Just by understanding the intricacies of a tax-free gold IRA rollover, you equip yourself to safeguard your retirement savings against the whims of market volatility and inflation. When you move your assets carefully within IRS guidelines, you avoid costly taxes and penalties, allowing your investments to grow uninterrupted. This process not only preserves your wealth but also grants you access to a tangible, historically resilient asset class. In this detailed guide, you’ll discover how to navigate the rollover process with precision, ensuring your financial future remains as robust as the metals you invest in.

Understanding Tax-Free Gold IRA Rollovers

The concept of a tax-free gold IRA rollover allows you to transfer funds from your existing retirement account into a self-directed Gold IRA without incurring immediate tax penalties. This strategy preserves your investment power while enabling diversification into physical precious metals like gold, silver, platinum, or palladium. Since gains compound free of annual capital gains taxes, you can better withstand market volatility and inflation pressures, turning uncertainty into a measured, evidence-based step in securing your financial future.

What is a Gold IRA?

There’s a Gold IRA, a subtype of self-directed IRAs, which permits you to hold IRS-approved physical bullion instead of traditional stocks or bonds. This account stores your metals securely in an IRS-compliant depository, ensuring tax advantages along with protection from market and currency risks. With purity standards of ≥ 99.5% for gold and higher for other metals, your investment remains tangible, transparent, and aligned with long-term wealth preservation.

How Does a Tax-Free Rollover Work?

There’s a process that safeguards your funds from taxation while moving them into a Gold IRA, commonly through a trustee-to-trustee rollover. This involves directly transferring your assets from your existing custodian to a new self-directed IRA custodian, preventing the 20% withholding tax and IRS penalties. By following IRS timelines and forms, you maintain your retirement funds’ integrity while gaining exposure to precious metals.

The mechanics of this rollover require strict adherence to IRS rules: funds cannot be accessed personally during the transfer, or you risk triggering taxes and penalties. Typically, a trustee-to-trustee rollover is the safest path, avoiding the 60-day window risks where IRS scrutiny intensifies. Compliance ensures your capital remains protected, tax-deferred, and supports your strategy to hedge against inflation and market instability.

Key Benefits of Tax-Free Gold IRA Rollovers

If you’re exploring ways to protect your retirement savings, a tax-free gold IRA rollover offers unique advantages by shielding your investments from taxable events while opening access to precious metals. This strategy lets you maintain control over your assets, avoid immediate tax liabilities, and capitalize on gold’s historical status as a haven. By leveraging IRS-approved bullion within a self-directed IRA, you gain a tangible asset that complements traditional investments, enabling you to balance growth potential with security in a volatile market.

Preserving Wealth Against Inflation

Wealth preservation is a persistent challenge as inflation steadily erodes purchasing power, often faster than traditional bond funds can compensate. Allocating a portion of your IRA to gold bullion, which has maintained purchasing power over decades, helps cushion your portfolio against currency devaluation and shifting monetary policies. With a self-directed Gold IRA, your gains compound tax-deferred or tax-free (depending on IRA type), allowing you to stay ahead of inflation without annual capital-gains taxes diminishing your returns.

Diversifying Investment Portfolios

Diversifying your portfolio with a tax-free gold IRA rollover introduces a non-correlated asset that reduces overall volatility, especially during severe market downturns. Gold’s historical performance during the five worst S&P 500 drawdowns shows its resilience as a portfolio stabilizer. This diversification protects you from currency risk and sharp equity swings, ultimately smoothing your retirement journey and enhancing long-term stability.

Preserving your portfolio’s stability through diversification means integrating gold’s low correlation to stocks and bonds, which helps mitigate risks inherent in traditional markets. Given that gold prices and inflation often rise in tandem, holding metals inside a secured, IRS-approved depository, where your coins are insured and audited, adds layers of protection. However, it’s important to balance your allocation carefully; over-allocating to a single metal like silver, known for higher volatility, can introduce unnecessary risk. Thoughtful diversification through a tax-free gold IRA rollover empowers you to optimize your portfolio’s resilience.

