Embarking on the journey to transfer your 401(k) to a gold IRA tax-free requires careful navigation of IRS rules to safeguard your retirement savings. In this guide, you’ll learn step-by-step how to execute a rollover without triggering taxes or penalties, ensuring your assets remain protected while diversifying into physical precious metals. By understanding the eligible transfer methods, timelines, and custodian requirements, you can confidently manage your portfolio and bolster your financial security with tangible gold holdings.

Understanding Gold IRAs

The Gold IRA is a specialized version of a self-directed IRA that allows you to include physical precious metals like gold, silver, platinum, or palladium within your retirement portfolio. These IRAs follow IRS rules for approved bullion and require secure storage in an IRS‑approved depository. By holding tangible assets, you can diversify beyond stocks and bonds, potentially shielding your savings from inflation, market volatility, and currency risk.

What is a Gold IRA?

One type of self-directed IRA, a Gold IRA, permits you to invest in IRS‑approved bullion with at least 99.5% purity for gold. Your physical metals are stored securely by a third-party custodian in an approved vault, ensuring you comply with tax laws and retain the associated benefits throughout your retirement savings journey.

Benefits of Investing in Gold

Some of the main advantages include protection against inflation, reduced portfolio volatility, and diversification beyond traditional assets. Gains inside your Gold IRA compound without annual capital gains taxes, helping you navigate long metal cycles more efficiently than a regular brokerage account. This stability is vital as you prepare for retirement in uncertain economic times.

Understanding the benefits of investing in gold can help you balance your retirement portfolio by lowering overall risk during market downturns. Gold’s historical performance, especially during major stock market drawdowns, coupled with its role as a hedge against currency fluctuations and inflation, makes it a valuable asset for maintaining purchasing power over the long term.

401(k) Basics

Assuming you want to move your 401(k) savings into a Gold IRA tax-free, understanding your 401(k) plan is key. Your 401(k) is a tax-advantaged retirement account where contributions grow tax-deferred or tax-free, depending on the plan type. For detailed guidance on avoiding penalties during this transfer, see How To Execute A 401(k) To Gold IRA Rollover Without … to ensure your rollover proceeds smoothly and in full compliance.

Types of 401(k) Plans

While choosing how to transfer your retirement funds, you should consider the type of 401(k) you hold. Common plans include:

- Traditional 401(k): Contributions are pre-tax, and withdrawals are taxed as income.

- Roth 401(k): Contributions are made after tax, and withdrawals are generally tax-free.

- Simplified Employee Pension (SEP) 401(k): Designed for small business owners.

- Safe Harbor 401(k): Offers immediate vesting of employer contributions.

- Solo 401(k): Tailored for self-employed individuals with no employees.

Recognizing your plan type helps you understand tax implications and rollover options.

| Plan Type | Key Feature |

|---|---|

| Traditional 401(k) | Pre-tax contributions, taxable withdrawals |

| Roth 401(k) | After-tax contributions, tax-free withdrawals |

| SEP 401(k) | Immediate vesting on an employer match |

| Safe Harbor 401(k) | Designed for the self-employed without employees |

| Solo 401(k) | Immediate vesting in an employer match |

Withdrawal Rules and Penalties

Some withdrawal methods from your 401(k) may trigger taxes or penalties, especially if you withdraw before age 59½. Direct rollovers to a Gold IRA avoid early withdrawal penalties and tax hits, as long as you follow IRS rules carefully.

Basics of withdrawal rules include a 10% early withdrawal penalty on distributions before age 59½ unless exceptions apply, like qualified rollovers. Improper handling can cause tax liabilities or loss of tax benefits. Therefore, executing a trustee-to-trustee rollover directly into a self-directed Gold IRA ensures you avoid taxes and penalties while preserving your retirement savings’ growth potential through physical precious metals.

Tax-Free Transfer Options

Many investors seek ways to move their 401(k) funds into a Gold IRA without triggering taxes or penalties. IRS-approved methods include trustee-to-trustee transfers and 60-day rollovers, both designed to maintain your account’s tax-deferred status. By carefully choosing the right path, you can reposition your portfolio toward precious metals, like gold, while keeping your retirement savings intact. Understanding each option’s rules helps you avoid unwanted taxes and ensures your investment aligns with your long-term goals.

Trustee-to-Trustee Transfers

Little risk exists when you move your 401(k) directly from the original custodian to your Gold IRA trustee. This process avoids you handling the funds, eliminating potential tax withholding or penalties. The money transfers securely and remains tax-deferred, making it the most straightforward and IRS-favored way to shift assets into physical precious metals.

60-Day Rollovers

An alternative to trustee transfers, the 60-day rollover lets you receive the distribution personally before depositing it into a Gold IRA within 60 days. While it offers more control, it carries higher IRS scrutiny, and failure to complete the rollover on time results in taxes and penalties. Careful planning is vital when using this method to keep your rollover tax-free.

