Why Precious Metals Matter for Passive‑Profit Seekers

The appeal of “sleep‑well” assets

If you’ve spent any time tracking markets lately, you know the nightly roller‑coaster feeling: stocks gyrate on headlines, bonds slump when rates creep, and even so‑called “safe” ETFs can surprise you with sudden dips. Precious metals offer something refreshingly different: tangible value you can hold, vault, or store in an IRA, far removed from Wall Street’s algorithmic mood swings. Gold, silver, platinum, and palladium have weathered wars, recessions, and ten‑digit inflation spikes for millennia. For anyone who wants wealth to grow quietly in the background, that long history of resilience is priceless.

How metals generate hands‑off growth

Metals aren’t yield‑bearing in the coupon‑or‑dividend sense, yet their track record shows steady appreciation during currency devaluations and market crises. When the dollar weakens or when investors simply lose faith in traditional paper assets, demand for hard assets spikes. Anyone already holding bullion sits back and watches prices lift. Pair metals with a tax‑advantaged account (like a self‑directed Gold IRA) and you compound the benefits: deferred or potentially tax‑free growth without having to lift a finger after the initial setup.

Meet Birch Gold Group: Your Partner in Stress‑Free Metal Investing

Founded in 2003 and headquartered in Burbank, California, Birch Gold Group has one mission: to make precious‑metal ownership simple for regular people, not just hedge‑fund quants. Over two decades, the firm has earned:

- A+ rating with the Better Business Bureau

- Thousands of five‑star customer reviews across Google, Trustpilot, Consumer Affairs, and BBB

- Endorsements from high‑profile financial commentators and conservative media hosts

- High marks for transparency and no‑pressure education

Low barrier to entry

You can launch your metals strategy with as little as ≈ $10,000. Invest $50,000 or more, and Birch waives first‑year custodial fees on an IRA, saving hundreds of dollars right out of the gate.

Concierge‑level guidance

Birch pairs each new client with a Precious Metals Specialist who explains metal choices, answers tax questions, and even walks you through paperwork step by step. For busy professionals pursuing passive profit, this white‑glove approach is a time‑saver and stress‑reducer in one.

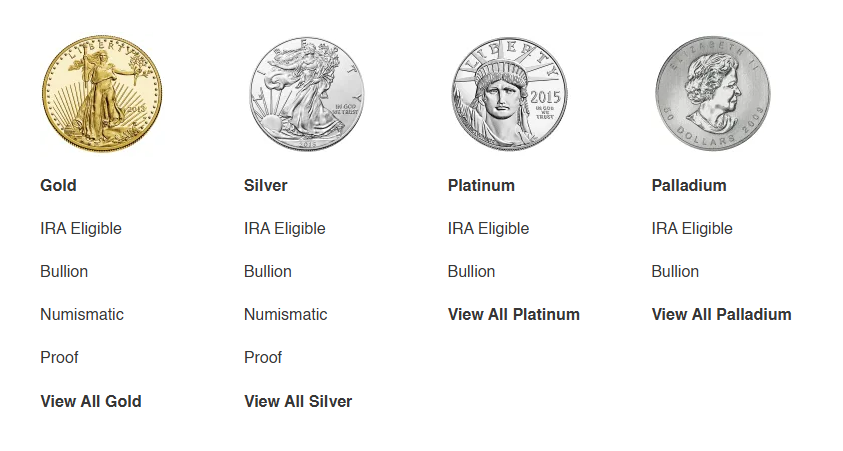

The Metals Menu: Gold, Silver, Platinum & Palladium at a Glance

Gold is the classic safe haven

Flagship products: American Gold Eagle (bullion & proof), Canadian Maple Leaf, British Britannia, South African Krugerrand, fractional bars, and the futuristic Goldback note. Gold’s scarcity, liquidity, and worldwide recognition make it your portfolio’s “anchor metal.” It shines when inflation rises and central‑bank policy gets murky.

Silver is affordable upside & industrial demand

Silver is often called “gold’s little brother,” yet its dual role in electronics, solar panels, and medicine gives it a turbo‑charged demand profile. Birch’s line‑up includes Silver American Eagles, America the Beautiful 5‑ounce rounds, 100‑gram Valcambi CombiBars, and twin‑maple leaf coins.

Platinum, rare industrial powerhouse

Only a handful of mines (mostly in South Africa and Russia) supply the world’s platinum, and output rarely keeps up with the auto and hydrogen‑fuel‑cell industries. Birch offers American Platinum Eagles, Australian Platinum Florins, and Valcambi CombiBars in divisible form, handy if you ever need to sell just part of your holdings.

Palladium high‑growth wild card

Palladium’s claim to fame is its use in catalytic converters, but it’s also finding a place in green tech and dentistry. Tight supply and unpredictable demand can send prices soaring, precisely the kind of non‑correlated action passive‑profit seekers love. Products range from Palladium Maple Leafs to low‑mintage American Palladium Eagles and investment‑grade rounds.

IRA‑eligible vs. collectible/numismatic

Birch distinguishes between IRA‑eligible bullion (meeting IRS purity standards) and collectibles (proofs, numismatics). IRA investors stick to bullion for compliance, while collectors may hold proofs outside retirement accounts for additional rarity‑driven upside.

