If you follow finance TikTok or binge podcasts on FIRE (Financial Independence, Retire Early), you’ve heard this mantra: “Make your money work harder than you do.” Usually, the conversation centers on dividends, rental cash flow, or selling digital products while you sleep. But there’s a quieter side of the passive‑profit equation that often gets ignored: the strategic use of affordable credit.

When deployed correctly, a personal installment loan can become the rocket fuel that accelerates your passive‑income engine. Instead of waiting months (or years) to save a lump sum, you tap tomorrow’s money at a predictable cost today, funnel it into a well‑researched asset, and let the spread between your loan’s fixed payment and your asset’s cash flow work its magic.

Sound risky? It certainly can be if you choose the wrong kind of loan. That’s why today we’re dissecting the critical differences between mainstream personal installment loans and their dangerous cousins, payday loans, while spotlighting an online portal St Patricks Day Loans, that connects you to installment‑loan offers in minutes.

By the end of this deep dive (yes, we’re going well past 2,500 words), you’ll know:

- How installment loans are structured, what they cost, and why they can help your credit score

- Why payday loans almost always sabotage passive‑profit plans

- Actionable case studies of borrowers who turned installment funds into hands‑off income

- Step‑by‑step instructions for securing the right loan, at the right rate, from the right lender

Let’s start with the strategic lens every profit‑focused borrower needs.

Why Passive‑Profit Seekers Use Low‑Cost Credit

Turning Borrowed Dollars into an Income‑Producing Asset

Picture this: You’ve located a gently used vending machine route listed for $3,500 on Facebook Marketplace. Each unit already sits in a high‑traffic lobby and nets $170 per month after restocking costs, a 58 percent annual return if you pay cash. But your liquid savings today are only $900. Wait to save the difference, and the route will sell to someone else tomorrow.

Enter the personal installment loan. Suppose you borrow $3,500 at a fixed 12 percent APR over 24 months. Your monthly payment? Roughly $165. Your route still spits out $170 of free cash flow, so the asset pays the note for you and leaves you $5 every month to spare. Once the loan is gone, that $170 becomes pure passive profit.

That, in a nutshell, is the spread strategy. The key is cheap, predictable financing and reliable income from the asset you acquire. When those two variables line up, borrowing is not a burden; it’s a force multiplier.

The Compounding Edge of Fixed Payments

Installment loans shine because they feature fixed monthly payments crafted on an amortization schedule. You know from day one exactly how many dollars leave your checking account on the 1st of every month, whether the economy booms or stumbles. Meanwhile, a quality passive‑income stream, dividends, peer‑to‑peer notes, and a self‑serve car‑wash bay often rise with inflation or market growth.

As long as your asset’s income stays equal to or above the loan payment, the profit gap widens over time. Even if the spread starts tiny, a 2 percent mismatch compounded for five years produces a serious tailwind.

Personal Installment Loans vs. Payday Loans: A Quick Snapshot

Before we go deeper, let’s zoom out for a side‑by‑side comparison. (Spoiler: one of these loan types actively works against passive‑profit goals.)

| Feature | Personal Installment Loans | Payday Loans |

|---|---|---|

| Typical Loan Amount | $1,000–$100,000+ | Up to $500–$1,000 |

| Repayment Term | Fixed monthly payments over 6–60 months (sometimes longer) | Due in full on next payday (2–4 weeks) |

| APR Range | 6 %–36 % | 200 %–400 %+ |

| Credit Check | Low‑to‑moderate if payments fit the budget | Low‑to‑moderate if payments fitthe budget |

| Credit‑Score Impact | Timely payments build credit; reports to bureaus | Usually no credit benefit unless you default (then it tanks) |

| Risk Profile | Low‑to‑moderate if payments fit the budget | Very high; debt‑cycle trap common |

| Ideal Use | Funding assets, consolidating costlier debt | Emergency bills when no other option exists |

The contrast is brutal. Installment loans offer a longer runway, manageable rates, and the potential to improve your credit. Payday loans exist for last‑ditch SOS moments and often escalate into a cycle of rollovers and triple‑digit interest. If your goal is passive profit, the payday route nearly guarantees the opposite.

