There’s a detailed process lenders use to evaluate your creditworthiness before approving any loan. They pull your credit reports and scores from major bureaus, analyze your payment history, debt levels, and financial behavior to predict risk. Understanding this process helps you maintain a strong credit profile, ensuring better loan offers and lower interest rates. However, be aware that some checks involve a hard inquiry, which can temporarily lower your score. Knowing how lenders assess your credit empowers you to manage your financial health and improve your chances of approval.

Types of Credit Checks

Your credit check determines how lenders evaluate your borrowing risk. There are two main types: soft inquiries and hard inquiries. Each serves a different purpose:

| Soft Inquiry | Occurs without affecting your credit score; used for pre-qualification and background checks. |

| Hard Inquiry | Results from your credit application, can lower your score slightly and stay on your report for two years. |

| Purpose | Soft: informational; Hard: lending decisions. |

| Visibility | Soft: visible only to you; Hard: visible to all lenders. |

| Impact on Score | Soft: none; Hard: 3–5 point dip, temporary. |

The type of check your lender uses influences your application and credit health.

Soft Inquiries

There’s no impact on your credit score when a soft inquiry occurs. These are typically used by lenders for pre-qualification or routine account reviews. For example, when you submit basic info on platforms like GetCash4Me, a soft pull helps match you with loan offers without lowering your score or alerting others. The inquiry stays visible only to you and does not affect your ability to borrow.

Hard Inquiries

A little effect on your credit score can separate a soft from a hard inquiry. This happens when you formally apply for credit, prompting lenders to assess your full report. A hard pull usually lowers your FICO score by 3–5 points temporarily. The inquiry remains on your credit report for two years, visible to all lenders, but only affects your score during the first year.

Credit agencies record hard inquiries whenever you apply for a loan, mortgage, or credit card. These checks signal active borrowing behavior and can slightly lower your credit score, especially if you have multiple inquiries in a short period. While a small dip (3–5 points) is typical, too many within months can suggest increased risk to lenders. However, hard inquiries that result in approved loans offer positive credit-building opportunities if you repay responsibly, demonstrating financial discipline and improving your score over time.

Factors Influencing Credit Checks

It’s not just your credit score that lenders review when assessing your loan application. They consider multiple factors, including:

- Credit history – your record of repayments and debts.

- Debt-to-income ratio – how much of your income goes toward debt.

- Employment stability – steady income boosts lender confidence.

- Loan amount and purpose – larger or riskier loans prompt deeper checks.

Knowing these factors helps you understand why lenders dig beyond numbers to evaluate your overall financial health.

Credit Score

To lenders, your credit score is a quick snapshot of your borrowing risk, usually ranging from 300 to 850. Higher scores indicate better creditworthiness, potentially securing you lower rates, like the 7.99% to 35.99% APR seen in online personal loans. Maintaining a strong score improves your chances of instant approval and favorable loan terms.

Credit History

Some lenders dig into your credit history to examine your past payment patterns, outstanding debts, and how long you’ve managed credit accounts. Consistent on-time payments and diverse credit types can strengthen your profile.

With a detailed credit history, lenders evaluate risks such as late payments or defaults, which can drag your score down by 3–5 points or more during a hard inquiry. But positive behaviors, like steady repayments or reducing high-interest debts, highlight your reliability and may lead to better loan offers with fixed APRs, helping you calculate and maintain a profitable spread on your investments.

Tips for Borrowers

Unlike traditional loans that rely heavily on collateral, online personal loans focus on your credit score and financial stability. To improve your approval chances, follow these tips:

- Borrow only what you need excess borrowing raises interest costs.

- Match loan terms to your asset’s cash flow to avoid payment stress.

- Automate payments to avoid late fees and credit damage.

You should monitor your loan spread regularly and refinance if your credit score improves.

How to Improve Credit Score

Clearly, improving your credit score involves timely payments and minimizing new hard inquiries. Keep your credit utilization low and avoid maxing out cards. Consistently paying down debt, particularly high-interest balances, demonstrates creditworthiness. Use tools like GetCash4Me to find loans with low APRs that help refinance costly debt. Small but steady improvements can increase your loan options and reduce funding costs.

