Over time, market ups and downs can make your retirement savings feel uncertain, but a tax-free Gold IRA rollover offers you a powerful way to protect and diversify your nest egg. By moving your existing IRA funds into physical gold, you can enjoy tax advantages while shielding your investments from inflation and market volatility. This strategy not only helps secure your financial future but also gives you peace of mind knowing your retirement plan includes a tangible, time-tested asset. Let’s explore how a Gold IRA rollover can work in your favor.

Understanding Gold IRAs

A Gold IRA offers a unique way to diversify your retirement portfolio by including physical precious metals like gold, silver, platinum, and palladium. If you want to learn more about how a Gold IRA Rollover Benefits vs 401k: Advantages & Tips can protect your savings from market volatility and inflation, a Gold IRA might be what you’re looking for to balance growth and security in your retirement planning.

What is a Gold IRA?

An Individual Retirement Account (IRA) that allows you to hold physical gold and other IRS-approved metals is called a Gold IRA. You control your investments by directing funds into secure vault storage rather than traditional stocks or bonds. This setup helps your money grow tax-deferred or tax-free, depending on whether you choose a traditional or Roth IRA, giving you more flexibility for your retirement years.

Types of Gold IRAs

Even within Gold IRAs, different types give you options to best suit your strategy and tax needs. Below is a breakdown of common types for your understanding:

| Gold IRA Type | Key Features |

|---|---|

| Traditional Gold IRA | Contributions are tax-deductible; withdrawals taxed as ordinary income after 59½ |

| Roth Gold IRA | Contributions made with after-tax dollars; withdrawals are tax-free if qualified |

| Self-Directed Gold IRA | Expanded asset choices, including precious metals and other non-traditional investments |

| Inherited Gold IRA | Allows beneficiaries to inherit gold assets with specific tax rules |

| SEP Gold IRA | Designed for self-employed individuals with higher contribution limits |

Understanding how these Gold IRA types differ can help you align your investments with your retirement goals, providing both growth potential and protection. Perceiving your personal tax situation and investment horizon will guide your best choice.

Understanding the nuances of Gold IRAs lets you harness the advantages of physical metals, safeguarding your wealth from inflation and market swings.

- Tax-deferred or tax-free growth based on account type

- Storage in IRS-approved depositories for security and compliance

- Ability to diversify beyond traditional assets like stocks and bonds

- Potential for a hedge against currency risks and volatility

- Annual fees and storage costs that affect overall returns

Perceiving these factors empowers you to make informed decisions that fit your retirement plan smoothly.