It’s important to note that the 60-day rollover can only be done once every 12 months per IRA, according to IRS rules. Missing the 60-day deadline means the distribution is treated as taxable income, potentially incurring early withdrawal penalties if you’re under 59½. To avoid these risks, ensure you have clear timelines and funds ready to deposit, maintaining tax advantages while diversifying your portfolio with precious metals.

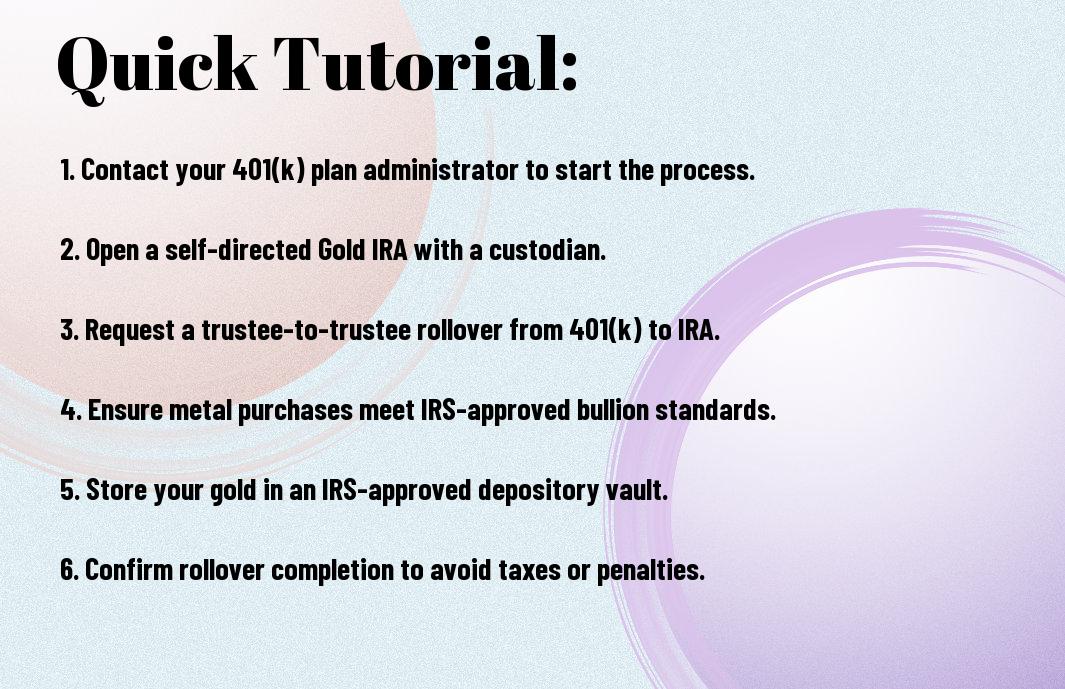

Step-by-Step Guide to Transfer

All transfers from your 401(k) to a Gold IRA must follow IRS rules carefully to avoid taxes or penalties. The process involves several stages, including preparation, execution, and finalizing your new Gold IRA account. Below is a concise overview to guide you smoothly through the transfer.

| Step | Action |

|---|---|

| Prepare | Review your 401(k) plan rules and select a self-directed Gold IRA custodian. |

| Execute | Initiate a trustee-to-trustee rollover to move funds directly without withholding taxes. |

| Finalize | Purchase IRS-approved bullion and arrange secure storage in an IRS-approved depository. |

Preparing for the Transfer

Preparing for your 401(k) to Gold IRA transfer means confirming eligibility for a rollover and choosing a trustworthy custodian specializing in self-directed IRAs. You’ll want to gather your retirement statements and understand your current asset mix, ensuring the allocated amount suits your portfolio goals. Clear knowledge of IRS contribution limits and tax rules helps position your Gold IRA to compound without annual capital-gains tax.

Executing the Transfer

On executing the transfer, request a trustee-to-trustee rollover, which directly moves your funds from your 401(k) custodian to your Gold IRA custodian, avoiding the 20% withholding that applies with indirect rollovers. This method reduces IRS audit scrutiny and keeps your investment fully intact to buy IRS-approved bullion with high purity standards.

Plus, your new custodian will handle paperwork, notify the IRS via Form 5498, and coordinate with the depository to ensure your metals are stored securely and insured up to $1 billion, keeping your tax benefits intact and giving you peace of mind with transparent fees.

Selecting a Gold IRA Custodian

Now that you’ve decided to transfer your 401(k) to a Gold IRA, choosing the right custodian is key to ensuring a smooth, tax-free rollover. Your custodian manages your account, facilitates paperwork, and works with approved depositories to store your metals securely. Look for a custodian experienced in self-directed IRAs and transparent about their processes, so you avoid delays or IRS penalties. This foundation helps you confidently transition your retirement funds into precious metals while complying with IRS guidelines.

