You face an important choice between achieving financial independence and pursuing early retirement, each offering unique benefits and challenges. Understanding how your lifestyle goals, risk tolerance, and financial habits align with these paths will empower you to make decisions that suit your vision. Whether you want the flexibility to keep working on your terms or the freedom to step away completely, this guide will help you evaluate which approach fits your journey toward long-term financial freedom.

Key Takeaways:

- Financial independence offers flexibility to work on your own terms without relying on a paycheck, whereas early retirement involves completely leaving the workforce to focus on personal passions.

- Achieving early retirement requires aggressive saving and significant lifestyle adjustments, while financial independence allows for a more balanced approach between enjoying life now and planning for the future.

- A hybrid approach can be effective: reaching financial independence first provides options and security, allowing a gradual transition into early retirement if desired.

Understanding Financial Independence

Before deciding your financial path, it’s important to grasp what financial independence truly means. It’s not just about quitting your job, but about having enough income from investments or passive sources to cover your living expenses without relying on a paycheck. This freedom lets you choose how to spend your time, whether continuing to work, scaling back, or pursuing activities that bring you joy, all on your own terms.

Defining Financial Independence

Defining financial independence means reaching a point where your passive income consistently covers your important expenses. It doesn’t mean you must stop working entirely; instead, it gives you the freedom to work as much or as little as you want, letting you focus on what matters most to you without financial stress.

Core Principles and Benefits

Principles of financial independence center on building self-sustainability and flexibility. You create enough wealth or income streams to live comfortably while maintaining the freedom to choose your work and lifestyle. The benefits include improved financial security, reduced stress, and the ability to pursue passions, hobbies, or part-time work without the pressure of a traditional paycheck.

Plus, reaching financial independence means you can navigate unexpected challenges like economic downturns or emergencies with greater ease. While it demands years of disciplined saving and investing, it also protects you from the stress of living paycheck to paycheck and offers you peace of mind and greater control over your life. This balance between security and freedom is what makes financial independence appealing for many people seeking a life aligned with their passions and values.

Exploring Early Retirement

One popular path to financial freedom is early retirement, which means leaving the workforce well before the traditional retirement age. This choice requires careful planning and a significant savings buffer to support your lifestyle over the decades. Early retirement offers you the chance to reclaim your time, pursue personal passions, and escape workplace stress. However, it also involves managing financial risks and anticipating expenses such as healthcare. Understanding what early retirement entails helps you decide if this lifestyle aligns with your goals and values.

Overview of Early Retirement

One defining feature of early retirement is stopping work completely, relying solely on your accumulated savings and passive income streams. Achieving this often demands saving approximately 25 times your annual expenses, based on the 4% rule. You’ll need to embrace a simpler lifestyle and carefully plan for long-term expenses like healthcare and inflation. Early retirement centers on designing a life filled with freedom and fulfillment, but requires strong discipline and forethought to sustain it for many years.

Key Aspects and Advantages

Retirement through early retirement allows you to break free from work-related stress, deadlines, and office politics, enabling you to focus on what truly matters to you. You gain complete time freedom to invest in passion projects, travel, or volunteering. This lifestyle shift supports better mental health and personal fulfillment. Yet, the path demands aggressive saving and a strong financial safety net to avoid outliving your assets. Proper healthcare planning is imperative, as expenses can rise without employer coverage.

Exploring these advantages further, early retirement offers you the rare opportunity to live intentionally and detached from financial pressure related to employment. This freedom means crafting your daily routine around activities and people you love, promoting well-being and satisfaction. It’s important to weigh the benefits against potential financial challenges, such as market fluctuations and increasing healthcare costs. By planning thoroughly and maintaining a flexible mindset, you can enjoy the profound rewards of early retirement while safeguarding your long-term security.

Key Differences Between Financial Independence and Early Retirement

Despite their shared goal of freedom from traditional work, financial independence, and early retirement lead you down different paths in how you manage work, finances, and lifestyle. Understanding these differences can help you decide which approach fits your vision. For a deeper dive, consider exploring Financial Independence, Retire Early (FIRE): How It Works.

Work Status

Independence means you have the option to continue working if you choose, without relying on a paycheck, allowing you control over how you spend your time. In contrast, early retirement means fully stepping away from work, dedicating your life to other interests since income must come entirely from your savings or passive streams.

