Embarking on a gold IRA rollover can seem daunting, but with a clear roadmap, you can confidently transfer your retirement funds into precious metals while avoiding costly IRS penalties. In this guide, you’ll learn each stage from selecting a custodian to securely moving your assets, all designed to protect your savings and optimize your portfolio’s stability. Following this systematic process ensures your investment aligns with IRS regulations and maximizes your potential for long-term growth.

>>>>>>>>>>>>>Compare Top Gold IRA Platforms<<<<<<<<<<<<<

Understanding Gold IRAs

While diversifying your retirement portfolio, knowing what a Gold IRA entails is imperative. These specialized self-directed accounts let you hold physical precious metals like gold and silver, offering a hedge against inflation and market volatility. They operate under strict IRS rules, ensuring tax-advantaged growth while requiring secure storage in approved depositories. Before initiating a rollover, you should grasp how these accounts work and the benefits and obligations involved to make informed decisions aligned with your financial goals.

What is a Gold IRA?

The Gold IRA is a variation of a self-directed IRA that allows you to invest in physical gold and other precious metals approved by the IRS. Your IRA owns the bullion, stored securely in a third-party vault, rather than holding traditional stocks or bonds. This setup helps preserve your retirement assets’ purchasing power, mitigating risks like inflation and currency fluctuations while benefiting from tax-advantaged growth.

Types of Gold IRAs (Traditional vs. Roth)

| Feature | Traditional IRA/Roth IRA |

| Contribution Tax Treatment | Tax-deductible now / After-tax |

| Withdrawal Tax Treatment | Taxed as ordinary income later / Tax-free after age 59½ |

| Growth Compounding | Tax-deferred / Tax-free |

| Withdrawal Restrictions | Required Minimum Distributions (RMDs) apply / No RMDs |

| Best For | Current tax deduction / Future tax-free gains |

Types of Gold IRAs differ mainly in their tax mechanics and withdrawal rules. A Traditional Gold IRA offers upfront tax deductions but requires you to pay taxes on distributions, whereas a Roth Gold IRA uses after-tax contributions with tax-free qualified withdrawals. You must evaluate which aligns better with your current tax situation and retirement strategy.

This distinction influences how you plan your contributions and withdrawals. A Traditional IRA may appeal if you want immediate tax relief, but you’ll face taxes during retirement. Conversely, a Roth IRA requires paying taxes today but provides tax-free gains and withdrawals. Urgency in tax planning is necessary, as Required Minimum Distributions (RMDs) only apply to Traditional IRAs, which can impact your overall retirement income. You should weigh these factors when deciding your ideal Gold IRA structure.

Eligible Precious Metals

What qualifies for your Gold IRA investments is limited to IRS-approved bullion with strict purity standards. Acceptable metals include gold with at least 99.5% purity, silver at 99.9%, and platinum or palladium at 99.95%. Collectible or numismatic coins are disallowed due to valuation difficulties. These rules ensure your metals remain liquid and IRS-compliant for retirement use.

Metals held in your IRA must meet rigorous purity and IRS approval to maintain tax benefits. While gold and silver coins like American Eagles and Canadian Maple Leafs are common choices, numismatic coins pose risks and are typically rejected. You must also avoid storing metals personally, as the IRS mandates secure custodial vaults to maintain tax advantages, protecting your retirement assets from penalties and forced distributions.

Preparing for the Rollover

Some key steps will help you transition smoothly into a Gold IRA. Preparing involves understanding your current retirement account, getting familiar with IRS rules, and selecting a trustworthy custodian. Proper preparation minimizes costly mistakes, such as unintended taxes or storage penalties. Taking time to educate yourself on fee structures, storage requirements, and transfer methods ensures your valuable metals and funds stay secure throughout the rollover process.

Assessing Your Current Retirement Account

Some initial evaluation of your existing retirement plan helps clarify the best rollover approach. Check account type, balance, and any restrictions that might affect transfers. Knowing whether your account supports trustee-to-trustee rollovers or 60-day rollovers influences timing and tax implications. This groundwork avoids surprises and aligns your new Gold IRA goals with your current portfolio.

Understanding the IRS Regulations

Assuming you want to keep tax advantages intact, learning IRS rules is vital. The IRS mandates that physical metals must be stored in an approved depository, forbidding self-storage. Incorrect rollovers can trigger tax penalties or disqualify your IRA. Familiarizing yourself with contribution limits, rollover timelines, and reporting requirements protects your investment and avoids costly IRS audits.

Understanding IRS regulations means grasping that any misstep in timing or storage can cause unintended tax liabilities and penalties. The IRS specifically disallows storing your metals personally; instead, your bullion must reside in an IRS-approved, insured depository. Additionally, rollover methods like trustee-to-trustee transfers avoid 20% withholding taxes, while 60-day rollovers carry higher audit risks. You should map out your process carefully to comply with forms and deadlines, ensuring your IRA retains its tax-protected status.

