold IRA slightly daunting, but it can be very straightforward with the right tools and guidance. Securing your retirement savings with gold requires a few necessary steps, and getting started is easier than you think!

Step-by-Step Guide

Any successful Gold IRA setup requires following a clear process. Here’s a simple breakdown:

| Step | Description |

| Choose a Custodian | Select an IRS-approved company to manage your Gold IRA. |

| Fund Your Account | Transfer or roll over funds from an existing retirement account. |

| Select Gold | Pick eligible gold products to invest in for your IRA. |

| Complete Transactions | Finalize your purchases through your custodian. |

| Store Your Gold | Choose a secure storage facility recommended by your custodian. |

Common Pitfalls to Avoid

If you’re not careful, setting up a Gold IRA can lead to some easily avoidable mistakes. Make sure you’re aware of these to ensure a smooth process.

Plus, it’s necessary to steer clear of high fees, unapproved gold products, and untrustworthy custodians. Not understanding the tax implications of your rollover can result in unnecessary penalties that could eat into your savings. So, always conduct thorough research, confirm that your chosen gold products meet IRS regulations, and take advantage of the guidance provided by your custodian. By being cautious and informed, you can navigate your Gold IRA journey with confidence!

How to Fund Your Gold IRA Account

After selecting the right Gold IRA platform, you need to fund your account to start investing in precious metals. This typically involves rolling over funds from an existing retirement account or making a direct contribution. Always consult with a financial advisor to ensure that you maximize your potential benefits while adhering to IRS regulations.

Funding Options Explained

On your journey to fund your Gold IRA, you have several options. You can choose to conduct a 401(k) rollover, IRA transfer, or make direct contributions. Each method has specific tax implications and eligibility requirements, so understanding these will help you make a well-informed decision.

Tips for a Smooth Transition

Transitioning your retirement funds into a Gold IRA can be a straightforward process if you take care in planning. Follow these tips to ensure everything goes smoothly:

- Research trustworthy custodians to manage your IRA.

- Check the fees associated with your Gold IRA.

- Understand the investment options offered.

This will help you avoid any unnecessary hiccups during your transition.

This transition process can sometimes be overwhelming, but arming yourself with the right knowledge can pave the way for a successful experience. Ensure you stay organized and have all your documents ready for submission.

- Have a list of frequently asked questions you can refer to.

- Contact your financial advisor for guidance.

- Keep track of any timelines you need to follow.

This level of preparation will help you achieve your financial goals while safeguarding your investments.

How to Select Gold Investments for Your IRA

Not every gold investment is suitable for your IRA. It’s important to analyze different options to ensure they fit your financial goals. Look at factors like liquidity, storage fees, and potential growth. Balancing risk and reward will lead to sound decisions as you navigate through your gold investment journey.

Types of Gold Investments

For your IRA, you can consider various types of gold investments:

| Gold Coins | Popular choice due to historical value and liquidity. |

| Gold Bars | Typically cost-effective, especially for larger investments. |

| Gold ETFs | Easily traded on stock exchanges for convenient access. |

| Gold Mining Stocks | Indirect investment that tracks the performance of mining companies. |

| Gold-Backed Securities | Varies by issuer but can provide attractive returns. |

Any choice you make should align with your investment strategy and long-term objectives.

Factors Influencing Your Choices

Any decisions you make can be influenced by several factors. Understanding these will help you refine your investment approach:

- Market Trends

- Investment Goals

- Risk Tolerance

- Storage Solutions

- Tax Implications

After evaluating these factors, you can make more informed choices with your investments.

Choices like your storage solutions and the tax implications can significantly affect your overall returns. It’s important to weigh the advantages and disadvantages of each option carefully. For example, some storage solutions come with high fees, while keeping assets at home may pose a security risk. Ultimately, your investment goals and risk tolerance should drive your selections.

- Long-term vision

- Financial advice

- Diversification strategies

- Portfolio management

- Investment research

After thorough consideration of these aspects, your optimal gold investment choices will become clearer.

