Many investors want to diversify their retirement savings by moving funds into a Gold IRA, but worry about triggering unwanted taxes. When you execute a Gold IRA rollover with no tax penalty, you must follow IRS rules precisely to avoid costly pitfalls like early distribution taxes or penalties. By using the proper trustee-to-trustee transfer methods and completing rollovers within the 60-day window, you can shift your assets smoothly, keeping your retirement strategy intact and tax-efficient. This guide will help you navigate the process confidently and protect your investment’s growth potential.

>>>>>>>>>Get Your Free Gold IRA Kit<<<<<<<<<<<

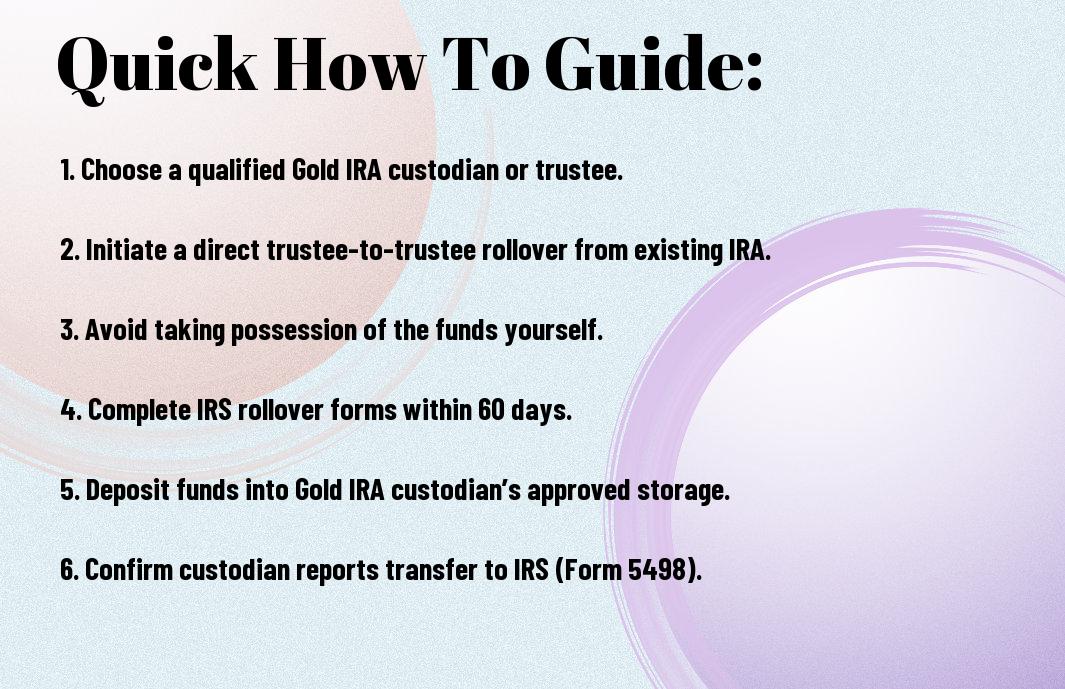

How to Initiate a Gold IRA Rollover

Before starting a Gold IRA rollover, you need to evaluate your current retirement account and understand the IRS rules to avoid tax penalties. Initiating a trustee-to-trustee transfer lets you move funds directly from your existing IRA or 401(k) to a self-directed Gold IRA, which keeps your investment tax-deferred. You’ll want to choose a reputable custodian and confirm which IRS forms apply. Taking these steps ensures a smooth rollover process that protects your assets and maximizes your portfolio’s diversification, with no immediate tax consequences.

Understanding the Rollover Process

Some key aspects define the Gold IRA rollover process: funds are transferred directly from your existing account to your new custodian without requiring you to take possession, which helps avoid triggering taxes. You can contribute new money up to IRS limits, do a trustee-to-trustee rollover, or opt for a 60-day rollover, but the latter carries higher IRS scrutiny. Each path has specific forms and timelines, so knowing which applies to your situation helps you navigate safely and prevent penalties.

Steps to Follow for a Successful Transition

Some important steps include contacting your current IRA custodian to request a rollover, selecting a self-directed IRA provider specializing in precious metals, and ensuring your metals meet IRS purity standards. Complete the necessary paperwork promptly, and verify that storage will be in an IRS-approved, insured depository. By following this process attentively, you keep control while safeguarding your rollover from tax issues.

