Investing in dividend-paying stocks is a proven strategy to generate passive income, providing both regular cash flow and potential long-term capital appreciation. By carefully selecting companies with a history of consistent and growing dividends, investors can build a reliable income stream that requires minimal active management.

Understanding Dividend Stocks

Dividends are portions of a company’s earnings distributed to shareholders, typically on a quarterly basis. Companies that pay dividends are often well-established with stable earnings, making them attractive to investors seeking regular income. The key metrics to evaluate dividend stocks include:

- Dividend Yield: This measures the annual dividend payment as a percentage of the stock’s current price. A higher yield indicates more income relative to the investment’s cost.

- Dividend Payout Ratio: This ratio indicates the proportion of earnings paid out as dividends. A sustainable payout ratio suggests that the company can maintain its dividend payments over time.

- Dividend Growth Rate: The annualized percentage rate of growth in dividends over a period. Consistent growth can signal a company’s financial health and commitment to returning value to shareholders.

- P/E Ratio (Price-to-Earnings Ratio): This metric helps determine if a stock is overvalued or undervalued based on its earnings. A lower P/E ratio may indicate a good investment opportunity.

- Company Fundamentals: Evaluating a company’s financial statements, debt levels, and business model can provide insights into its ability to sustain dividends.

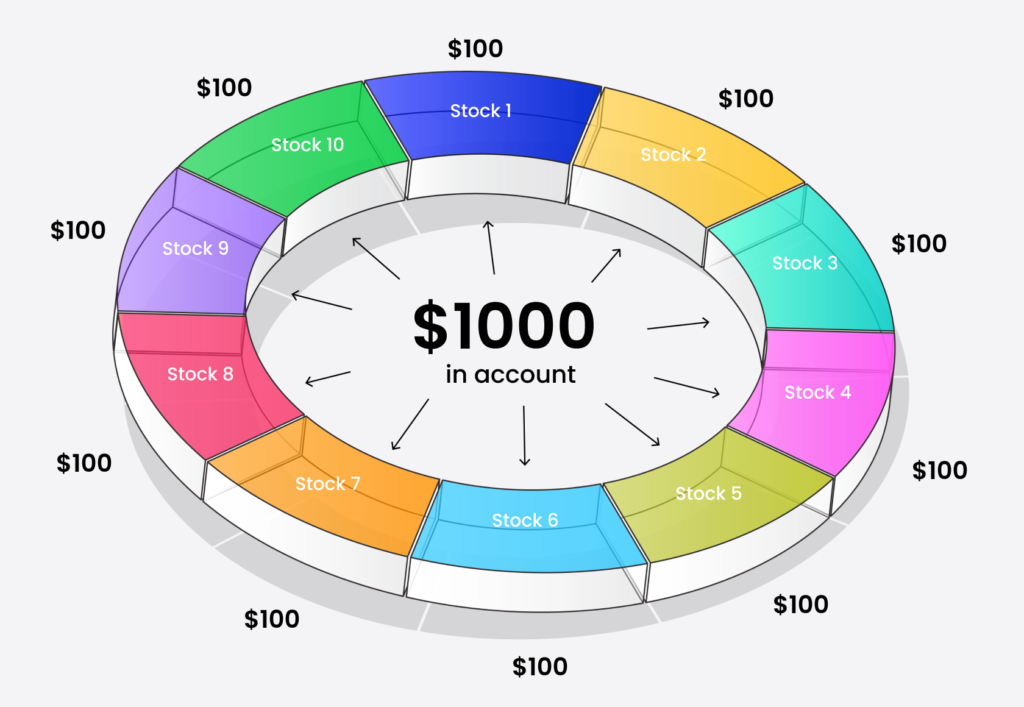

Building a Dividend Portfolio

Constructing a diversified portfolio of dividend-paying stocks involves selecting companies across various sectors to mitigate risk. Consider focusing on “Dividend Aristocrats,” which are S&P 500 companies that have increased their dividends annually for at least 25 years. Examples include:

- Target Corp. (TGT): A major U.S. retailer known for its extensive range of products and strong private-label brands.

- Dover Corp. (DOV): An industrial conglomerate with diverse operations, known for its consistent dividend growth.

