Just as you approach retirement, understanding how state choices affect your finances can make a significant difference in your lifestyle and savings. You’ll want to explore states that offer tax advantages, a lower cost of living, and access to quality healthcare to maximize your retirement income. With so many factors in play, knowing where your money goes first can empower you to unlock your full retirement potential, allowing you to prioritize what truly matters: financial freedom and peace of mind.

Key Takeaways:

- States like Florida, Nevada, and Texas offer significant tax advantages for retirees by eliminating state income taxes, helping your retirement income stretch further.

- Balancing overall tax burden, including property and sales taxes, is vital states such as New Hampshire provide benefits like no sales tax that may suit certain spending habits.

- Cost of living varies widely; states like Mississippi, Arkansas, and Alabama offer affordable housing and living expenses that can extend retirement savings without sacrificing comfort.

- Healthcare quality and accessibility differ by state, with Minnesota, Massachusetts, and Hawaii standing out for excellent medical services and senior-friendly healthcare options.

- Retirement lifestyle preferences and community engagement opportunities play a major role; states with active adult communities and cultural amenities can enhance social connection and daily enjoyment.

Understanding the Types of Retirement Accounts

For planning your retirement finances effectively, knowing the different types of retirement accounts is important. These accounts offer various tax advantages and savings opportunities, including:

- Traditional IRAs

- Roth IRAs

- 401(k) plans

- 403(b) plans

- Simplified Employee Pension (SEP) IRAs

After understanding their features and tax implications, you can tailor your retirement strategy to maximize your savings and financial freedom.

| Retirement Account Type | Key Features |

|---|---|

| Traditional IRA | Tax-deductible contributions, taxes on withdrawals |

| Roth IRA | Contributions with after-tax dollars, tax-free withdrawals |

| 401(k) Plan | Employer-sponsored, pre-tax contributions, employer match potential |

| 403(b) Plan | Similar to 401(k), available to public education and nonprofit employees |

| SEP IRA | Designed for self-employed or small business owners, tax-deductible |

Traditional vs. Roth IRAs

Little differences in tax treatment make Traditional and Roth IRAs unique. Traditional IRAs allow you to defer taxes on contributions, paying taxes upon withdrawal in retirement. Roth IRAs require after-tax contributions but provide tax-free withdrawals, ideal if you expect to be in a higher tax bracket later. Your choice impacts how much of your savings you keep and how flexible your retirement income can be.

401(k) Plans and Their Variants

The 401(k) plan is a popular employer-sponsored retirement savings vehicle, letting you contribute pre-tax income with potential employer matches that accelerate your savings growth. Variants like Roth 401(k)s and solo 401(k)s offer tailored benefits to meet diverse needs, making this account versatile for your retirement journey.

Understanding 401(k) plans and their variants helps you leverage opportunities for tax advantages and employer contributions. The traditional 401(k) lets you reduce taxable income now but taxes distributions later, while the Roth 401(k) offers tax-free withdrawals after retirement. Solo 401(k)s cater to self-employed individuals, enabling higher contribution limits. Be mindful of contribution limits and withdrawal rules to avoid penalties. By aligning the right 401(k) type with your goals, you can maximize your financial freedom during retirement.