You must never take physical possession of your funds during the transition to avoid IRS penalties. Opting for a trustee-to-trustee rollover is typically the safest method. Be aware of potential fees like setup (~$50) and annual storage/admin fees ($180–$230), as these affect long-term returns. Additionally, selecting segregated storage enhances security but may increase costs. Staying organized and using checklists from expert kits can help you complete each step efficiently and confidently.

Tips for Avoiding Tax Penalties

One effective way to avoid tax penalties during your Gold IRA rollover is to follow IRS rules carefully.

- Complete your rollover within 60 days.

- Use trustee-to-trustee transfers when possible.

- Avoid taking physical possession of the metals personally.

After completing these steps, you reduce the risk of unintended taxes and penalties, protecting your retirement savings and ensuring smooth handling of your Gold IRA funds.

Timing Your Rollover Correctly

Tips for timing your rollover include beginning the process well before the 60-day deadline imposed by the IRS. Starting early allows you to address any unexpected delays without jeopardizing your tax benefits. You should coordinate with your custodians promptly to ensure funds move within this window, avoiding penalties and maintaining your tax-advantaged status.

Utilizing Trustee-to-Trustee Transfers

Tips for utilizing trustee-to-trustee transfers emphasize making direct transfers between your current IRA custodian and the new custodian managing your Gold IRA. This method minimizes your involvement, eliminating the 60-day rollover countdown and reducing audit risks by avoiding personal receipt of funds or metals.

Correctly using trustee-to-trustee transfers is your safest option to prevent tax penalties during your Gold IRA rollover. Unlike 60-day rollovers, these transfers bypass IRS time limits and mitigate errors from handling distributions yourself. They also guarantee continual tax-deferred or tax-free treatment depending on your IRA type, and reduce exposure to missteps that could result in unintended distributions or early withdrawal penalties. You should work directly with both custodians to initiate the transfer seamlessly and keep documentation for your records.

Factors to Consider Before Rollover

While a Gold IRA rollover can be a smart move to diversify your portfolio, it’s important to weigh several factors before proceeding. Consider the tax implications, ensure compliance with IRS rules to avoid penalties, and review associated fees like setup or annual storage costs. You should also understand the storage requirements since the IRS mandates third-party custodians, not self-storage. The foundation of a successful rollover is clear knowledge about how your money moves and what costs you’ll encounter.

Assessing Your Current Retirement Account

Account evaluation helps you understand your existing retirement assets’ tax treatment, contribution limits, and whether a direct rollover or 60-day rollover suits your needs best. Knowing your current account type, traditional or Roth IRA,informs how the Gold IRA rollover will impact your long-term growth and withdrawal taxes. By aligning your existing portfolio goals with gold investments, you minimize risks and avoid costly mistakes during the transfer process.

Evaluating Eligible Gold Investments

If you consider a Gold IRA rollover, you must select IRS-approved bullion that meets purity standards, for example, gold ≥ 99.5% purity like American Gold Eagles or Canadian Maple Leafs. Avoid collectible coins, which the IRS generally disallows due to valuation challenges. Choosing the right metals ensures compliance and protects your investment from unnecessary penalties or losses.

Understanding the strict IRS guidelines for eligible metals is important when evaluating your gold investments. Only bullion with specified purity levels like gold at or above 99.5% qualifies for your IRA, safeguarding your portfolio’s eligibility and value. Conversely, investing in numismatic or collectible coins can lead to disallowed assets, triggering taxes and penalties. You need to focus on standard, fungible bullion such as American Gold Eagle coins or Canadian Maple Leaf bars, which also facilitates easier valuation and liquidity. Maintaining compliance here is your defense against IRS issues and ensures your Gold IRA rollover remains tax-advantaged.

Common Mistakes to Avoid During a Rollover

All too often, investors rushing a Gold IRA rollover miss key steps that lead to unwanted tax penalties. To avoid this, you should follow IRS guidelines carefully. For detailed rules, consult the Rollovers of retirement plan and IRA distributions page. Ensuring you complete trustee-to-trustee transfers within allowable timeframes can save you from costly withholding and penalties. Taking your time and using trusted resources makes your rollover smoother and protects your retirement savings.

Ignoring Tax Implications

For your rollover to remain tax-advantaged, you must understand different IRA types and contribution rules. Mistakes like missing the 60-day window or taking distributions can trigger taxes and penalties. Knowing how Traditional and Roth IRA rollovers differ helps you strategize withdrawals and avoid unexpected tax hits on gains or principal.