Anatomy of a Personal Installment Loan

Lump‑Sum Funding & Fixed Monthly Payments

When you’re approved for a personal installment loan, the lender wires a single lump sum, say $7,500, straight into your bank account, usually within one business day. In exchange, you sign a promissory note outlining:

- Principal – the amount you borrowed

- Interest rate (APR) – annual cost including fees

- Term – the number of months over which you’ll repay

- Monthly payment – fixed blend of principal + interest

Every payment knocks the balance down according to an amortization schedule. In the term’s final month, your balance hits $0 no balloon payment hiding at the end.

Typical Ranges: Amounts, Terms, and Rates

| Factor | Range | What Drives It |

|---|---|---|

| Loan Size | $1,000 to $100,000+ | Credit score, debt‑to‑income ratio, income stability |

| Term Length | 6 to 60 months (sometimes 84) | Lender policy, loan purpose |

| APR | 6 % (excellent credit) to 36 % (fair credit) | Creditworthiness, secured vs. unsecured |

Secured installment loans backed by collateral, such as a vehicle title, often land below 10 percent APR. Unsecured loans for borrowers with credit scores under 660 skew toward the high teens or low 20s. Either bracket beats payday loan costs by country miles.

Secured vs. Unsecured: Should You Pledge Collateral?

| Secured Installment Loan | Unsecured Installment Loan | |

|---|---|---|

| APR Often Lower | ✅ | ❌ |

| Requires Collateral | ✅ (car, savings, or real estate) | ❌ |

| Risk of Asset Loss | ✅ (if you default) | ❌ |

| Approval Odds | Higher (lender’s risk is lower) | Relies on credit profile |

If you own a car outright and need $8,000 to overhaul a duplex’s kitchen, a secured loan at 8 percent may save thousands compared with an unsecured option at 20 percent. Just weigh the emotional and financial impact of putting the car on the line.

Payday Loans: Why “Fast Cash” Can Crush Passive‑Profit Plans

The payday‑loan storefront sells “Instant Approval! No Credit Needed!” as a siren song when rent is due. But passive‑profit seekers should grasp three hard truths:

- Triple‑Digit APRs Kill Cash Flow

Borrow $600 for two weeks at a $75 fee (roughly 391 % APR). Miss the deadline, and the lender rolls the loan plus another $75 into a new two‑week term. Do this five times, and you’ve paid $375 over half the original principal without chipping away at the $600 balance. There’s no spread left for investment returns to cover. - No Credit Upside

Most payday outfits don’t report on‑time payments to Experian, Equifax, or TransUnion. You suffer the high rate without the credit‑building upside. If you default, however, they happily send your debt to collections, torpedoing your score. - Debt‑Cycle Risk

Because the loan must be repaid in a single lump sum, borrowers often juggle a second payday loan to pay off the first, fracturing their cash flow until even basic expenses require new debt. Passive profit? More like active bleed.

In short, payday loans are incompatible with the calculated, spreadsheet‑driven world of passive‑income building. Treat them as the absolute last resort.

Case Studies: From Installment Loan to Passive Profit

Let’s ground theory in reality. Below are three borrower profiles illustrating how a responsibly structured installment loan can accelerate wealth‑building.

The Vending‑Machine Reseller (Loan: $3,500 @ 12 % for 24 Months)

Asset: Route of four snack machines with existing contracts

Net Cash Flow: $170/month

Monthly Loan Payment: $165

Spread: $5/month early on; $170/month after loan maturation

Five‑Year Outcome: $170 × 36 additional months post‑loan = $6,120 passive profit (plus asset resale value)

The Debt‑Snowball Optimizer (Loan: $18,000 @ 9 % for 48 Months)

Before: Four credit cards totaling $18k at blended 19.9 % APR, minimums $540/month

After Installment Loan: One fixed payment $448/month

Savings on Interest: $104/month

Reinvested Difference: $100 auto‑draft into dividend ETFs yielding 3.8 %

Result: Credit score jumped 62 points; annual passive dividends after four years ~$200, small but snowballing.