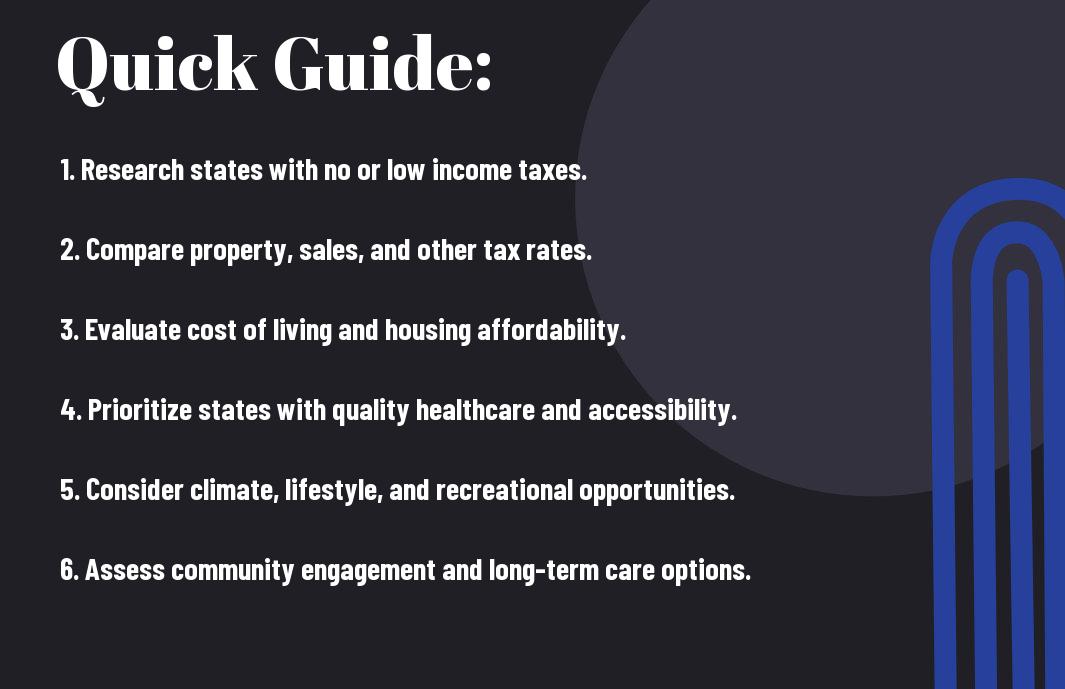

Key Factors in Evaluating States for Retirement

Any decision on the best place for your retirement should consider several key factors that impact your financial freedom and lifestyle. These include:

- Tax policies that affect your income, property, and sales taxes

- Cost of living, especially housing and healthcare expenses

- Quality of healthcare and accessibility

- Climate and lifestyle preferences

- Community and social engagement opportunities

- Long-term planning options and family proximity

Assume that understanding these dimensions helps you make a well-rounded choice for your retirement location.

Tax Policies and Financial Incentives

On your retirement journey, states with favorable tax policies can stretch your savings further. With no state income taxes, places like Florida, Nevada, and Texas allow you to keep more of your retirement income. Consider that some states don’t tax Social Security benefits, and others offer reduced property or sales taxes, like New Hampshire’s no sales tax benefit. Weighing these financial incentives helps you protect your nest egg and maximize your spending power during retirement.

Cost of Living and Affordability

One of the biggest factors affecting your retirement budget is the cost of living. States such as Mississippi, Arkansas, and Alabama offer lower housing, utility, and daily expenses, enabling your savings to go further. However, you’ll want to balance affordability with access to amenities and healthcare costs, which can vary greatly between locations. A careful review ensures your lifestyle remains comfortable without unexpected financial strain.

Affordability directly impacts how long your retirement funds last. While low housing costs in southern states can be a major positive, you should also evaluate regional variations in healthcare expenses, utilities, and transportation. Some states may have affordable homes but higher healthcare costs, which could erode savings quicker than anticipated. Conversely, low taxes paired with a reasonable cost of living enhance your financial freedom. Pay special attention to these factors to avoid dangerous financial surprises that might affect your quality of life.

Pros and Cons of Popular Retirement States

Now is the time to weigh the advantages and drawbacks of top retirement states to decide which aligns best with your lifestyle and financial goals. Each state offers unique benefits and challenges, from tax breaks to climate preferences. The table below breaks down key pros and cons to help you make an informed choice.

| Pros | Cons |

|---|---|

| Higher property taxes in some states, like Texas | Higher property taxes in some states like Texas |

| No state income tax in Florida, Texas, and Nevada | Lower access to some healthcare services in rural areas |

| Affordable housing in Mississippi, Arkansas, and Alabama | Hot summers and humidity may impact health |

| Access to active adult communities with social amenities | Sales taxes can be high in states with no income tax |

| Strong healthcare systems in Minnesota, Massachusetts | Higher healthcare costs in some low-cost living states |

Florida: The No-Income Tax Advantage

Retirement in Florida means you can keep more of your income thanks to the state’s absence of income tax, making Social Security and pension benefits stretch further. Beyond tax savings, Florida offers warm weather and numerous active communities, helping you enjoy a vibrant yet financially sensible retirement.