Managing Credit Wisely

For strong credit management, you should prioritize a balanced debt-to-income ratio and pay down outstanding balances methodically. Avoid chasing larger loan amounts that stretch your ability to repay. Automate your payments to ensure consistency and protect your credit score. Monitoring your credit regularly helps you spot any changes that might affect your loan terms or approval.

The most dangerous mistake is over-borrowing beyond your assets’ income coverage; this can lead to missed payments and credit damage. On the other hand, disciplined repayment, especially making extra principal payments, can cut interest costs and build equity faster. Using platforms like GetCash4Me to refinance and secure fixed-rate loans helps maintain stable payments and manage risk. In essence, your financial health depends on staying proactive with your credit and loan management.

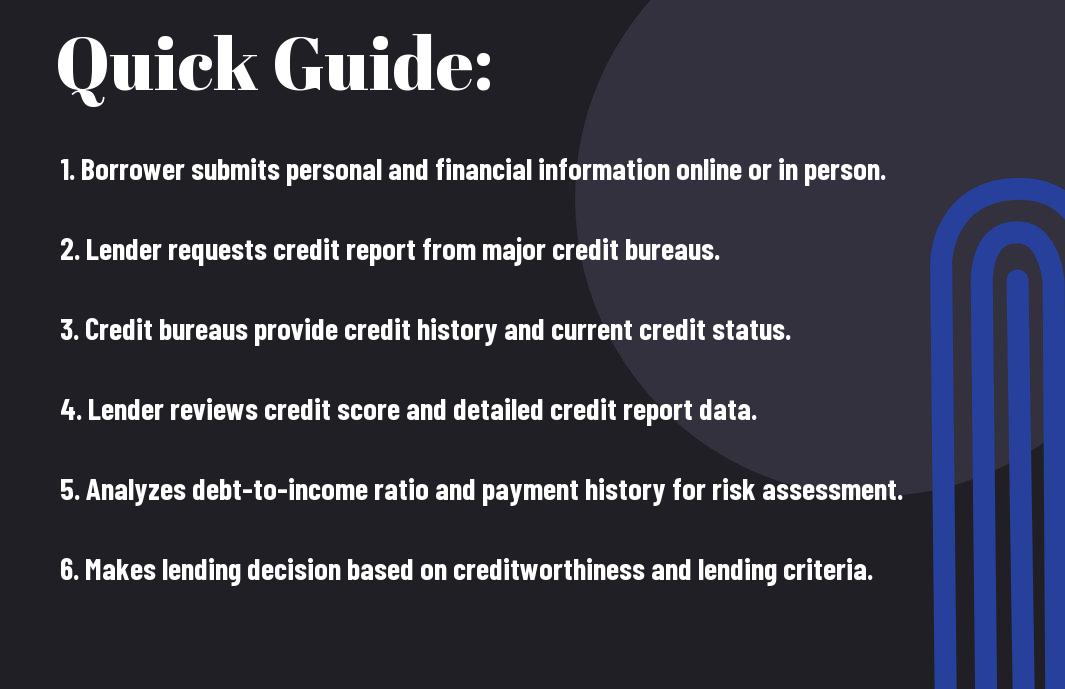

Step-by-Step Process of Checking Credit

After you apply for a loan, lenders follow a clear process to assess your creditworthiness. They start by gathering your personal data, then select a credit reporting agency to obtain your credit report. This report reveals your history, debt levels, and payment patterns. Using this info, lenders decide whether to approve your loan and determine your interest rate. Speed matters. Digital lenders can complete these steps within minutes, helping you access funds quickly while protecting your credit.

| Step | What Happens |

|---|---|

| Gathering Personal Information | Collect your name, ID, income, and banking details to identify you and verify your ability to repay. |

| Selecting a Credit Reporting Agency | Choose a bureau to pull your credit report, detailing your credit history and scores. |

| Credit Inquiry and Scoring | Perform a hard or soft credit pull to update your score and assess risk. |

| Final Evaluation | Analyze credit data alongside your financial info before making an approval decision. |

Gathering Personal Information

Checking your personal information is the lender’s first step to ensure they correctly identify you and evaluate your ability to repay. You’ll provide details like your name, address, employment status, income, and bank account info, often via a short online form. This information helps match you to your credit profile and establish your financial capacity, data lenders rely on to calculate risk and tailor loan offers that fit your situation.