Financial Focus and Lifestyle

Even though both require disciplined saving, financial independence centers on creating enough passive income to support your lifestyle without quitting work, providing flexibility. Early retirement demands aggressive saving to cover decades without employment, often leading to simpler living to ensure your funds last.

Financial focus is a key consideration as you plan your path. Financial independence emphasizes flexibility and security, allowing you to adjust work involvement as you wish, which can reduce stress from immediate financial pressure. Conversely, early retirement requires intense saving and lifestyle sacrifices upfront to accumulate enough wealth for a potentially lengthy retirement period. You should also be aware of higher risks, such as healthcare costs and market fluctuations, that can significantly impact early retirees. Your choice will affect not just your finances but also how you design your daily life and long-term well-being.

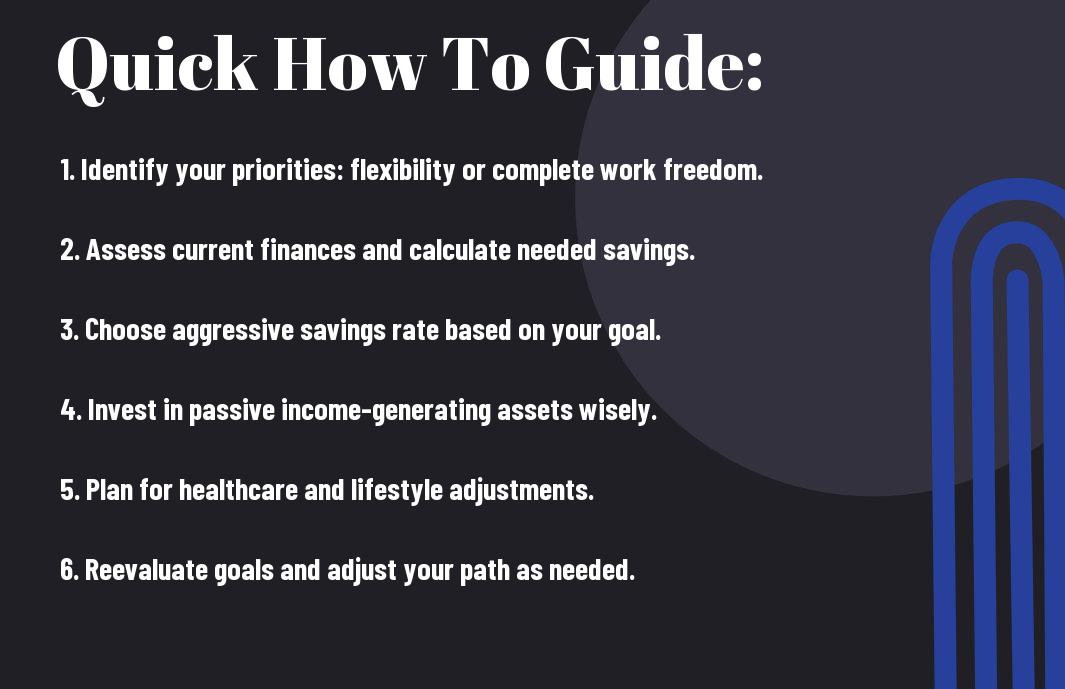

Steps to Achieve Financial Independence

Your journey toward financial independence starts with clear intentions and disciplined actions. Focus on saving consistently, investing wisely, and creating passive income streams that cover your living expenses. Keeping your spending in check and living below your means will accelerate your progress, allowing you to gain the freedom to work on your terms sooner. Each step you take brings you closer to a life where money supports your passions, not controls your choices.

Setting Your Goals

Financial goals form the foundation of your path to financial independence. Define what freedom means for you, whether it’s working part-time, pursuing a passion project, or having a safety net for unexpected events. This clarity will guide your saving and investment strategies. Setting a target amount, often calculated using the 4% rule, saving 25 times your annual expenses, helps you establish realistic milestones aligned with your desired lifestyle and timeline.

Building a Financial Plan

With a clear understanding of your income, expenses, and net worth, you can build a personalized financial plan that supports your goals. This plan should incorporate your savings rate, investment portfolio, and projected passive income streams. Using proven guidelines like the 4% rule can help you estimate the wealth needed for independence. Regularly reviewing and adjusting your plan ensures you stay on track despite life’s changes.

