Over time, you may want to diversify your retirement portfolio by adding physical gold through a tax-free rollover into a Gold IRA. Understanding the IRS rules and timelines is imperative to avoid unexpected penalties or taxes. This guide will walk you through how to efficiently transfer your existing IRA funds into a self-directed Gold IRA, ensuring your investment remains tax-advantaged and compliant. With careful planning, you can protect your savings against market volatility and inflation while enjoying the benefits of precious metals in your retirement strategy.

>>>>>>>>Get Your Free Gold IRA Kit<<<<<<<<

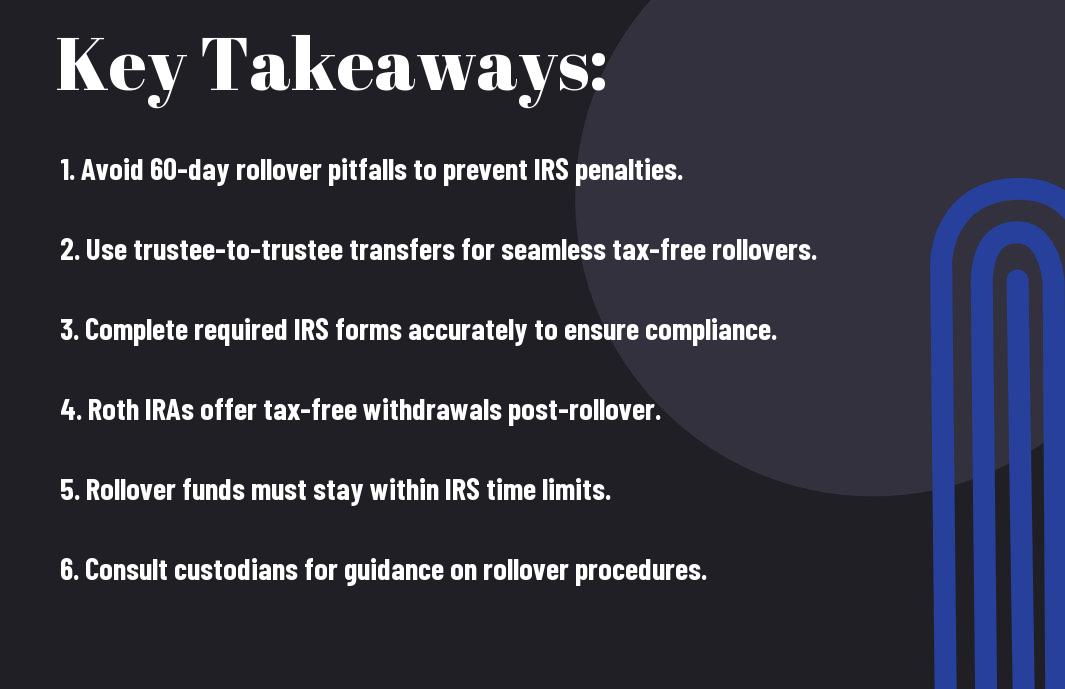

Key Takeaways:

- A tax-free rollover allows you to transfer funds from an existing retirement account into a Gold IRA without incurring immediate tax liability, preserving your investment’s growth potential.

- Trustee-to-trustee rollovers are the most efficient method, minimizing IRS scrutiny and avoiding mandatory withholding taxes.

- Completing a rollover within the IRS’s 60-day window is crucial to maintain tax-free status and avoid penalties or unintended distributions.

Understanding Gold IRAs

Your Gold IRA is a specialized retirement account that allows you to invest in physical precious metals like gold, silver, platinum, and palladium within a tax-advantaged structure. Unlike traditional IRAs limited to stocks and bonds, a Gold IRA offers diversification and protection against inflation, market volatility, and currency risk, helping safeguard your retirement savings. By holding IRS-approved bullion in secure, insured depositories, you maintain compliance while adding a tangible asset to your portfolio.

Definition of Gold IRA

Against a backdrop of fluctuating markets and inflation concerns, a Gold IRA is a self-directed individual retirement account (IRA) that holds physical, IRS-approved precious metals instead of traditional equities. This type of IRA enables you to diversify your retirement assets by including gold and other bullion that meets strict purity requirements, securely stored in IRS-approved facilities, ensuring tax benefits are retained.

Benefits of a Gold IRA

Any Gold IRA offers you an effective way to hedge against inflation and market turbulence while enjoying tax-advantaged growth. The gains within your Gold IRA compound without annual capital gains taxes, allowing you to ride long-term precious metal cycles more efficiently than in taxable accounts. Additionally, storage in insured, audited vaults provides security and liquidity, helping you balance your portfolio with a tangible asset that holds value over time.

With a Gold IRA, you gain access to regulated, high-purity metals in a secure, IRS-compliant depository, avoiding risks associated with self-storage that could trigger penalties. By understanding fee structures such as setup, storage, and commissions you protect your returns from hidden costs that can erode gains. Strong diversification reduces exposure to stock market swings, while tax-free compounding in Roth accounts can make your retirement savings more resilient and potentially more rewarding over the years.

Tax Implications of Gold IRA Rollovers

Even though gold IRAs offer a valuable way to diversify your retirement portfolio, understanding the tax implications of rollovers is imperative to avoid costly mistakes. When done correctly through a trustee-to-trustee rollover, your tax benefits remain intact, letting your gains compound without annual capital gains taxes. Incorrect handling, such as self-storage or missed deadlines, could trigger unexpected taxes and penalties. By following IRS rules carefully, you preserve the tax-advantaged status of your gold investment and maintain control over your retirement growth.

