Cryptocurrencies like Bitcoin and Ethereum have matured from speculative tech experiments into assets many investors are now including in long-term retirement portfolios. For those seeking passive profit, especially in tax-advantaged vehicles like IRAs, the idea of adding crypto to retirement savings is increasingly appealing. But navigating that process safely and in compliance with IRS regulations requires the right platform.

Enter BitIRA, one of the earliest and most secure companies offering crypto IRA services. Founded in 2017 by Birch Gold Group, BitIRA helps investors diversify their retirement accounts with digital currencies, combining tax efficiency, robust security, and professional support.

In this detailed BitIRA review, we break down what the company offers, how it compares to competitors, and whether it’s the right fit for your long-term investing goals.

What Is BitIRA?

BitIRA is a financial services company headquartered in Burbank, California. It specializes in helping U.S. investors include cryptocurrencies in their self-directed IRAs (SDIRAs). Unlike standard IRAs that only allow traditional assets (stocks, bonds, mutual funds), BitIRA enables exposure to high-growth digital assets under the same tax-deferred or tax-free umbrella.

Founded by Birch Gold Group, a trusted name in alternative retirement investing, BitIRA’s mission is to bring secure, insured, and IRS-compliant cryptocurrency investing to the mainstream.

If you’re aiming to build passive income or preserve purchasing power through diversified retirement planning, BitIRA is designed to offer an intuitive and compliant path to achieve that.

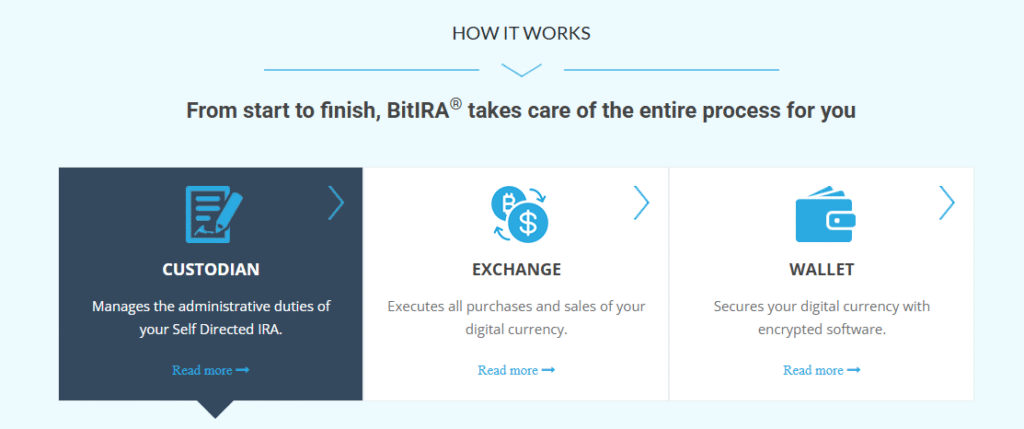

How BitIRA Works

BitIRA acts as a crypto IRA custodian platform, facilitating the full setup and management of self-directed IRAs that hold digital assets. Here’s a simplified breakdown of how it works:

✅ Choose Your IRA Type

BitIRA supports a variety of IRAs to align with different tax strategies:

- Traditional IRA – Tax-deferred contributions

- Roth IRA – Tax-free withdrawals in retirement

- SEP IRA – Ideal for self-employed individuals

- SIMPLE IRA – Tailored to small business owners

✅ Rollover Existing Accounts

Already have a retirement account? BitIRA allows rollovers from:

- Traditional or Roth IRAs

- 401(k), 403(b), 457 plans

- Thrift Savings Plans (TSPs)

✅ Invest in Cryptocurrency

Once funded, your account can be used to invest in a selection of 18 supported cryptocurrencies, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Solana (SOL)

- Stellar Lumens (XLM)

- Chainlink (LINK)

- Ripple (XRP)

- And more…

Trades can be executed directly within the platform, and your holdings are safely stored offline in cold storage.

BitIRA Features & Services

Let’s take a closer look at what makes BitIRA stand out in the increasingly crowded field of crypto IRA providers.

Top-Tier Security Measures

BitIRA is known for prioritizing investor protection. Features include:

- Cold storage wallets: Assets are stored offline, immune to online hacks.

- Multi-signature authorization: Transactions require multiple device confirmations.

- Physical security: Storage facilities are guarded by armed personnel.

- Full insurance coverage: Assets are insured against theft, fraud, and hacking through Lloyd’s of London.

This level of security is far above industry average and ideal for risk-conscious investors.

IRS Compliance and Custodian Support

BitIRA partners with:

- Equity Trust Company

- Preferred Trust Company

These licensed IRA custodians ensure your crypto IRA is 100% compliant with IRS regulations. BitIRA’s specialists help with:

- Paperwork and account creation

- Ensuring rollover accuracy to avoid tax penalties

- Administrative support throughout your investment journey

Cryptocurrency Options

You can choose from 18 major and emerging cryptocurrencies, including:

- Bitcoin

- Ethereum

- Solana

- Uniswap

- Yearn. finance

- Chainlink

- DAI and more

Though not as expansive as some competitors offering 50–250 tokens, BitIRA covers the essentials for most passive investors.

Fee Structure

BitIRA’s no-setup or monthly fees policy is a standout. However, transaction fees are not transparently listed on the website. Here’s what we know:

- No monthly or account setup fee

- Account establishment fee: $50

- Annual custodial fees: $300–$1,000 (varies by account balance)

- Trading fees: Not disclosed publicly; must speak with a representative

While the lack of clarity around transaction fees is a downside, the absence of ongoing monthly fees helps balance the cost equation for long-term holders.