How to Manage Your Gold IRA Effectively

To manage your Gold IRA effectively, it’s imperative to stay informed about the market trends and performance of your investments. Regularly reviewing your portfolio and understanding the potential benefits and risks associated with gold can help you make informed decisions. Establish a routine to assess your holdings, as this can enhance your investment strategy and lead to better financial outcomes.

>>>>>>>>>>>>>Compare Top Gold IRA Platforms<<<<<<<<<<<<<

Monitoring Your Investments

The key to successful management of your Gold IRA is consistent monitoring. Keeping an eye on gold prices and expert analyses will empower you to react promptly to market changes. Utilize reliable resources and platforms that provide real-time updates to stay ahead in your investment journey.

Tips for Rebalancing Your Portfolio

Assuming you regularly monitor your investments, *rebalancing your portfolio* becomes a vital strategy. It is important to periodically adjust your asset allocation to maintain your investment objectives and risk tolerance. Here are some tips for effective rebalancing:

- Assess your current *asset allocation*.

- Consider your *investment goals*.

- Reevaluate based on changes in *market conditions*.

Knowing when to make these adjustments can significantly impact your overall portfolio performance.

For instance, if gold prices experience fluctuations, *adjusting your holdings* may help you capitalize on potential gains while minimizing losses. By routinely checking the weight of gold in your portfolio against your *investment strategy*, you can determine when a rebalancing act is necessary. Consider these tactics:

- Have a clear *investment strategy*.

- Keep an eye on any *personal financial changes*.

- Act quickly on significant *market shifts*.

Knowing how to rebalance effectively ensures you remain aligned with your financial goals.

How to Withdraw from Your Gold IRA

Your journey to withdraw from your Gold IRA can be straightforward if you understand the process. It’s vital to follow the guidelines set by the IRS, as withdrawing funds prematurely can lead to penalties. Be sure to consider your financial needs and tax implications, especially when planning your withdrawal strategy to maximize your benefits.

Understanding Withdrawal Rules

Your knowledge of the withdrawal rules is key to avoiding penalties. Generally, you can withdraw funds after reaching age 59½ without incurring additional taxes. However, if you withdraw before this age, you might face a 10% early withdrawal penalty on top of regular income taxes. Therefore, it’s important to consult with a tax advisor for personalized guidance.

Tips for a Tax-Efficient Withdrawal

Withdrawal from your Gold IRA can have significant tax implications. To approach a tax-efficient strategy, consider the following tips:

- Evaluate the timing of your withdrawal to minimize tax impact.

- Explore the option of transferring amounts directly to a Roth IRA.

- Consider taking distributions in lower-income years to reduce tax burden.

After implementing these tips, you can enjoy your assets while maintaining tax efficiency.

Withdrawal from your Gold IRA can be managed wisely to minimize tax liabilities. Taking distributions strategically, such as during years of lower income or opting for direct transfers to different accounts, can be significantly beneficial. Be aware of the tax implications while planning your withdrawal; knowing your tax bracket can influence how much you choose to withdraw at a time.

- Review your income yearly to pick the best withdrawal timing.

- Consider utilizing your retirement account options strategically.

- Consult with a tax professional for tailored advice.

After making informed decisions regarding your withdrawals, you can achieve better financial outcomes.

Understanding the withdrawal process is paramount. Familiarizing yourself with penalties and the timing can save you from unexpected financial strain, allowing you to manage your retirement savings effectively.

To wrap up

So, as you explore the best Gold IRA tools and top platforms in 2025, it’s important to find options that align with your financial goals and values. Whether you’re new to investing or looking to diversify your portfolio, these platforms offer reliability and support tailored to your needs. Take your time to compare features, fees, and services so you can make an informed choice that empowers your investment strategy for a secure future.

>>>>>>>>>>Invest in Gold Today<<<<<<<<<<<<<

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.