Many people are discovering the benefits of a Gold IRA as a way to protect their retirement savings. Investing in gold not only offers inflation protection but also diversifies your portfolio against market volatility. In this post, you’ll learn how to buy the best Gold IRA online and take vital steps to secure your future. With the right information and strategy, you can trust that your retirement will be both stable and rewarding.

Understanding Gold IRAs

The Gold IRA is a special type of retirement account that allows you to invest in physical gold and other precious metals. Unlike traditional IRAs that hold paper assets, a Gold IRA gives you the unique opportunity to diversify your investment portfolio and potentially safeguard your wealth against inflation and market volatility. This makes it a popular choice for individuals looking to enhance their retirement savings with tangible assets.

What is a Gold IRA?

On a basic level, a Gold IRA is a self-directed individual retirement account that lets you hold physical gold, as well as other approved precious metals, as part of your retirement strategy. It functions similarly to a standard IRA but offers you more flexibility in choosing what assets you want to include, allowing you to invest in gold bullion, coins, and other forms of metal.

Benefits of Investing in Gold

What sets gold apart as an investment is its historical ability to act as a hedge against inflation and economic uncertainty. By adding gold to your portfolio, you are potentially protecting your savings from unpredictable market shifts, as gold often maintains value over time. This can provide you with peace of mind as you approach retirement.

Another key advantage of investing in gold is its tangible nature. Unlike stocks or bonds, gold has intrinsic value, making it a safeguard during economic downturns. Additionally, gold is often seen as a safe-haven asset, allowing your portfolio to benefit from its stability during turbulent times. By incorporating gold into your retirement strategy, you are actively taking steps to enhance your financial security and ensure that your hard-earned savings are protected against inflation and market fluctuations.

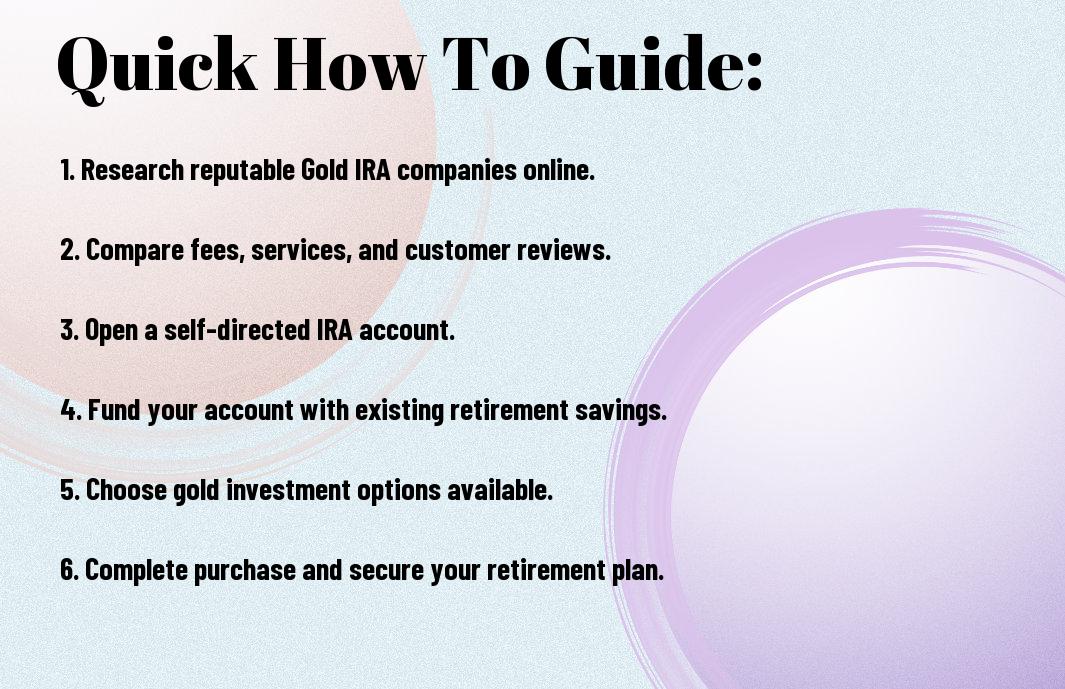

How to Buy a Gold IRA Online

Some people find the process of buying a Gold IRA online daunting, but it doesn’t have to be. With the right steps, you can secure your retirement by adding precious metals to your investment portfolio easily and efficiently.

Step-by-Step Guide

Guide your way through the process with this simple table:

| Step | Description |

| 1. Research | Look for reputable companies offering Gold IRAs. |

| 2. Open an Account | Fill out the necessary paperwork and set up your account. |

| 3. Fund Your IRA | Transfer funds from your existing retirement account or make a direct contribution. |

| 4. Choose Your Gold | Select the gold products you want to invest in. |

| 5. Place Your Order | Finalize your purchase and enjoy secure storage for your gold. |

Choosing a Reputable Provider

Provider selection can make a big difference in your Gold IRA experience. Ensure you choose a company with a strong track record, transparent fees, and excellent customer service to guide you through the setup process.