Choosing the Right Gold IRA Custodian

Gold IRA custodians manage your account and coordinate with depositories, so your choice impacts costs, security, and service quality. You want a custodian with transparent fees, both setup and ongoing storage, to avoid surprises. Look for firms like Birch Gold, whose fees ($50 setup, $180–$200 annual) are clear and competitive. Confirm that your custodian reports to the IRS and facilitates smooth rollovers without unnecessary delays.

Your custodian serves as the bridge between your funds and physical precious metals. Beyond fee transparency, assess their reputation, regulatory compliance, and depository partnerships. A custodian who collaborates with trusted vaults offering segregated storage and insurance up to $1 billion ensures your metals remain secure. Reliable custodians also provide clear paperwork handling to prevent IRS penalties and streamline distributions, whether cash or in-kind.

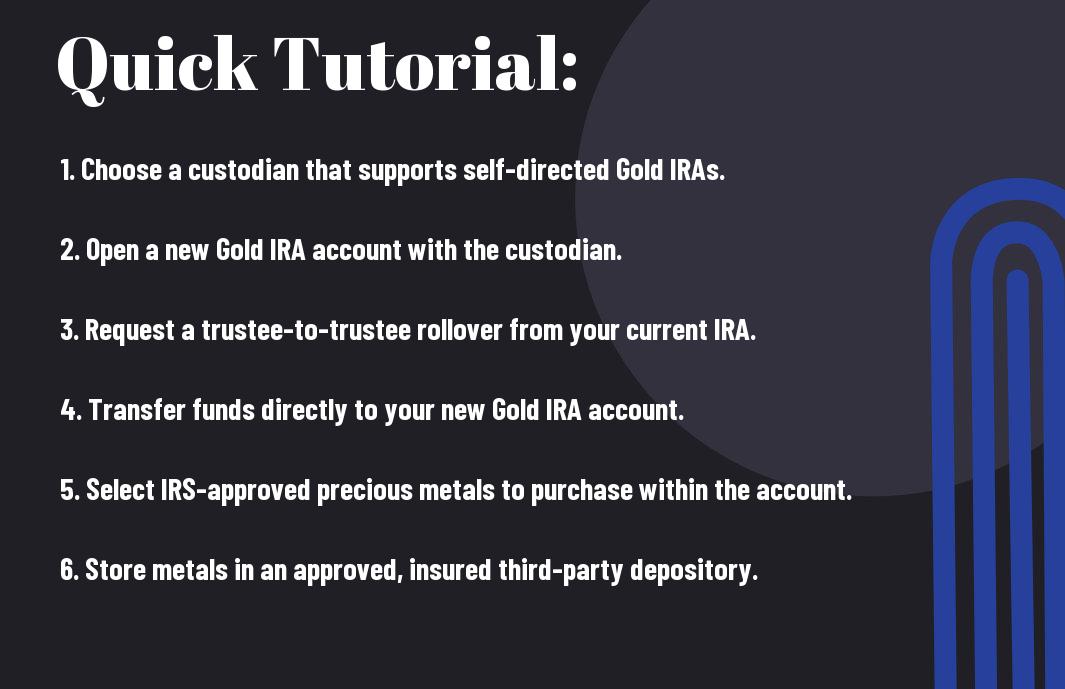

Initiating the Rollover

Now that you’ve decided to roll over your retirement funds into a Gold IRA, the first step is to initiate the process with your current custodian. This involves contacting them to request a rollover to a self-directed IRA custodian approved for precious metals. You’ll complete the necessary paperwork to ensure your funds transfer smoothly without triggering taxes or penalties. Clear communication and timely submission of forms set a solid foundation for your Gold IRA investment journey.

Steps for a Trustee-to-Trustee Transfer

Rollover via trustee-to-trustee transfer is the simplest method to move your assets directly between custodians without your involvement. Your current custodian transfers funds straight to your new Gold IRA custodian, avoiding the 60-day deadline and eliminating withholding tax risks. This approach ensures a seamless, IRS-compliant process with minimal audit scrutiny, helping you keep your retirement plan on track with less stress.

Managing a 60-Day Rollover Process

Rollover using the 60-day method gives you control over funds temporarily but comes with significant timing pressure. You must redeposit the full amount into your new Gold IRA within 60 calendar days to avoid taxes and penalties. It’s important to track timing carefully, as missing the deadline may result in the distribution being treated as taxable income.

With the 60-day rollover, you receive the funds personally, offering flexibility but also increasing IRS audit scrutiny. Failing to redeposit on time triggers ordinary income taxation and possible early withdrawal penalties. To minimize risk, plan transfers early, maintain detailed records, and consider consulting your custodian or a financial advisor. This method is best for those confident in managing deadlines and cash flow during the process.

Selecting Your Gold Investments

Many investors approaching a Gold IRA rollover wonder how to choose the right metals for their portfolio. Your selection should align with your retirement goals, risk tolerance, and the IRS requirements for purity and type. By focusing on approved bullion with transparent costs and secure storage options, you can avoid penalties and ensure your investment holds value. After considering your options, you’re better equipped to make strategic allocations that balance growth and protection within your IRA.