Criteria for Choosing a Custodian

Selecting a custodian means evaluating their reputation, experience with gold IRAs, and the quality of customer support they offer. You want a firm that clearly explains IRS regulations and manages all necessary documentation on your behalf. Transparency about storage options, such as segregated versus commingled vaults and annual audit practices, is also important. By focusing on these factors, you can protect your investment and keep your rollover tax-free and hassle-free.

Costs and Fees to Consider

Any custodian you select will charge fees, so understanding cost structures helps you avoid surprises that eat into your returns. Common fees include one-time setup charges around $50, annual administration fees between $180 and $230, and storage fees that may be flat or asset-based. Additionally, spreads or commissions on bullion purchases affect your overall cost. Knowing these line items enables you to compare providers effectively and choose one aligned with your budget and long-term goals.

A detailed fee breakdown can reveal how charges stack up. For example, a low purchase markup may be offset by higher annual storage fees or vice versa. Some custodians offer flat annual rates, while others charge a percentage of your IRA assets, often ranging from 0.4% to 1%. By gathering and comparing these costs using standardized worksheets, you can select a custodian that balances affordability with reliable service, helping you preserve and grow your retirement assets efficiently.

Best Practices for Managing Your Gold IRA

Keep a disciplined approach to managing your Gold IRA by understanding fee structures, storage options, and tax implications. Regularly review your portfolio allocation and storage arrangements to ensure alignment with your retirement goals. Use educational kits and resources to stay informed, allowing you to make strategic decisions rather than emotional ones. Consistency in monitoring and adjusting your account helps maximize tax advantages and protect your investment against market volatility and inflation risks.

Diversification Strategies

There’s value in diversifying your Gold IRA beyond just gold. Including other IRS-approved precious metals like silver, platinum, or palladium can reduce volatility and improve stability. Avoid over-allocating to a single metal; for example, silver’s price tends to be more volatile while gold offers steadier growth. Balancing your metals according to your risk tolerance and market outlook can help protect your retirement savings from economic shifts.

Monitoring Market Trends

Clearly, keeping an eye on gold price movements, central bank gold purchases, and inflation data empowers you to time your contributions and rebalancing effectively. Utilizing historical charts and reputable data sources lets you see how gold performs during market downturns and inflation spikes. This understanding enables you to adjust your allocation and optimize returns while maintaining your portfolio’s defensive qualities.

For instance, the Birch Gold kit highlights how gold prices correlate with inflation over 50 years and perform well during the five worst S&P 500 drawdowns. By tracking central bank buying patterns and economic indicators, you can anticipate shifts in demand and price, helping you decide when to rebalance or add to your holdings. Automated reviews, at least annually, ensure your plan stays aligned with evolving market conditions and your retirement timeline.

Conclusion

Presently, to transfer your 401(k) to a Gold IRA tax-free, you need to execute a direct trustee-to-trustee rollover. This method moves funds directly from your existing 401(k) custodian to your Gold IRA custodian, avoiding mandatory tax withholdings and penalties. By following IRS guidelines carefully and working with a reputable custodian, you ensure your retirement savings transition smoothly into physical precious metals, preserving the tax advantages. Taking these steps allows you to diversify your portfolio while maintaining control of your retirement funds.

FAQ

Q: How can I transfer my 401(k) funds to a Gold IRA without incurring taxes?

A: To move your 401(k) to a Gold IRA tax-free, you can perform a trustee-to-trustee rollover. This means the funds move directly from your 401(k) custodian to the Gold IRA custodian without you taking possession of the money. Completing this transfer within the IRS guidelines avoids triggering taxes or penalties.

Q: What is the difference between a trustee-to-trustee rollover and a 60-day rollover when transferring a 401(k) to a Gold IRA?

A: A trustee-to-trustee rollover involves your current 401(k) custodian sending funds directly to the Gold IRA custodian, which prevents tax withholding and reduces audit risk. In contrast, a 60-day rollover occurs when you withdraw funds yourself and then deposit them into a Gold IRA within 60 days. The 60-day rollover carries higher audit scrutiny, and missing the deadline can result in taxes and possible penalties.

Q: Are there IRS forms I need to file when rolling over my 401(k) into a Gold IRA?

A: Yes. When performing a trustee-to-trustee or 60-day rollover, you typically need to report the transaction using IRS Form 1099-R and Form 5498. The custodian of the Gold IRA will send you Form 5498 to confirm the rollover was completed. It’s important to keep copies of these forms and include the rollover information accurately on your tax return to maintain the tax-deferred status of your account.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.