Essential Tips for a Successful Rollover

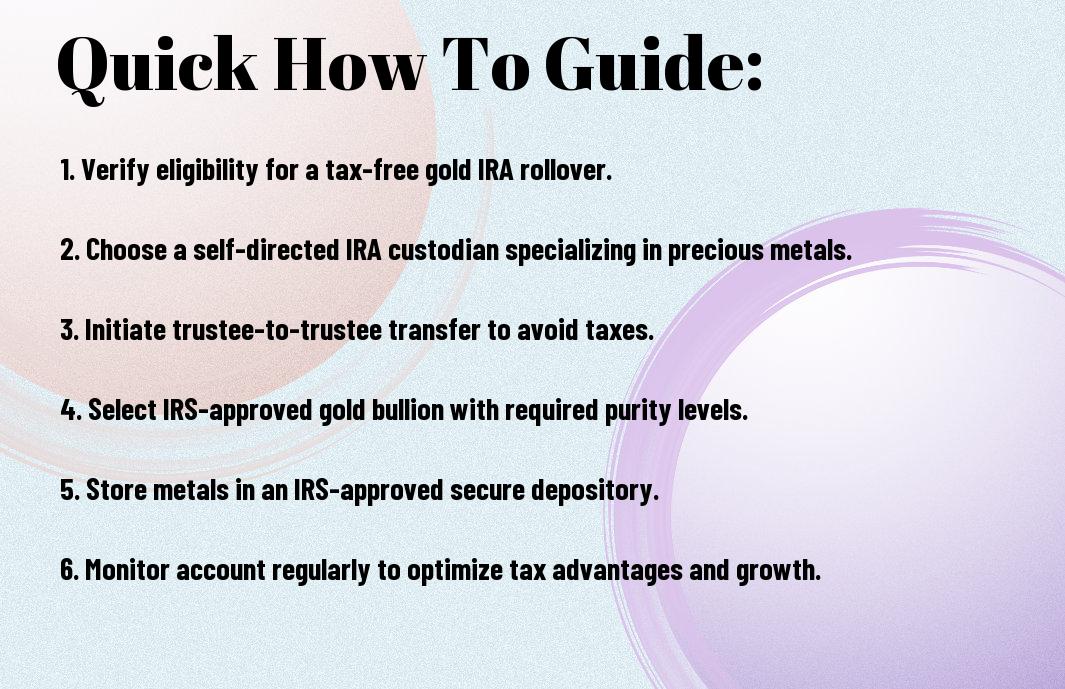

Keep your tax-free gold IRA rollover on track by following clear steps:

- Choose a qualified custodian with transparent fees and experience.

- Understand IRS rules to avoid penalties and taxes.

- Complete your rollover within the 60-day window to maintain tax advantages.

- Maintain detailed records of all transactions and forms filed.

The right preparation ensures your rollover maximizes benefits without surprises.

Selecting a Qualified Custodian

For your gold IRA rollover to be secure and efficient, selecting a qualified custodian is paramount. You want a custodian who complies with IRS regulations, offers clear fee structures such as flat or asset-based fees, and partners with reputable depositories. Their role includes safeguarding your precious metals, filing necessary tax forms, and facilitating smooth transactions, minimizing your risk of errors and penalties during the rollover process.

Navigating IRS Rules and Regulations

Little room for error exists when you manage a tax-free rollover. You must ensure the funds move directly between custodians or complete your rollover within 60 days to avoid triggering taxes or penalties. IRS forbids self-storage of metals if you want to keep tax benefits metals must be in IRS-approved depositories, or distributions will become taxable events. Adhering to these standards protects your IRA’s tax-advantaged status and your financial future.

Qualified investors understand that the IRS mandates strict compliance: rollovers executed outside the 60-day limit are treated as distributions, incurring ordinary income taxes and potential penalties. Additionally, storing metals outside approved depositories violates rules, resulting in immediate tax liabilities. The IRS requires custodians to report transactions via Form 5498 and distributions on Form 1099-R, so you benefit from transparency, but you must be diligent. To avoid costly mistakes, systematically follow IRS timelines and storage mandates, ensuring your rollover remains a truly tax-deferred or tax-free strategy.

Factors to Consider Before Rolling Over

Not every gold IRA rollover suits your financial landscape. You should assess:

- Your existing retirement accounts’ compatibility.

- Potential tax implications and IRS rules on transfers.

- Fee structures including storage and admin costs.

Recognizing these factors helps prevent penalties and hidden expenses. For a comprehensive overview of procedures and safeguards, consult What Is a Gold IRA Rollover? – U.S. ….

Evaluating Your Current Retirement Accounts

Current retirement holdings determine how smoothly a rollover can proceed. You need to confirm whether your accounts are eligible for a trustee-to-trustee rollover, which avoids the 20% withholding tax. Reviewing your mix of stocks, bonds, and cash helps you calculate how adding physical metals will shift your portfolio’s stability and growth trajectory.

Analyzing Market Conditions and Trends

Analyzing current market volatility and long-term metal price trends empowers you to time your rollover strategically. Gold has historically outperformed during economic downturns, but fees and storage logistics may erode gains if overlooked.

Rolling into a gold IRA requires a nuanced understanding of market signals. You face the positive potential of gold’s resilience during inflation and stock drawdowns, as shown over 50 years, yet must weigh it against risks like temporary price spikes and storage fees. The inflation-busting ability of gold helps hedge against currency risk intensified by policy shifts. By integrating this insight, you ensure your rollover complements, rather than conflicts with, your retirement goals.

Common Mistakes to Avoid in Rollovers

Despite the appeal of a tax-free gold IRA rollover, many investors stumble by rushing in without a full understanding. Errors like missing IRS rules, underestimating fees, and neglecting secure storage can erode your gains and trigger penalties. You must approach the rollover process systematically, using clear data and verified guidelines, to transform uncertainty into confident, evidence-based decisions that fortify your retirement portfolio.