Types of Gold and Precious Metals to Consider

Types of gold and precious metals to include should meet IRS standards to maintain tax advantages. You can consider bullion coins and bars that are highly pure, such as:

| Metal | Purity & Examples |

|---|---|

| Gold | ≥ 99.5% (American Gold Eagle, Canadian Maple Leaf) |

| Silver | ≥ 99.9% (American Silver Eagle, Philharmonic) |

| Platinum | ≥ 99.95% |

| Palladium | ≥ 99.95% |

| Disallowed Items | Numismatic or collectible coins |

- A gold IRA rollover requires IRS-approved bullion.

- Purity levels impact valuation and eligibility.

- Physical metals must be stored in approved depositories.

After selecting your metals, focus on custodial and storage logistics to preserve your IRA benefits.

Evaluating Quality and Purity

Consider the exact purity of the metals you include in your IRA, since IRS rules mandate standards to qualify for tax-advantaged status. Having metals below these thresholds or collectible coins can trigger fees and penalties, undermining your investment’s purpose. Ensuring your metals are from reputable sources and meet or exceed IRS purity ensures safe harbor for your retirement savings.

With gold requiring ≥ 99.5% purity and silver at ≥ 99.9%, buying recognized coins and bars like the American Gold Eagle or Canadian Maple Leaf guarantees you meet requirements. IRS approval, proper storage, and certification improve liquidity and ease of valuation. Beware of numismatic coins, as they are disallowed and may complicate your tax situation. Focus on standard bullion its consistency safeguards your IRA’s integrity and marketability.

Storage Solutions for Your Gold IRA

To safeguard your physical metals in a Gold IRA, you must use an IRS-approved depository that offers secure vaults insured up to $1 billion with regular audits. Selecting the right storage option ensures your assets are protected and compliant, letting you focus on your investment strategy. For detailed rollover insights, check out the Step-by-Step 403(b) to Gold IRA Rollover Guide.

IRS Requirements for Storage

If you want to maintain the tax advantages of a Gold IRA, the IRS mandates that your metals cannot be stored at home. Instead, they must reside in an approved, third-party depository with secure, often segregated or commingled, vault options. Failing to comply can trigger distribution taxes and penalties, so choosing a certified storage facility is vital for your IRA’s compliance and security.

Choosing between Segregated and Commingled Storage

Some investors prefer segregated storage to have their specific bullion stored separately, preserving coin serial numbers and ensuring no mixing with others’ metals. Others opt for commingled storage to lower costs by pooling metals by type. Each method carries benefits and trade-offs that can impact accessibility, insurance claims, and control over your holdings.

Your choice between segregated and commingled storage affects how your metals are handled and valued. Segregated storage offers personalized security by keeping your gold distinct, which can simplify claims and ease liquidations. However, it usually costs more. On the other hand, commingled storage reduces fees but combines your metals with others’, which might complicate precise asset tracking and influence how quickly you can liquidate. Understanding these differences helps you align storage with your comfort level and financial goals.

Monitoring and Maintaining Your Gold IRA

Your Gold IRA requires ongoing attention to ensure it continues to align with your retirement goals. Regularly tracking your investment’s performance and staying informed about market trends helps you make informed decisions. Staying engaged with your custodian and keeping documentation updated will prevent surprises. This active approach supports long-term growth while avoiding pitfalls such as unexpected tax penalties or storage issues.

Annual Reviews and Adjustments

Clearly, conducting an annual review of your Gold IRA is imperative to maintain optimal portfolio balance. During these reviews, assess your allocation percentage, re-evaluate fees, and adjust your holdings as necessary to respond to market conditions. This disciplined process helps you stay aligned with your risk tolerance and investment objectives, enhancing the potential for steady growth over time.

Understanding Fees and Expenses

You should be aware of all costs associated with your Gold IRA. Common fees include one-time setup charges (~$50), annual administration and storage fees (ranging from $180 to $230 or 0.4–1% of assets), and the spread or commission on bullion purchases. These costs can significantly impact returns, especially if hidden or poorly understood, so transparency is key to protecting your investment’s value.

Maintaining clear knowledge of your fees allows you to avoid unexpected erosion of your returns. For example, a low commission but high asset-based storage fee may reduce your gains more than anticipated, particularly as your balance grows. A flat annual fee of around $180 on a $50,000 balance equals roughly 0.36%, which is often lower than many bond ETF expense ratios. By regularly reviewing your fee structure and comparing providers, you can ensure your Gold IRA remains cost-effective and aligned with your retirement strategy.

Final Words

With these considerations in mind, following a step-by-step gold IRA rollover process helps you navigate each stage confidently, from selecting your custodian and completing IRS paperwork to funding your account and securing approved bullion in a trusted depository. By approaching your rollover methodically, you reduce risks, avoid penalties, and align your investment strategy with long-term goals. Taking deliberate actions ensures your precious metals investment supports portfolio diversification and financial security throughout retirement.