The Certificate‑of‑Deposit (CD) Ladder Builder (Loan: $5,000 @ 8 % for 36 Months)

Strategy: Borrow at 8 %, lock funds into 5‑year CDs yielding 5.5 % average

Why It Works: Borrower anticipates Fed rate cuts within two years; CDs lock higher yield for five.

Net Spread: −2.5 % initially, but borrower uses introductory 0 % APR for 15 months promo, then pays loan down aggressively once CDs appreciate. Advanced maneuver requiring excellent discipline and backup cash flow.

Disclaimer: Each case used real market data but simplified for illustration. Your mileage will vary. Always run your own numbers and stress‑test worst‑case scenarios.

Step‑by‑Step: Securing a Personal Installment Loan Online

Ready to chase your own opportunity? Here’s a six‑step roadmap.

Step 1: Evaluate ROI vs. Borrowing Cost

- Calculate projected annual return on the asset or strategy.

- Ensure it comfortably exceeds the loan’s APR (with a margin of safety).

- Stress test: What if income dips 20 %? Will you still cover the payment?

Step 2: Check Your Credit (Free)

Pull reports at AnnualCreditReport.com or use a free monitoring app. Knowing your score helps you target lenders realistically and avoid unnecessary hard pulls.

Step 3: Gather Income Documentation

Expect to upload recent pay stubs, W‑2s, 1099s, or tax returns. A tidy digital packet speeds approval and may qualify you for better terms.

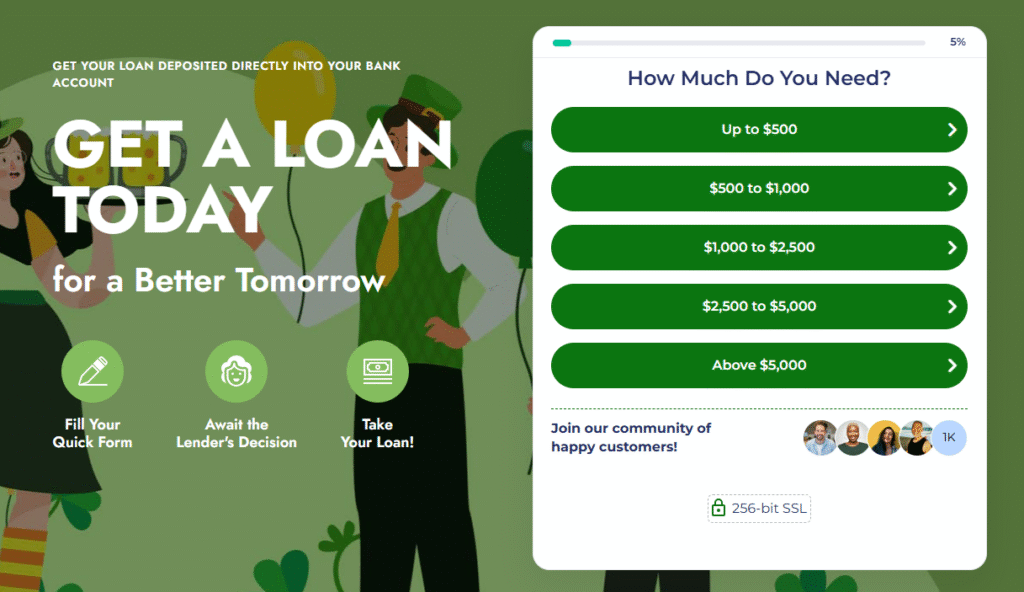

Step 4: Compare Lenders in One Shot

Instead of filling out ten separate applications, leverage a marketplace that does the matchmaking for you. St Patricks Day Loans operates a nationwide network of legitimate lenders and lending partners offering personal installment loans from $200 to $5,000. Complete one secure form, receive multiple conditional offers within minutes, and weigh:

- APR

- Monthly payment

- Term length

- Early‑repayment policy

Step 5: Review, Accept, and Sign Digitally

Click through to the lender’s portal, e‑sign the disclosures (Federal Truth in Lending Act docs), and choose your funding method usually ACH into your checking account.

Step 6: Deploy Funds & Automate Repayment

Send the money straight to your asset purchase or debt‑consolidation target immediately. Then set up autopay to ensure on‑time payments that boost your credit score and protect the spread.