Selecting a Credit Reporting Agency

Now, the lender decides which credit bureau to consult: Experian, Equifax, or TransUnion. Each agency maintains your credit records but may have variations in data and scoring models. The choice affects what information lenders see and can influence loan terms and rates offered to you. Some lenders may pull reports from multiple bureaus to get the clearest picture.

To make an informed choice, understand that each bureau updates your credit data differently, and some lenders specialize in reports from a particular agency. Your FICO score can differ slightly between bureaus, impacting loan pricing. Knowing this helps you anticipate the lender’s perspective and guides which offers you pursue. Generally, you see a soft inquiry during pre-qualification (with no credit score impact) and a hard inquiry at formal application, which may lower your score by a few points temporarily.

Pros and Cons of Credit Checks

All lenders run credit checks to evaluate your financial trustworthiness, but these checks come with both advantages and disadvantages. Understanding the balance helps you manage your credit health while optimizing loan prospects.

| Pros | Cons |

|---|---|

| Helps lenders assess risk accurately | Hard pulls may reduce your credit score by 3–5 points |

| Speeds up loan approval process | Speeds up the loan approval process |

| Offers transparency on borrowing capacity | Soft pulls don’t impact credit but reveal info to lenders |

| Enables better loan terms for good scores | Hard inquiries stay on your report for 2 years |

| Protects against overborrowing | May cause anxiety or hesitation in applying for credit |

Benefits for Lenders

Credit checks provide lenders with a detailed snapshot of your financial history, helping them make informed decisions. They can identify your credit score, debt-to-income ratio, and payment patterns, enabling faster approvals and tailored loan offers with competitive APRs. This reduces the risk of defaults and allows lenders to offer you terms that fit your profile, ensuring both parties benefit from a transparent lending process.

Risks for Borrowers

Now, when you apply for multiple loans, hard credit pulls may lower your score temporarily, affecting your eligibility and interest rates. If not planned carefully, these checks could increase your borrowing costs or limit your options. You also risk mixing loan funds with personal money, which may complicate repayments and damage your credit if mistakes happen.

Benefits from understanding the risks include better loan timing and managing inquiries to maintain a healthy credit profile. However, the most dangerous aspect is the potential for uncontrolled borrowing leading to negative spreads, where your loan cost exceeds your asset returns, quickly turning leverage into a liability. The key is to balance quick access to funds with disciplined repayment to protect both your credit score and financial future.

Best Practices for Borrowers

Despite the convenience of instant approvals, you should approach credit responsibly by borrowing only what you truly need. Borrowing more than necessary increases your interest costs and risks your credit health. Matching your loan term to your asset’s cash flow ensures payments remain manageable, reducing stress on your finances. Automating payments helps avoid late fees that can damage your credit score and erode your returns. By staying disciplined and proactive, you can maintain a positive credit profile that supports better loan offers over time.

Regular Credit Monitoring

There’s great value in checking your credit report regularly to spot errors or fraudulent activity early. Since loans using hard pulls can temporarily lower your FICO by 3–5 points, keeping tabs on your score helps you understand these fluctuations. Monitoring also helps you see how your loan repayments improve your credit history, enabling you to refinance when better offers appear via platforms like GetCash4Me, potentially reducing your APR and increasing your profit spread.

Understanding Credit Reports

Some parts of your credit report have more impact than others. Payment history and credit utilization weigh heavily in scoring models, so on-time payments and keeping balances low are positive signals. Negative items like missed payments or collections can remain visible for up to seven years, damaging your score and borrowing power. Understanding these details lets you focus on behaviors that improve your creditworthiness.

With your credit report, you gain insight into the factors lenders consider: payment history, amounts owed, credit mix, and new credit inquiries. A hard pull when applying for loans may dip your score briefly, but timely payments help it recover and grow. You should review your report for inaccuracies that could unfairly lower your score and dispute them promptly. This awareness empowers you to maintain a stronger credit profile, which translates to better loan terms and lower interest rates on future financing.

Summing up

Ultimately, lenders check your credit by running either a soft or hard inquiry, depending on the application stage. Soft pulls assess basic information without impacting your score, while hard pulls verify your identity, income, and creditworthiness, potentially lowering your FICO by a few points. They evaluate factors like your credit history, debt-to-income ratio, and payment consistency to determine your loan terms. Understanding this process helps you manage your credit proactively and secure the best possible loan offers tailored to your financial profile.