User Experience

BitIRA provides a streamlined and intuitive digital platform. Key benefits include:

- Real-time access to your IRA account

- 24/7 trading and performance monitoring

- Clear portfolio tracking tools

- Dedicated access to Digital Currency Specialists

While the platform doesn’t yet have a dedicated mobile app, the website is mobile-responsive and functional on most devices.

Customer Support

BitIRA’s standout feature is its personalized customer service a key advantage for investors seeking passive returns without micromanaging every detail.

You’ll be assigned:

- A Digital Currency Specialist for asset selection, trading help, and guidance

- An IRA Specialist to handle rollovers, custodian coordination, and compliance

Support is available via phone, email, and fax, with responsive weekday service hours. Reviewers frequently praise BitIRA’s professionalism, speed, and clarity.

Company Philosophy

BitIRA was founded to solve two problems: a lack of crypto exposure in traditional IRAs and a lack of security in most crypto platforms.

Their philosophy emphasizes:

- Diversification through non-traditional assets

- Security-first investing

- Investor education to demystify digital currencies

Backed by Birch Gold Group’s years of experience in alternative IRAs, BitIRA is built on a foundation of transparency, compliance, and trust.

Is BitIRA Legit and Safe?

Short answer: Yes.

Here’s why:

- A+ rating from the Better Business Bureau

- 4.9-star average on Birdeye reviews

- Registered with FinCEN as a Money Services Business

- SOC 2 compliance to ensure data integrity and security

- Partnership with Ledger Enterprise and Fireblocks for added crypto protection

In short, BitIRA exceeds security and compliance norms for the crypto IRA industry.

BitIRA Pros and Cons

✅ Pros:

- No monthly or setup fees

- Strong security protocols

- Full asset insurance

- Works with licensed, IRS-approved custodians

- Personalized customer support

- IRA rollover assistance

- Tax-advantaged crypto exposure

❌ Cons:

- Limited number of cryptocurrencies

- Lack of transparency around trading fees

- No mobile app (yet)

BitIRA vs. Alternatives

BitIRA vs. iTrustCapital

While iTrustCapital gives investors access to over 25 cryptocurrencies and charges a 1% transaction fee, BitIRA stands out in other areas:

- Superior security features

- No monthly account fees

- Broader support for IRA types, including SIMPLE and SEP IRAs

BitIRA vs. Bitcoin IRA

Bitcoin IRA offers a wider selection with more than 75 cryptocurrencies, but this comes at a cost:

- High fees, including 2% per trade, plus setup and ongoing monthly fees

- In contrast, BitIRA offers:

- Lower overall fees

- A more personalized, high-touch service experience

BitIRA vs. Alto CryptoIRA

Alto CryptoIRA supports a diverse range of over 250 cryptocurrencies and even alternative assets like farmland, making it ideal for active investors. However:

- BitIRA is better suited for passive investors

- It emphasizes tailored support and a security-first approach

How to Get Started with BitIRA

Investing with BitIRA is simple and guided:

- Visit the BitIRA website – Click here to get started

- Choose your IRA type (Traditional, Roth, SEP, or SIMPLE)

- Fund your account – via direct deposit or rollover from an existing account

- Select cryptocurrencies with help from your Digital Currency Specialist

- Trade and manage your portfolio securely 24/7

Your specialists will assist with every step, from paperwork to post-purchase strategy.

Who Should Consider BitIRA?

BitIRA is a great fit for:

- Investors seeking passive profit via long-term crypto exposure

- Retirees or pre-retirees looking to hedge with non-traditional assets

- Self-employed professionals seeking IRA diversification

- People wanting tax-advantaged crypto investing with hands-on support

It may not be ideal for:

- High-frequency crypto traders

- Those who want access to dozens of altcoins

- Investors strictly seeking the lowest possible trading fees

FAQs About BitIRA

Is BitIRA safe?

Yes. With cold storage, full insurance, and government registration, BitIRA ranks among the safest crypto IRA providers available.

Is BitIRA good for retirement investing?

If you’re bullish on crypto long-term and want to leverage tax-advantaged growth, BitIRA offers a secure and compliant solution.

What fees does BitIRA charge?

There are no monthly or setup fees, but trading fees are not disclosed publicly. Annual custodian fees range from $300 to $1,000.

Is my crypto insured?

Yes, BitIRA insures crypto assets against theft, fraud, and cyberattacks. Cash held in custodial accounts is FDIC-insured up to $250,000.

Final Verdict: Is BitIRA Worth It?

BitIRA offers a rare combination in the crypto IRA space: security, service, and simplicity. While it doesn’t have the widest range of assets or the lowest trading fees, it does excel where it matters most for passive, long-term investors:

- Compliant account structures

- Personalized, ongoing support

- Industry-leading insurance and protection

For those looking to grow their wealth over the long term while minimizing hands-on management, BitIRA is a trusted and secure partner for digital asset retirement planning.

Ready to Diversify Your Retirement Portfolio with Crypto?

👉 Click here to request your FREE Digital IRA Guide from BitIRA

Learn how to:

- Roll over an existing IRA or 401(k)

- Choose from 18 major cryptocurrencies

- Secure your assets with cold storage and insurance

- Maximize tax advantages while growing your crypto portfolio

Take control of your financial future safely, securely, and strategically.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.