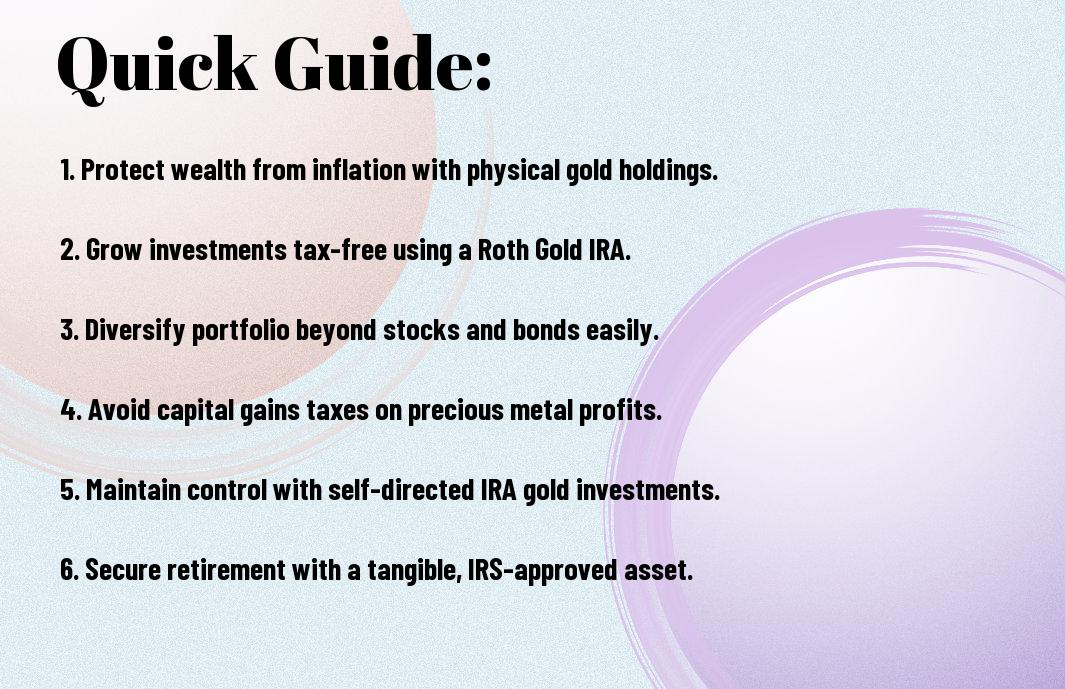

Benefits of a Tax-Free Rollover

Some of the biggest advantages of a tax-free Gold IRA rollover include growing your retirement savings without immediate tax consequences and diversifying your portfolio with physical precious metals. By moving your funds directly into a Gold IRA, you avoid penalties and keep your investments tax-advantaged, whether you choose a traditional or Roth IRA. This smart move helps you take control, maintain tax benefits, and position yourself for long-term stability in unpredictable markets.

Protecting Against Market Volatility

To shield your retirement savings from the ups and downs of the stock market, a Gold IRA adds a layer of stability. Gold’s performance often contrasts with stocks, making it a reliable hedge during market downturns. By allocating a portion of your portfolio to gold, you reduce overall risk and soften the ride when markets become volatile, giving you peace of mind in uncertain times.

Preserving Wealth from Inflation

For keeping your purchasing power intact, gold shines as a powerful defense against inflation. With inflation rates eroding the value of fiat currency, investing in IRS-approved bullion secures your savings in an asset that typically appreciates as prices rise, helping your retirement nest egg hold its value through economic shifts.

Plus, gold has demonstrated resilience over decades compared to its 50-year price trends against the Consumer Price Index, and you’ll see how it preserves value better than many traditional assets. Inflation can drastically reduce cash and bond worth, but your Gold IRA’s tax-deferred gains allow you to ride these metal cycles more efficiently. This means you’re proactively safeguarding your wealth from invisible threats that slowly chip away at your financial security.

Tips for a Successful Rollover

Once again, a smooth tax-free Gold IRA rollover depends on careful planning and knowing the right steps. Key tips include:

- Confirm the custodian and depository are IRS-approved.

- Choose between a trustee-to-trustee rollover or a 60-day rollover to avoid penalties.

- Keep track of all paperwork and IRS forms.

- Be aware of fees set up, storage, and commissions to guard your returns.

You must allow yourself enough time to review information and consult experts before moving funds to protect your investment and tax benefits.

Choosing the Right Custodian

On your Gold IRA rollover journey, selecting the right custodian is key. Look for firms like Equity Trust or STRATA Trust that report accurately to the IRS and provide transparent fees. You want a partner who facilitates smooth transfers and secure storage arrangements, so your metals are safely held in approved depositories. A knowledgeable custodian helps you navigate tax rules and minimizes costly errors, setting a solid foundation for your retirement planning.

Knowing IRS Regulations

Choosing to invest via a self-directed Gold IRA means staying aligned with IRS rules is paramount. The IRS prohibits self-storage of metals; your bullion must be held in a certified facility to keep tax advantages. Withdrawals trigger specific tax treatments depending on whether you use a Traditional or Roth IRA. Understanding these regulations helps you avoid unexpected penalties and keeps your retirement savings growing efficiently.

Rollover procedures come with strict IRS guidelines that you can’t ignore. For instance, failing to complete trustee-to-trustee rollovers within IRS timelines or improperly handling a 60-day rollover can lead to tax penalties and loss of tax-deferred status. The IRS also mandates that your metals meet purity standards and are held only in approved, insured depositories, not at home. On the positive side, following these regulations correctly means you benefit from tax-free gains, especially with a Roth IRA, and multi-year compounding without capital gains taxes. Taking time to understand these rules safeguards your investment and peace of mind.

Step-by-Step Rollover Process

Now, completing a tax-free Gold IRA rollover is simpler than you might think. It involves clear steps to move your retirement funds into a self-directed IRA holding physical precious metals without triggering taxes or penalties. The process includes contacting your current custodian, choosing the right funding method, and working with a trusted custodian and depository. Below is a handy guide to the key steps.

| Step | Description |

|---|---|

| Initiating the Rollover | Contact your current retirement account custodian to start the rollover process with the right IRS forms. |

| Funding Your Gold IRA | Choose between a direct contribution, trustee-to-trustee rollover, or 60-day rollover to transfer funds smoothly. |

| Storage & Insurance Setup | Select an IRS-approved depository with insured, audited storage to protect your metals. |

| Review & Management | Use fee worksheets and rebalancing plans to keep your investment on track annually. |

Initiating the Rollover

You’ll begin by contacting your current 401(k) or IRA custodian to request a rollover. This step involves filling out IRS-required forms to avoid tax penalties, typically including a trustee-to-trustee transfer that moves your funds directly to your new Gold IRA custodian. This method reduces IRS withholding risk and streamlines your rollover.