Texas: Low Costs and Vibrant Communities

Cons include somewhat higher property taxes and varying healthcare accessibility depending on the area, but Texas still delivers a low overall cost of living and thriving social environments. You can find energetic cities as well as peaceful towns that suit your preferences.

To maximize your retirement in Texas, focus on balancing the low housing costs and vibrant cultural scenes with the potential downside of higher property taxes. Many retirees thrive in communities offering active lifestyles and ample recreational options, yet it’s important to assess local healthcare quality since rural areas may have limited medical resources.

Step-by-Step Guide to Choosing Your Retirement Location

Despite the many appealing retirement options available, selecting the right place requires careful consideration of various factors. Use this simple table to organize your priorities and compare key elements like taxes, cost of living, and healthcare quality, helping you make a well-informed decision that aligns with your retirement goals.

| Factor | Considerations |

|---|---|

| Taxes | State income, property, sales taxes, Social Security tax policies |

| Cost of Living | State income, property, sales taxes, and Social Security tax policies |

| Healthcare | Housing affordability, utilities, transportation, and food costs |

| Climate & Lifestyle | Weather preferences, recreational and cultural activities |

| Community | Access to quality care, availability of specialists, and Medicare options |

| Long-Term Planning | Social engagement, retiree-friendly communities, and volunteer opportunities |

Assessing Personal Needs and Preferences

Guide your retirement planning by honestly evaluating what matters most to you, whether it’s climate, proximity to family, or access to healthcare. Understanding your lifestyle desires and health requirements will help you prioritize states that offer the right blend of amenities, social opportunities, and medical resources to support your well-being and enjoyment in retirement.

Researching Potential States Effectively

There’s a wealth of data available to help you weigh each state’s pros and cons. Focus on analyzing tax structures, cost of living indices, and healthcare rankings before narrowing your choices. This research ensures you choose a retirement location where your savings can stretch further without sacrificing quality of life.

The process of researching potential retirement states involves careful evaluation of multiple financial and lifestyle aspects. The tax environment varies widely. Some states, like Florida and Texas, attract retirees by offering no state income tax, letting you keep more income from pensions and Social Security benefits. Conversely, certain states provide exceptional healthcare quality and accessibility, such as Minnesota and Massachusetts, which may come with a higher cost of living but better medical support. Pay attention to property and sales taxes because some states offset low-income taxes with higher rates in these areas, potentially affecting your budget. Finally, assess whether the state’s amenities, climate, and community resources align with your personal preferences to ensure lasting satisfaction in your retirement years.

Tips for Maximizing Your Retirement Income

After you retire, effectively managing your retirement income becomes vital to sustaining your lifestyle. Focus on strategies such as:

- Creating a diversified income stream combining Social Security, pensions, and investments

- Reducing unnecessary expenses to stretch your savings further

- Evaluating state tax policies to minimize your tax burden

- Planning for healthcare costs and long-term care

You should aim to make every dollar work hard for you to unlock true financial freedom in retirement.

Investment Strategies and Considerations

Now is the time to align your investment strategies with your retirement goals. Focus on preserving capital while generating a steady income. Consider annuities, dividend-paying stocks, and bonds. Balancing growth and safety is key, especially as markets shift. Diversification across asset classes helps protect your nest egg from volatility. You’ll want to review your portfolio regularly and adjust for changes in income needs or risk tolerance to ensure your investments continue to support your lifestyle.

Utilizing Tax Breaks and Incentives

Considerations around tax breaks and incentives can significantly enhance your retirement income. Explore how states like Florida, Nevada, and Texas offer no state income tax, enabling you to keep more of your savings. Additionally, some states exclude Social Security benefits from taxable income or provide deductions and credits specifically for seniors. Aligning your retirement location and financial choices with these benefits can substantially improve your financial security.