This financial plan acts as your roadmap, combining disciplined saving with strategic investing. Failing to accurately track expenses or underestimating future costs poses a serious risk to achieving financial independence. On the positive side, a well-constructed plan cultivates flexibility and security, preparing you for economic downturns or unexpected events. Incorporating diverse income sources like dividend stocks and real estate rental properties increases your chances of sustained passive income, reducing reliance on active work and enhancing your financial freedom.

How to Prepare for Early Retirement

Keep in mind that early retirement demands careful planning and a clear vision of your future lifestyle. You’ll need to build a substantial financial cushion by saving aggressively and investing wisely to generate sustainable passive income. Planning for healthcare costs and embracing intentional, simpler living will help you stretch your resources over potentially decades without employment income. Preparing thoughtfully today paves the way for a fulfilling and worry-free early retirement.

Saving Strategies

Little can replace disciplined saving when aiming for early retirement. Target a savings rate of 50% or more of your income to accelerate wealth accumulation quickly. Reducing unnecessary expenses and prioritizing saving over lifestyle inflation will help you reach your goal faster. Consistently applying the 4% rule, accumulating 25 times your annual expenses, ensures you have a solid financial foundation to retire comfortably.

Creating Passive Income Streams

Early in your journey, focus on developing multiple passive income sources that can replace your paycheck. Investments like dividend-paying stocks, rental properties, and index funds offer reliable cash flow while minimizing your direct involvement. Diversifying these income streams reduces risk and builds resilience in your financial plan, supporting your goal of long-term early retirement.

A well-rounded passive income strategy strengthens your financial independence and early retirement outlook. Building diverse income streams protects you against market fluctuations and unexpected expenses. However, some sources, like real estate, may require ongoing management, which could impact your desired lifestyle. By prioritizing investments that generate regular returns with minimal effort, you enhance your ability to cover living costs without working. This approach not only supports your early retirement goals but also offers flexibility should your priorities shift.

Tips for Balancing Both Approaches

To successfully blend financial independence with early retirement, focus on maintaining flexibility and planning ahead. Consider these strategies:

- Set clear, evolving goals as your priorities shift.

- Save aggressively while allowing enjoyment in your current lifestyle.

- Build diverse passive income streams to support various life stages.

- Periodically reassess your investments and spending habits.

Perceiving the balance between FILE vs FIRE can help you find what fits your unique needs; explore more at FILE vs FIRE – Finding what is right for you.

Adapting Lifestyle Changes

While pursuing either financial independence or early retirement, adapting your lifestyle by embracing simplicity and intentional spending can make a significant impact. You’ll find that aligning your daily habits with your financial goals not only accelerates wealth building but also enhances your overall satisfaction. This approach allows you to reduce unnecessary expenses while still enjoying meaningful experiences.

Planning for Healthcare Needs

Adapting well in advance for healthcare costs is imperative when moving towards early retirement or financial independence. Without employer coverage, you’ll need reliable options, whether that’s private insurance, government programs, or health savings accounts, to protect against rising medical expenses and avoid unexpected financial burdens.

To safeguard your financial future, thoroughly research healthcare plans that fit your intended retirement timeline and lifestyle. Since healthcare costs can strain early retirees significantly, integrating these expenses into your long-term plan minimizes risk. Utilizing tools such as Health Savings Accounts (HSAs) can offer tax advantages, while exploring government subsidies may reduce costs. Failing to plan adequately can lead to severe financial strain, threatening the sustainability of your independence or retirement goals. Prioritize this aspect alongside your saving and investing strategies to ensure lasting financial security.

Conclusion

Presently, choosing between financial independence and early retirement depends on your personal goals and lifestyle preferences. If you desire flexibility to work on your terms while maintaining security, financial independence may suit you best. Conversely, if you wish to leave the workforce entirely and dedicate yourself to passions, early retirement could be the right path. You might also consider a blend of both approaches, allowing you to adapt as your priorities evolve. Ultimately, your disciplined saving, strategic investing, and intentional choices will shape the path that aligns with your vision for freedom and fulfillment.