Funding Your Gold IRA

You can fund your Gold IRA through a direct contribution up to IRS limits, a trustee-to-trustee rollover, which doesn’t incur withholding, or a 60-day rollover requiring timely action to avoid taxes. Each way has different controls and timelines, so choose the one that fits your comfort.

Rollover funding carries some important tax implications. The trustee-to-trustee rollover is safest for keeping your account tax-free and avoiding the 20% automatic withholding. If you opt for the 60-day rollover, be aware of the strict deadline to redeposit funds. By understanding and selecting the right method, you maintain your retirement’s tax advantages and keep your investment plan intact.

Factors to Consider Before Rollover

All investors should weigh several important factors before initiating a tax-free Gold IRA rollover. Consider your current financial situation, the specific retirement goals you want to achieve, and the fees and storage options related to a Gold IRA. Pay close attention to:

- Your existing retirement assets and liquidity needs.

- The IRS rules on custodian transfers and storage requirements.

- Potential impact of annual fees and metal price volatility.

Recognizing these elements will help you make a more informed, confident rollover decision.

Current Financial Situation

There’s value in assessing your overall portfolio and cash flow before a rollover. With a Gold IRA, you want to ensure you have enough liquid assets to cover your daily expenses and unexpected costs, since metals are less liquid than stocks. Understanding your current balances, debts, and emergency funds can guide how much you allocate to precious metals without straining your finances.

Retirement Goals

Little compares to having clear retirement objectives when considering a Gold IRA rollover. Is your priority preservation against inflation, or protection from stock market swings? Your goals will influence how much of your portfolio you dedicate to metals and your choice between Traditional or Roth IRA options, leveraging their different tax advantages to fit your long-term plan.

Rollover decisions hinge on aligning your retirement goals with your investment approach. Since a Gold IRA protects against inflation and market volatility better than traditional portfolios alone, you can strategically allocate a portion, say 5–10% to metals. Be aware of IRS storage rules and fees, which affect returns, and avoid over-allocating to a single metal to manage risk. Balancing your targets with these factors helps you build a resilient, tax-advantaged retirement nest egg.

Pros and Cons of Gold IRA Rollovers

Not all retirement plans suit everyone, so weighing the pros and cons of a Gold IRA rollover is wise before you decide. Below is an easy-to-scan table summarizing key benefits and potential challenges to help you make an informed choice for your retirement portfolio.

| Pros | Cons |

|---|---|

| Tax-deferred or tax-free growth (Traditional or Roth) | Setup and annual fees can impact returns |

| Hedge against inflation and market volatility | Required use of IRS-approved vault storage (no home storage allowed) |

| Diversifies your retirement portfolio beyond stocks and bonds | Set-up and annual fees can impact returns |

| Physical asset you can hold in a secure depository | Strict IRS purity and product rules limit coin/metal choices |

| Potential protection during economic downturns | Complex paperwork and rollover steps may require guidance |

Advantages of Tax-Free Gold IRAs

Rollovers into tax-free Gold IRAs let you grow your retirement savings without annual capital gains taxes on precious metals. You get a unique hedge against inflation and stock market swings, with the added comfort that your metals are securely stored in IRS-approved vaults. Plus, you gain flexibility with Roth contributions, allowing tax-free withdrawals after age 59½, making your retirement income potentially more predictable and tax-efficient.

Potential Drawbacks to Consider

Pros come with considerations: Gold IRA rollovers do carry annual storage and administrative fees, which can range from $180 to $230 or around 0.4% to 1% of assets. Also, the IRS mandates that your metals stay in approved third-party vaults, meaning no home storage and limited immediate access. You’ll want to be mindful of liquidity timing since metal sales through a custodian can take days or weeks.

For instance, if you expect fast access to your retirement funds, the logistics of metal custody might feel restrictive, especially since the IRS penalizes self-storage and requires metals stored off-site. Additionally, fees, although seemingly modest (e.g., $180 annually on $50,000 equates to just 0.36%), can erode returns over time if not monitored carefully. Finally, understanding rollover rules is important to avoid unexpected taxes or penalties, so thorough preparation with trusted resources can make a big difference.

Summing up

The top benefits of a tax-free Gold IRA rollover for your retirement planning include growing your savings without annual capital gains taxes, diversifying your portfolio with a stable asset, and enjoying potential protection against inflation and market volatility. By rolling over into a Gold IRA, you keep control over your investments while taking advantage of IRS-approved precious metals. This strategy can bring you peace of mind and a clearer path toward a more secure financial future.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.