- PepsiCo Inc. (PEP): A global food and beverage leader with a robust portfolio of brands and a long history of dividend increases.

- Johnson & Johnson (JNJ): A healthcare giant with a strong reputation for consistent dividend payments.

- Procter & Gamble (PG): A consumer goods company known for stable earnings and reliable dividend growth.

Investing in such companies can provide a stable and growing income stream.

Reinvesting Dividends

To harness the power of compounding, consider enrolling in Dividend Reinvestment Plans (DRIPs). DRIPs automatically reinvest your cash dividends to purchase additional shares of the dividend-paying company, often without commissions and sometimes at a discount. This strategy can accelerate the growth of your investment over time.

The Power of Compounding

Reinvesting dividends allows your investment to grow exponentially over time. For example, an initial investment of $10,000 in a stock yielding 4% annually, with dividends reinvested, can grow significantly over a 20-year period. The compounded returns often outperform simple dividend withdrawals.

Selecting the Right Brokerage

Choosing a brokerage that supports dividend investing and offers favorable terms is crucial. Some top online brokers for dividend reinvestment include:

- Fidelity: Offers a comprehensive platform with no minimum investment and commission-free trades.

- Charles Schwab: Provides a user-friendly interface with a wide range of investment options and no commission fees.

- Robinhood: Known for its mobile-first approach and commission-free trades, suitable for new investors.

- Vanguard: Ideal for long-term investors with low-cost funds and excellent DRIP options.

- Merrill Edge: A great choice for Bank of America customers looking to integrate their accounts for easier management.

These platforms facilitate easy management of dividend portfolios and often provide tools for automatic reinvestment.

Affiliate Products to Enhance Your Dividend Investing Journey

To further support your dividend investing strategy, consider leveraging affiliate products that offer valuable resources and tools:

- The Motley Fool Stock Advisor: A renowned investment advisory service providing stock recommendations and insights to help investors make informed decisions.Call to Action: Enhance your investment strategy with expert stock picks from The Motley Fool. Learn more here.

- Ally Invest: A brokerage platform offering a range of investment options, including self-directed trading and managed portfolios, with competitive pricing.Call to Action: Start building your dividend portfolio with Ally Invest’s user-friendly platform. Get started today.

- eToro: A social trading platform that allows you to follow and copy the trades of experienced investors, making it easier to implement dividend investing strategies.Call to Action: Join eToro to connect with a community of investors and explore dividend stock opportunities. Sign up now.

By utilizing these resources, you can gain access to expert analyses, user-friendly trading platforms, and a community of like-minded investors to support your passive income goals.

Additional Passive Income Strategies With Stocks

While dividend investing is a great way to earn passive income, there are other stock market-related strategies that can enhance your earnings:

Selling Covered Calls

If you own shares of dividend-paying stocks, selling covered calls can generate additional income. This options strategy involves selling call options against your holdings to earn premiums while still collecting dividends.

Investing in Dividend ETFs

Dividend exchange-traded funds (ETFs) offer a way to diversify your dividend portfolio without picking individual stocks. Some popular dividend ETFs include:

- Vanguard Dividend Appreciation ETF (VIG): Focuses on companies with a strong track record of increasing dividends.

- iShares Select Dividend ETF (DVY): Invests in high-dividend-paying U.S. stocks.

- Schwab U.S. Dividend Equity ETF (SCHD): A well-balanced ETF with exposure to quality dividend stocks.

Utilizing a Dividend Income Tracker

Keeping track of your dividend income is essential for managing cash flow and reinvestment. Consider using tools like:

- TrackYourDividends.com: Helps monitor dividend payouts and forecast income.

- Personal Capital: A free tool for tracking investments and net worth.

- Simply Safe Dividends: Provides safety scores for dividend-paying stocks.

Conclusion

Earning passive income through stock dividends is a viable strategy for building wealth over time. By selecting financially sound companies with a history of dividend growth, reinvesting dividends to capitalize on compounding, and utilizing supportive brokerage services and affiliate products, you can establish a robust income stream that contributes to your financial independence.

Additionally, strategies such as selling covered calls, investing in dividend ETFs, and tracking dividend income can further optimize your returns.

For a comprehensive guide on dividend investing, you might find this video helpful:

Dividend Investing for Beginners | Step by Step Guide