Why Second‑Chance Funding Fuels Passive‑Income Plays

Missed Opportunity = Lost Lifetime Value

Passive‑income gurus love the phrase: “Money loves speed.” In practice, speed decides who lands:

- A foreclosure‑priced duplex that cash‑flows $350 each door

- A Facebook Marketplace vending‑machine route making $700 net a month

- A dividend aristocrat is temporarily 20 % off its 52‑week high

The trouble? Traditional lenders freeze at credit scores below about 620. That lock‑out pushes thousands of cash‑flow projects into the hands of investors with perfect credit, while subprime borrowers watch from the sidelines.

Cash‑Flow Gaps Kill Momentum

Even established landlords and resellers run into short‑run deficits:

- HVAC blows mid‑July ($4 800)

- Car fleet’s transmission fails ($3 200)

- Surprise tax bill from last year’s Airbnb boom ($1 600)

Let those assets sit idle, and your passive‑income flywheel stops spinning. A fast, if comparatively expensive, personal loan bridges the gap and keeps money working.

Bad‑Credit Personal Loans 101: What “Guaranteed Approval” Really Means

Direct lenders that advertise “guaranteed approval” aren’t defying math; they’re widening their underwriting lens. Approval is conditional on minimum income, ID verification, state‑law rules, and a repayment plan that makes sense. The phrase signals “we accept subprime borrowers; let’s see if you’re affordable.”

| Feature | Typical Bad‑Credit Installment Loan | Payday Loan (Avoid) |

|---|---|---|

| Amount | $200 – $5 000 (sometimes $10k–$50k) | $100 – $1 000 |

| Repayment | 6 – 36 equal monthly installments | Lump sum on next payday |

| APR Cap | 15 % – 35.99 % (state‑limited) | 200 % – 400 %+ |

| Credit Pull | Soft for quote; hard on final approval | Rarely checked |

| Credit Impact | On‑time payments build score | Usually no benefit |

| Cash‑Flow Fit | Can align with asset income | Kills profit spread |

For a passive‑income plan to survive, your financing cost must stay well below your asset’s return. Installment loans under 36 % APR can work; payday loans never do.

Beyond the Score: How Direct Lenders Size You Up

Income‑to‑Debt Ratio (DTI)

Even with a 540 FICO, showing a DTI below 50 % assures lenders that you can handle another monthly payment.

Bank‑Statement Cash‑Flow Analysis

Fintech lenders hook into your checking account via Plaid and weigh:

- Deposit regularity

- Average daily balance

- Bounce‑fee history

Consistency often outranks raw dollar totals.

Alternative Data

Timely rent, phone, and utility payments; gig‑economy 1099 inflows; even eBay seller ratings can tilt a “maybe” into “approved.”

Secured vs. Unsecured

Putting up collateral (car title, equipment) chops APR but risks asset repossession. Most bad‑credit borrowers prefer unsecured installment loans for speed and safety.

Rate‑Shopping First: Payday ‑ Installment Loans US / Personal Loans US

Before locking any deal, load up a comparison engine. Payday ‑ Installment Loans US / Personal Loans US:

- Runs a soft credit pull (no score ding).

- Returns multiple offers in 90 seconds.

- Let’s you filter for APR ≤ 30 %, zero origination fee, and no pre‑payment penalty.

Think of it as the Kelley Blue Book of bad‑credit loans: you’ll know the fair price range before approaching direct lenders.

GreenMoneyLoans.net Fast Track to $200–$5 000 for Sub‑Prime Borrowers

Why GreenMoneyLoans?

| Advantage | Details |

|---|---|

| Loan range | $200 – $5 000 (sweet spot for mini‑flips, repairs, or inventory buys) |

| Decision time | Often, within minutes aftera soft pull |

| Funding speed | Money can hit your bank next business day |

| APR ceiling | Capped at 35.99 % (avoids payday‑style gouging) |

| Early payoff | Often, within minutes after a soft pull |

| Privacy & security | 256‑bit SSL + site‑visit recordation; no data resale fluff |

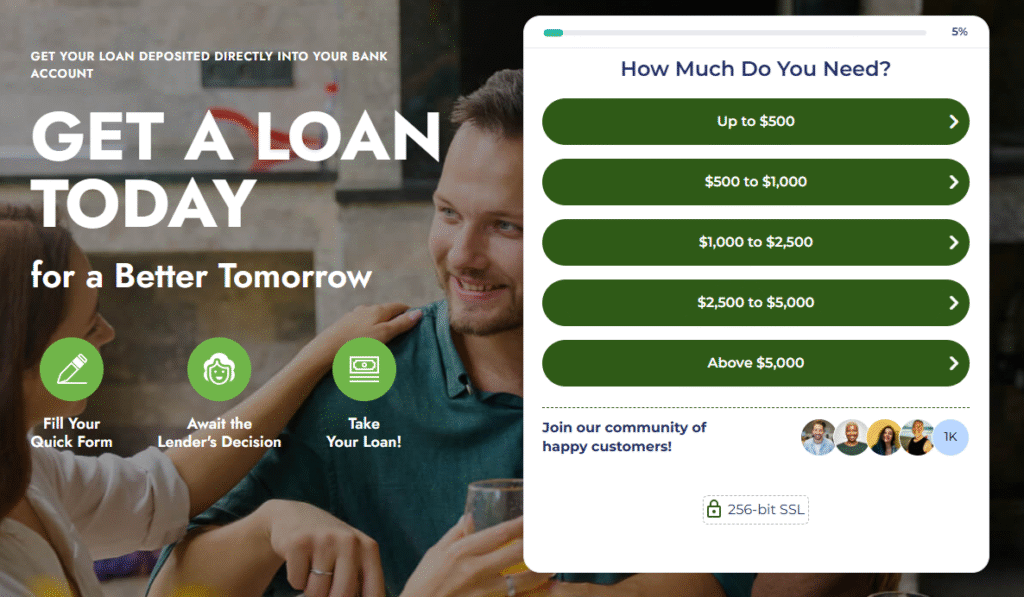

Five‑Minute Application Walkthrough

- Start Your Speedy Form at GreenMoneyLoans.net.