Overlooking Storage and Custodial Fees

Storage fees can quietly erode your returns if you don’t evaluate them upfront. Storage costs range from flat fees ($180–$230 annually) to percentage-based fees (0.4–1%) on your assets. You should weigh these against purchase spreads and commissions to ensure your gains stay protected. Transparent fee comparisons empower you to select the best custodial option.

Mistakes in underestimating annual admin and storage fees can undermine your investment’s performance. Some providers charge a flat fee, while others use asset-based pricing, meaning fees grow as your portfolio does. Since the IRS requires metal to be stored off-site in approved vaults, factoring in custodial and insurance costs is imperative. Ignoring this can lead to surprise expenses that chip away at your “safe haven” returns. You benefit most when you compare fee structures side-by-side and plan for these costs over the long term, not just at setup.

How to Choose a Custodian for Your Gold IRA

Your choice of custodian will shape the ease and safety of your Gold IRA rollover. Look for a custodian experienced in handling precious metals and compliant with IRS rules to avoid tax penalties. A good custodian guides you through the transfer process and offers transparency about fees and storage. For a detailed view on managing rollovers smoothly, explore Rollover IRA | Simplify Your Retirement Savings.

Checking Credentials and Fees

Choose a custodian with strong regulatory oversight and clear fee structures. Typical fees include setup ($50), annual administration ($180–$230), and storage costs. Understanding these helps you avoid unexpected charges that can erode your returns over time. Transparent providers will offer a detailed fee worksheet, so you can compare costs before committing.

Understanding Storage Options

Options for storing your metals are either segregated, kept separately for you, or commingled, pooled with others’ assets. Both should be in IRS-approved, insured depositories. For example, top vaults like Brink’s or Delaware Depository offer up to $1 billion in insurance. Choose storage that fits your budget and gives you peace of mind regarding security and liquidity.

Checking storage details means verifying insurance coverage, audit frequency, and whether your metals are segregated or commingled. Segregated storage protects your exact bullion from mix-ups, while commingled storage may reduce costs but limits access to specific coins. Also, understand that IRS rules prohibit self-storage to keep tax benefits intact. Selecting the right option ensures your physical metals are both secure and compliant with regulations.

The Importance of Proper Documentation

Not having proper documentation during your Gold IRA rollover can lead to unexpected tax penalties and delays. Clear, thorough paperwork provides a verifiable trail that shows the IRS your rollover qualifies for tax-free treatment. Proper documentation also protects your investment and helps you avoid costly mistakes like missed deadlines or misunderstood rollover methods, which the IRS scrutinizes closely.

Required Forms and Paperwork

You need to complete specific IRS forms to ensure your rollover is processed smoothly. Key documents include the trustee-to-trustee transfer forms to avoid the 20% withholding tax, and the IRS Form 5498, which reports your IRA contributions and rollovers. Keeping these forms organized helps you demonstrate your compliance and prevent audits or penalties.

Ensuring Compliance with IRS Regulations

Regulations demand that your Gold IRA rollover be handled via approved methods to avoid taxes and penalties. For example, money must move directly between trustees, and holding physical metals outside approved custodians is prohibited. Meeting IRS purity and storage rules ensures your investment retains tax-advantaged status.

Understanding IRS rules means you must transfer funds only through proper channels, such as trustee-to-trustee rollovers, to qualify for tax-free benefits. Failure to comply can result in immediate taxation and penalties, particularly if you store metals personally, which the IRS forbids. Additionally, only IRS-approved bullion with specified purity levels qualifies. Ensuring your metals reside in an IRS-approved depository, often insured up to $1 billion, safeguards your assets and tax advantages, letting you enjoy the intended benefits of your Gold IRA rollover without surprise costs.

Final Words

On the whole, a Gold IRA rollover with no tax penalty offers you a strategic way to diversify your retirement portfolio while preserving tax advantages. By carefully following IRS guidelines and using trustee-to-trustee transfers, you can move your assets smoothly without triggering unwanted taxes or penalties. This approach empowers you to safeguard your wealth against market volatility and inflation, ensuring that your precious metals investments align with your long-term financial goals. Staying informed and using proper rollover methods helps you maximize the benefits of your Gold IRA confidently and efficiently.