This is where you need to pay attention to reviews and ratings of potential providers. Look for ratings from trusted sources and ensure they provide clear information about their fees and services. A good provider will have responsive customer support and a transparent process, which can help you make informed decisions. Avoid companies with hidden fees or poor customer service to protect your investment and ensure a smoother experience.

Tips for Securing Your Retirement

Keep your retirement on solid ground by implementing these important strategies:

- Diversify your investments.

- Choose a reputable Gold IRA provider.

- Regularly review market trends.

- Set up an emergency fund for unexpected expenses.

Thou will find that taking charge of your investments today leads to a more secure tomorrow.

Diversifying Your Portfolio

You should consider diversifying your portfolio to minimize risks and enhance potential returns. Investing in a mix of assets, including stocks, bonds, and precious metals such as gold, can provide balance and stability. A well-rounded portfolio can help you achieve your retirement goals while safeguarding your assets from market fluctuations.

Staying Informed on Market Trends

Tips for staying up-to-date with market trends include following financial news and subscribing to investment newsletters. Being aware of both positive and dangerous trends can empower you to make informed decisions about your retirement investments and Gold IRA options.

Staying informed on market trends is key to optimizing your retirement strategy. Make it a habit to monitor not only the performance of your investments but also any economic changes that may affect them. By analyzing market shifts and trends, you can react accordingly, making adjustments to your portfolio that can potentially shield you from losses and capitalize on opportunities for growth.

Factors to Consider When Purchasing a Gold IRA

To ensure a smart investment, consider the following factors when purchasing a Gold IRA:

- Reputation of the company

- Investment options available

- Storage solutions provided

- Customer service and support

- Fees and costs in the process

Thou should keep these factors in mind to secure your retirement effectively.

Fees and Costs

Any investment in a Gold IRA comes with specific fees and costs that you must consider. These might include:

- Account setup fees

- Annual maintenance fees

- Storage fees for your gold

- Transaction fees for buying and selling

- Seller’s premiums when acquiring gold

Understanding these costs will help you gauge the total investment required.

Types of Gold Investments Available

While exploring a Gold IRA, you’re presented with several types of gold investments to choose from:

- Gold bullion coins

- Gold bars

- Gold exchange-traded funds (ETFs)

- Mining stocks

- Gold certificates

This variety helps diversify your retirement portfolio effectively.

| Investment Type | Description |

|---|---|

| Gold Bullion Coins | Coins with intrinsic value; highly liquid. |

| Gold Bars | Large amounts; lower premiums. |

| Gold ETFs | Buy shares in gold; easy access. |

| Mining Stocks | Invest in companies mining gold. |

| Gold Certificates | Proof of ownership without physical gold. |

Costs associated with each option can vary greatly, impacting your overall investment strategy. You should weigh the pros and cons of each type to make informed decisions. Consider factors like liquidity, storage, and market trends to align with your retirement goals.

- Liquidity is vital for quick access

- Security in storage impacts costs

- Market trends influence long-term gains

- Tax implications need assessment

- Diversifying reduces risk

This information will guide you in choosing the right investments for your future.

Maintaining Your Gold IRA

Despite the benefits of owning a Gold IRA, it requires ongoing attention to ensure your investment remains secure and aligned with your retirement goals. Regularly reviewing your holdings, understanding market trends, and staying informed about economic changes can help you maintain a healthy balance in your retirement portfolio.

Regular Reviews and Adjustments

On a regular basis, take the time to assess your Gold IRA’s performance. This involves checking the current value of your gold assets and making any necessary adjustments to optimize your investment strategy. Staying proactive will allow you to stay ahead in a dynamic market.

Understanding Withdrawal Rules

Maintaining your Gold IRA also means being aware of the withdrawal rules that govern these investments. It’s crucial to know when and how you can access your funds without incurring penalties or taxes.

Understanding withdrawal rules allows you to plan effectively for retirement. Typically, you can withdraw funds without penalties after you reach age 59½, but any distributions made before this age might be subject to a 10% early withdrawal penalty along with applicable taxes. Additionally, be aware of the rules surrounding Required Minimum Distributions (RMDs), which begin at age 72. Failure to comply can lead to steep penalties, impacting your retirement savings. By understanding these regulations, you can strategically time your withdrawals, ensuring you enjoy your hard-earned gold investments while minimizing any financial setbacks.

Summing up

Upon reflecting on your retirement options, investing in a Gold IRA could be the smart choice you need to secure your financial future. By buying the best Gold IRA online, you can diversify your portfolio and enjoy the peace of mind that comes with protecting your savings. Take the step today to explore your options, and you’ll find yourself paving the way for a stable and prosperous retirement. Your journey towards financial security starts now—embrace the golden opportunity ahead!