- Choose desired amount, basic contact info, monthly income, and checking‑account age.

- Submit for a soft inquiry (your score stays untouched).

- If pre‑approved, read the Truth‑in‑Lending disclosure: payment, term, total payback.

- E‑sign the note; ACH details auto‑populate from your bank.

- Check your account the next morning for funds, then deploy them into your cash‑flow plan.

Borrower‑First Policies

- Transparent fee sheet beside “Accept” button no surprises.

- Automated ACH payments so you never miss and wreck your rebuilding credit.

- Live chat & phone for humans who explain any line item you don’t understand.

Need up to $5 000 fast? Apply through GreenMoneyLoans.net now →

Turning High‑APR Money Into Positive Cash Flow

Below are three realistic (if simplified) scenarios showing how sub‑prime loans can still widen your passive‑profit margin when you crunch the math.

Airbnb Furnishing Upgrade

- Problem: A downtown studio sits half‑booked because reviews knock outdated décor. New package (smart TV, queen bed, fresh paint) costs $1 900.

- Loan: $2 000 from GreenMoneyLoans @ 29 % APR, 18 months → $131 / mo.

- Result: Higher nightly rate and 10 % occupancy jump add $230 net per month.

- Spread: $99 surplus day one. Borrower snowballs $50 extra toward principal; loan dead in 11 months, ROI 167 % first year.

Vending‑Route Compressor Save

- Problem: Soda machine compressor fails. Repair quote $780; each down day loses $45 in sales.

- Loan: $1 000 @ 32 % APR, 12 months → $94 / mo.

- Result: Machine back online in 48 hours; monthly net returns to $350.

- Spread: $256 after payment. Loan crushed with four $250 extra payments; interest cost $61. Net pocket: $3 039 the first year instead of $540 loss.

Debt‑Consolidation Yield Play

- Problem: Two cards total $4 800 @ 26 % APR $104 monthly interest.

- Loan: $5 000 @ 22 % APR, 24 months → $259 (principal + $46 interest).

- Opportunity: Freed $58/month goes to a dividend ETF yielding 4 %. In two years ETF worth $1 500; loan zeroed out; credit score +70; future borrowing cheaper.

Risk‑Management Blueprint for Bad‑Credit Borrowers

- Stress‑Test at 80 % Revenue

Assume your asset underperforms by 20 %. If payment still clears, proceed. - Automate + Accelerate

ACH autopay + extra‑principal snowballs destroy interest faster than any refinance. - Review APR After Six On‑Time Payments

Bad‑credit lenders reward performance. A 40‑point FICO boost can drop your APR 5‑10 points on a refi. - Avoid “No Credit Check” Payday Temptations

Anything > 36 % APR narrows spreads so much that one hiccup forces a rollover and robs months of profits. - Keep Revolving Utilization Under 30 %

Reducing card balances while the installment loan seasons raises your score faster than any dispute hack.

Fast‑Approval Checklist Boost Your Odds Today

| Task | Why It Matters | Time Needed |

|---|---|---|

| Pull credit report & fix errors | 20‑point jump can shave APR 2 % | 30 min |

| Calculate post‑loan DTI | Lenders like ≤ 50 % | 10 min |

| Gather income proof (pay stubs/1099) | Speeds underwriting | 15 min |

| Pre‑qualify on marketplace | Sets rate baseline | 5 min |

| Submit to GreenMoneyLoans | Direct bad‑credit route | 5 min |

| Compare ALL‑IN cost (APR + fees) | Choose cheapest money | 10 min |

| Build payoff spreadsheet | Track spread; schedule extras | 15 min |

Total prep: about 1.5 hours for thousands in potential savings.

Frequently Asked Questions

Q: Can I really get approved with a 520 FICO?

A: Many borrowers report approvals in the 520–560 range provided income is steady and DTI reasonable.

Q: Will applying hurt my score?

Pre‑qualification is a soft inquiry. A hard pull only appears if you accept and e‑sign the loan.

Q: How fast will funds appear?

Complete e‑signature before 11 a.m. Eastern and many lenders fund by the next business day.

Q: What if I repay early?

GreenMoneyLoans network lenders typically charge zero pre‑payment penalties double‑check your disclosure page.

Q: Are there hidden fees?

All partner lenders must disclose origination or late fees beside the Accept button. Read carefully; ask live chat to clarify anything that smells vague.

Final Thoughts & Action Steps

Bad credit doesn’t have to bench you while prime borrowers scoop up every cash‑flow asset. Direct lenders willing to price real‑world affordability not just a three‑digit score let you act when the spreadsheet says “profit.”

Remember the formula:

Passive Profit Spread = Asset Return – Loan APRIf that spread is healthy even under conservative projections speed trumps perfection. Grab the asset, keep it humming, and let the new revenue retire the debt early.

Your Dual Choice

- Shop Multiple Offers First

Risk‑free, soft‑pull comparison at Payday ‑ Installment Loans US / Personal Loans US. - Need up to $5 000 ASAP?

Start your GreenMoneyLoans.net application here funds could be in your bank tomorrow.

Make imperfect credit bend to your goals. The next passive‑income deal won’t wait.