Spotlight: Why Use St Patrick’s Day Loans?

Finding the perfect loan used to mean hitting multiple bank branches or pounding Google for hours. St Patrick’s Day Loans eliminates the friction.

One Form, Many Offers

Fill out a single encrypted application; the platform pings its ping‑tree of licensed lenders and presents qualified offers in real time, often within 90 seconds.

Range & Speed

- Loan Sizes: $200–$5,000 (ideal seed capital for micro‑passive projects)

- Funding Time: As fast as 24 hours after e‑signature

- Security: 256‑bit SSL encryption + strict data‑sharing policy

No‑Obligation Transparency

You’re never locked in until you click Accept on the lender’s site. Review APR, fees, and amortization schedule first. If the math doesn’t work for your project, simply decline.

Quick Win: Some borrowers apply to test the waters, then wait 30 days, pull another credit check, and reapply once they’ve boosted their score. Because St Patricks Day Loans is free, you can shop terms guilt‑free.

Privacy & Choice

Need cash for an Airbnb furniture package or a last‑minute wholesale real estate deposit? The platform doesn’t pry. Your reason stays between you and the lender.

Pro Tips to Maximize Gains & Minimize Risk

- Borrow Only What the Asset Demands – Just because you qualify for $15k doesn’t mean you should take it. Excess cash invites lifestyle creep.

- Mind the Payback Period – Ideally, choose the shortest term whose monthly payment your asset can comfortably cover. You’ll save on interest and free cash flow sooner.

- Reinvest Early Payoffs – Each principal reduction increases your monthly spread. Funnel that newfound surplus into another income stream index‑fund DRIPs, high‑yield savings, or even paying down the loan faster.

- Avoid Loan Stacking – Juggling two installment loans can work if both assets cash‑flow strongly, but the complexity multiplies. Stick to one loan, prove the model, then rinse and repeat.

- Protect Your Credit – Autopay + payment‑reminder apps ensure you never miss a due date. One 30‑day late mark can wipe out the gains of a year’s worth of passive income.

Frequently Asked Questions

Q: How much can I borrow with a personal installment loan?

A: Lenders in the St Patrick’s Day Loans network typically offer $200–$5,000, but many banks and credit unions extend up to $100,000. Loan size depends on your credit profile, income, and state regulations.

Q: Will applying hurt my credit score?

A: The initial inquiry on St Patrick’s Day Loans triggers a soft pull no impact. Only when you select and finalize a lender offer will a hard inquiry post (usually dropping your score 3–5 points temporarily).

Q: Can I repay early without penalties?

A: Most installment loans allow early payoff with zero prepayment fee, but always confirm in your loan agreement before signing.

Q: My credit is fair (630 FICO). Can I still get decent rates?

A: Yes, especially if you show steady income and a low debt‑to‑income ratio. Expect APR in the mid‑teens rather than single digits, but that can still pencil out against a high‑cash‑flow asset.

Q: What if I miss a payment?

A: Contact your lender before the due date. Many offer hardship extensions or payment deferrals. A single 30‑day late payment can shave 80+ points off your FICO, so proactive communication is crucial.

Ready to Turn Borrowed Dollars into Passive Profit?

Personal installment loans are the Swiss Army knife of consumer credit: flexible, affordable, and credit‑score friendly when treated with respect. Match a well‑priced loan to a well‑researched passive‑income play, and you accelerate years of growth into months.

Stop letting opportunities slip because you’re waiting to build capital dollar by dollar. Put cheap, fixed‑rate leverage to work and let tomorrow’s asset returns cover today’s financing.

Your Next Move

- Run the Numbers – Identify an investment yielding at least 4–6 percentage points above your expected loan APR.

- Explore Real Offers – In two minutes, see what you qualify for at St Patricks Day Loans no obligation, no upfront cost.

- Secure Funding & Deploy – Accept the best offer, sign digitally, and receive funds as soon as tomorrow.

- Automate, Monitor, Profit – Set autopay, track your asset’s performance, and enjoy the spread.

Unlock your personalized installment‑loan offers now.

Click here to apply in minutes and give your passive‑profit plan a head start!