Passive‑Profit Pathway #1: The Precious Metals IRA

A self‑directed Precious Metals IRA merges two powerhouses: the tax perks of retirement accounts and the intrinsic value of bullion. Here’s the process Birch Gold Group uses to keep it friction‑free:

- Rollover or Transfer

Move funds tax‑free from an existing 401(k), 403(b), TSP, or traditional IRA into a new Gold IRA. Birch’s IRA Department coordinates directly with your current custodian so you can avoid triggering taxable events. - Choose Your Metals

Select IRA‑approved coins or bars from the gold, silver, platinum, and palladium lists. Your Specialist provides side‑by‑side comparisons of pricing, premiums, and historical performance. - Secure, IRS‑approved Storage

Regulations require IRA metals to be held in a qualified depository. Birch partners with top‑tier vaults: Delaware Depository (Wilmington), Brink’s Global Services (Salt Lake City and New York), Texas Precious Metals Depository (Texas Hill Country), and International Depository Services (Ontario and Texas). - Ongoing Support & Reporting

You’ll receive periodic holding statements, market updates, and optional phone check‑ins. Birch can help you rebalance or add more metals later with a simple call or online instruction.

Fee structure: Expect a one‑time setup fee (≈ $50), annual management (≈ $100), and depository storage/insurance (≈ $100). Invest $50k+ and Birch covers year‑one custodial costs.

Passive‑Profit Pathway #2: Direct Physical Ownership

Maybe you prefer to touch and tally your metal stack at home or in a local safe‑deposit box. Birch Gold enables that too.

Coins, bars & rounds shipped to your door

After locking in a price, Birch arranges insured, discreet delivery often within a week. Each shipment requires an adult signature and is fully covered in transit.

Three popular strategies

- Dollar‑Cost Averaging (DCA): Buy a fixed dollar amount monthly or quarterly to smooth entry prices.

- Buy‑and‑Vault: Accumulate bars, then store them in a private, non‑IRA vaulting service for easy liquidation later.

- Legacy Stack: Build a mixed collection of iconic coins, Eagles, Maple Leafs, and Krugerrands to pass down to heirs as tangible, inflation‑proof wealth.

Liquidity when you’re ready to sell

Birch maintains a two‑way market. When you decide to cash in, request a quote; once you accept, ship metals back fully insured and get paid, often within 24 hours of verification.

Diversification Blueprint: Mixing Metals for Risk‑Adjusted Returns

Sample allocation models

| Strategy | Gold | Silver | Platinum | Palladium |

|---|---|---|---|---|

| Capital Preservation | 70 % | 25 % | 3 % | 2 % |

| Balanced Growth | 50 % | 30 % | 12 % | 8 % |

| Aggressive Upside | 35 % | 25 % | 20 % | 20 % |

(Percentages are illustrative, not financial advice.)

Why sprinkle in platinum & palladium?

These metals tend to zig when gold and silver zag because their demand stems from industrial cycles rather than purely monetary sentiment. Holding a slice of each reduces single‑metal risk and can increase overall returns.

Rebalancing tips

Set an annual check‑in, Birch can help you rebalance back to your original targets. This forces you to sell high and buy low automatically, capturing gains without active trading.

How to Get Started with Birch Gold Today

- Call or click Reach a Precious Metals Specialist at (877) 629‑4032 or complete the short online form.

- Select your path. Decide on a Precious Metals IRA, direct purchase, or a hybrid of both.

- Fund the account, transfer cash, or roll over retirement funds with no tax headaches.

- Pick your metals. Use Birch’s comparative pricing sheets and educational library to make informed choices.

- Relax, Birch handles shipping, vaulting, paperwork, and future buybacks. Your job? Check your statements once in a while and enjoy the peace of mind.

Frequently Asked Questions

What’s the minimum investment?

About $10,000 for either an IRA or a direct purchase.

Can I take delivery of IRA metals?

Not while they remain in the IRA. IRS rules require storage at an approved depository. You can, however, take an “in‑kind” distribution in retirement and have metals shipped to you just like taking a stock certificate from a traditional IRA.

How fast can I liquidate?

Many Birch clients complete a sale in three business days: quote acceptance, next‑day shipping, and wire transfer 24 hours after metal verification.

Are premiums over spot competitive?

Yes. Birch leverages wholesale relationships for volume pricing. Premiums vary by product and order size, and your Specialist will quote them live before you commit.

Is there a buyback guarantee?

Birch Gold maintains an industry‑standard buyback program. While prices follow market conditions, the company promises never to charge liquidation fees to its own customers.

Final Thoughts: Make Your Money Work While You Sleep

Stocks may thrill and crypto may dazzle, but precious metals remain the undefeated heavyweight champions of wealth preservation. Add the tax advantages of a Precious Metals IRA, sprinkle in Birch Gold Group’s concierge service, and you have a turnkey strategy for passive profit that hums along quietly while you focus on living life.

Whether you’re rolling over a chunk of an old 401(k) or just starting with a few silver rounds each month, Birch makes the process simple, secure, and surprisingly personable. The only regret most new clients voice? Wishing they’d diversified sooner.

Ready to explore your options? Request your free Precious Metals IRA guide and discover how easy it is to put gold, silver, platinum, and palladium to work for you today.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.