Ignoring Tax Implications

Overlooking the tax consequences during rollovers can be costly. Not following IRS protocols, such as the 60-day rollover window or trustee-to-trustee transfer requirements, can lead to unwanted income taxes and penalties. You need to align your moves carefully with tax-advantaged structures, distinguishing between Traditional and Roth IRAs, to maintain your rollover’s tax-free status and long-term growth potential.

Overlooking Storage and Insurance Arrangements

Now, placing your physical gold without approved, insured depositories jeopardizes your account’s tax advantages and asset security. The IRS mandates third-party storage, with facilities like Brink’s or Delaware Depository offering insurance up to $1 billion and audited segregated options. If you store metals yourself, you risk unintended distributions and penalties that could undermine your retirement goals.

This aspect demands your full attention because self-storage is strictly prohibited by the IRS if you want to preserve tax benefits. When metals reside in approved vaults, they benefit from annual audits and insurance coverage that safeguard your investment against theft or loss. Choosing between segregated storage, which protects your specific coins, and commingled storage, which may be cheaper but is pooled by type, impacts liquidity and authenticity assurance. Neglecting these details can result in unexpected tax liabilities and reduced flexibility when you decide to liquidate or transfer your assets.

How to Get Started with Your Rollover

After deciding that a tax-free gold IRA rollover suits your retirement goals, your first move is to gather reliable information to guide you. A solid understanding of different rollover methods and IRA custodians will save you from costly mistakes and IRS penalties. Leveraging comprehensive kits, like those provided by Birch Gold Group, helps you visualize each step, from trustee-to-trustee transfers to storage logistics, offering you clarity and peace of mind before making any commitments.

Step-by-Step Rollover Process

Assuming you have your current IRA or 401(k) custodial details handy, the rollover involves a series of defined steps designed to keep your investment tax-advantaged.

| Step | Action |

|---|---|

| 1. Initiate Contact | Reach out to your target self-directed IRA custodian to request their rollover documentation and a Gold IRA kit. |

| 2. Choose Rollover Type | Select trustee-to-trustee rollover to avoid 20% IRS withholding and reduce audit scrutiny. |

| 3. Complete Paperwork | Submit required IRS forms and custodian onboarding documents, ensuring compliance with metal purity and storage rules. |

| 4. Fund Your Account | Your current custodian transfers funds directly to the new IRA custodian for bullion purchase and storage. |

| 5. Confirm Transfer | Verify metals are securely stored in an IRS-approved depository with annual audits and insurance coverage. |

Resources for Further Information

Step by step, empower yourself with well-curated materials like Birch Gold’s detailed 24-page Gold IRA kit, which offers transparent cost breakdowns, regulatory insights, and strategic allocation advice. This evidence-based resource enables you to navigate complex financial jargon, boosting your confidence to manage your rollover efficiently.

Your best path forward includes consulting multiple providers’ kits to compare fees and services side-by-side, using blank worksheets provided within these kits. With these tools, you gain clarity on costs, such as flat annual fees versus asset-based fees, and learn how to avoid pitfalls like self-storage penalties or overlooked RMDs. In short, these resources transform ambiguity into informed action, aligning your rollover with your broader retirement strategy.

To wrap up

Following this, you gain insight into how a tax-free gold IRA rollover empowers your retirement strategy by shielding your wealth from capital gains tax while allowing you to diversify beyond traditional assets. This mechanism lets you transfer existing retirement funds into physical precious metals without immediate tax consequences, enhancing your portfolio’s resilience against economic uncertainties. By navigating the process with informed precision, you position your financial future on a foundation both stable and adaptable, harnessing the scientific rigor of data and the clarity of strategic foresight.

FAQ

Q: What is a tax-free gold IRA rollover, and how does it work?

A: A tax-free gold IRA rollover involves transferring funds from an existing retirement account, such as a 401(k) or traditional IRA, into a self-directed Gold IRA without incurring immediate taxes or penalties. The funds are moved directly from one custodian to another in a trustee-to-trustee transaction, allowing you to invest in IRS-approved physical precious metals while maintaining the tax-advantaged status of the original account.

Q: What are the main benefits of doing a gold IRA rollover without triggering taxes?

A: Conducting a tax-free gold IRA rollover preserves the tax-deferred or tax-free growth of your retirement savings and allows you to diversify your portfolio with physical precious metals. By avoiding early withdrawal taxes and penalties, you keep your retirement funds intact and benefit from potential protection against inflation, market volatility, and currency risk, all while maintaining compliance with IRS regulations.

Q: Are there any specific IRS guidelines to follow to ensure the rollover remains tax-free?

A: Yes, to keep the rollover tax-free, the transaction must be completed within IRS rules, primarily by executing a direct trustee-to-trustee transfer or completing a 60-day rollover within the allowed time frame. Additionally, the assets moved must be deposited into a qualified self-directed IRA custodian that follows IRS-approved storage and custody protocols, and the funds cannot be taken as personal possession during the process, which would trigger taxes and penalties.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.