Your ability to leverage tax-friendly policies can be a powerful tool. Some states have no sales tax, like New Hampshire, which reduces everyday expenses. Others balance property taxes with income tax relief, so investigating the full tax picture is beneficial. However, overlooking higher sales or property taxes could erode your savings. Likewise, taking advantage of local incentives, such as credits for long-term care insurance or prescription assistance programs, supports both your health and finances. Carefully integrating these options into your retirement plan positions you to keep more of what you’ve earned.

Lifestyle Considerations for Retirees

Many factors beyond finances shape your retirement satisfaction. Your ideal lifestyle depends on what daily experiences bring you joy, whether that’s vibrant city life, peaceful rural surroundings, or something in between. You’ll want to find a place where amenities, pace, and cultural opportunities align with your preferences to ensure your retirement years are fulfilling and enjoyable.

Climate and Recreational Opportunities

Assuming you enjoy the outdoors, the state’s climate plays a vital role in your retirement lifestyle. Warm-weather states like Arizona and Florida offer year-round sunshine and activities like golfing, while regions with four distinct seasons like Colorado provide varied recreational options. Aligning your location with your favorite hobbies enhances how you spend your free time and influences your overall well-being.

Community Engagement and Social Networks

One of the best ways to enrich your retirement is by engaging with an active community. Areas with established retiree populations, such as Florida’s The Villages or Arizona’s Sun City, offer numerous social clubs, volunteer opportunities, and educational programs that can help you build meaningful connections and stay mentally and physically active.

For instance, being part of a vibrant community not only combats loneliness but also encourages a healthier, more engaged retirement. Many retirement hotspots provide facilities like fitness centers and hobby clubs tailored to your interests. Additionally, volunteering and lifelong learning programs can help you share your experience while expanding your social circle. While these communities offer valuable support and interaction, it’s important to choose one that fits your social preferences and lifestyle goals to maximize satisfaction.

Unlocking the Potential of Retirement: Top States for Financial Freedom

On the whole, choosing the right state for your retirement can unlock significant financial freedom and enhance your quality of life. By carefully weighing factors like tax policies, cost of living, healthcare quality, and lifestyle preferences, you ensure your savings stretch further while enjoying the environment that suits you best. Taking a thoughtful approach to these decisions empowers you to create a retirement experience tailored to your needs, helping you maximize your resources and embrace this new chapter with confidence and peace of mind.

FAQ

Q: Which states offer the most tax benefits for retirees looking to maximize their income?

A: States like Florida, Nevada, and Texas provide significant tax advantages for retirees by not charging state income tax, allowing retirement income such as Social Security benefits and pensions to go further. Additionally, places like New Hampshire eliminate sales tax, helping reduce expenses on purchases.

Q: How does the cost of living affect retirement planning across different states?

A: The cost of living greatly influences how far your retirement savings will stretch. States like Mississippi, Arkansas, and Alabama have lower housing, food, and utility costs, enabling retirees to maintain a comfortable lifestyle with less financial pressure. Balancing affordability with quality of life options, such as amenities and services, is important when selecting a state.

Q: What healthcare factors should retirees consider when choosing a retirement state?

A: Access to quality healthcare is an important factor. States such as Minnesota, Massachusetts, and Hawaii are known for excellent healthcare facilities and higher physician availability. Retirees should also examine healthcare affordability, availability of specialists, and the convenience of reaching medical services, especially in rural versus urban areas.

Q: How can climate and lifestyle preferences influence the choice of a retirement location?

A: Climate impacts health and lifestyle choices significantly. Warm-weather states like Arizona and Florida attract those who enjoy outdoor activities year-round, while states like Colorado and Virginia offer four distinct seasons. Lifestyle factors such as recreational opportunities, cultural activities, and pace of life should be matched to personal preferences to enhance retirement satisfaction.

Q: What are the important long-term considerations when selecting a retirement state?

A: Long-term planning involves looking at elder care options, state laws affecting seniors, and estate planning advantages. Some states offer innovative long-term care insurance programs and options for assisted living or continuing care communities. Additionally, estate tax policies and the economic stability of the state play a role in future financial security and quality of life during retirement.