Traditional vs. Roth Gold IRAs

Between Traditional and Roth Gold IRAs, the main difference lies in when you pay taxes. With a Traditional Gold IRA, your contributions may be tax-deductible now, but withdrawals in retirement are taxed as ordinary income. Roth Gold IRAs require after-tax contributions upfront, but allow tax-free withdrawals including gains after age 59½ and a five-year holding period. Choosing the right type depends on your current tax rate and expected retirement income, allowing you to strategize your gold investment’s tax efficiency.

>>>>>>>>Learn More and Start Diversifying Today<<<<<<<<<<

Key Tax Regulations

One of the most important tax regulations is that you cannot store your gold IRA metals personally doing so is considered a distribution and triggers taxes plus penalties. Also, you must complete rollovers within IRS timeframes to avoid unintended taxable events. The IRS requires annual valuation reporting via Form 5498 and proper documentation for distributions, including Form 1099-R. Non-compliance with these rules could jeopardize your IRA’s tax advantages, so adhering to them safeguards your retirement savings.

This section clarifies that self-storage of metals is forbidden under IRS rules to maintain tax benefits, meaning your precious metals must be held in an approved, insured depository. Missing the trustee-to-trustee rollover window or misfiling IRS forms can lead to unexpected taxes and penalties. However, by following proper procedures, you ensure your gold IRA grows tax-deferred or tax-free, and your distributions comply with regulations. Being aware of these rules helps you mitigate risks and maximize the lasting benefits of your precious metals investment.

Steps to Execute a Tax-Free Rollover

To complete a tax-free gold IRA rollover, you first need to select a qualified custodian who handles precious metals IRAs, then initiate the transfer by notifying your current plan administrator. Ensure funds move via a trustee-to-trustee transfer to avoid the 20% IRS withholding and potential penalties. After the assets arrive, coordinate with your custodian to purchase IRS-approved bullion and arrange secure storage in an approved depository. Following this step-by-step approach helps protect your investment from tax traps and keeps your rollover IRS-compliant.

Choosing the Right Custodian

Above all, your custodian must specialize in self-directed IRAs with experience in precious metals. Look for clear fee structures setup fees around $50 and annual admin plus storage fees between $180–$230 are typical. Confirm they handle IRS reporting like Form 5498 and coordinate secure, insured storage with trusted depositories. Selecting the right custodian ensures your gold IRA complies with IRS rules and keeps your retirement assets protected and properly managed.

Initiating the Rollover Process

Besides contacting your current IRA or 401(k) provider, you must request a trustee-to-trustee rollover to transfer funds directly to your new custodian. This method avoids the 60-day window risks and possible tax penalties. You’ll likely complete IRS forms and provide documentation to both custodians. Staying organized during this phase helps your rollover proceed smoothly without unnecessary delays or tax consequences.

Understanding the rollover initiation involves coordinating between your existing plan and the new custodian to facilitate a direct transfer. This prevents you from taking possession of the funds, which would otherwise trigger taxes and penalties. Your custodian will often guide you through filing the appropriate IRS forms and complying with rollover rules. Swift, accurate execution of this process protects your tax-deferred status and positions you to invest in gold with confidence while maintaining IRS compliance.

Eligible Metals for Gold IRA

Despite the variety of metals you might consider, only specific precious metals qualify for inclusion in a Gold IRA. These metals must meet IRS standards, focusing on purity and form. Knowing which metals are permitted helps you avoid costly mistakes and tax penalties, ensuring your investment aligns with regulatory requirements while providing the protective benefits you seek from a physical asset.

>>>>>>>>>>>>Download Our Free Gold IRA Rollover Guide<<<<<<<<<<<

IRS Approved Precious Metals

Against the backdrop of numerous options, the IRS strictly limits your Gold IRA to IRS‑approved bullion: gold, silver, platinum, and palladium. Collectible coins are excluded, as the IRS demands standard, fungible bullion that’s easy to value for tax purposes. Choosing approved metals helps safeguard your tax advantages and keeps your account compliant.

Purity Requirements

About the quality of metals, the IRS sets minimum purity thresholds you must meet to qualify for Gold IRA inclusion. Gold bullion requires at least 99.5% purity, silver must be 99.9%, while platinum and palladium need to hit 99.95%. Ensuring your metals meet these standards protects your investment and maintains eligibility under IRS rules.

And if your metals fall below these required purities, they may be disqualified from your IRA, potentially triggering tax penalties and complicating your rollover. Adhering strictly to these purity rules minimizes risk and supports the long-term growth and security you want your Gold IRA to provide.

Storage and Security Considerations

Many investors worry about the safety of their physical metals in a Gold IRA. To protect your assets and maintain tax benefits, your holdings must be stored in IRS-approved depositories not at home. A secure facility with proper insurance and audited practices ensures your metals are safeguarded against theft or loss. For detailed insights on handling your investment carefully, check out the comprehensive Gold IRA Rollover Guide Released.

Approved Depositories

Against self-storage, the IRS mandates that your metals stay in certified depositories like Brink’s or Delaware Depository to retain tax advantages. These facilities offer options for segregated (your specific metals kept apart) or commingled storage, with regular audits ensuring transparency and security. Choosing the right depository protects your investment and supports easier liquidation when needed.

Insurance Requirements

Security of your metals includes mandatory insurance coverage most approved vaults carry policies up to $1 billion. This protection minimizes risk from theft, damage, or loss, providing peace of mind as you build your retirement portfolio.

Due to the substantial value of physical gold and precious metals, vault insurance is not just an added benefit but a necessary safeguard. With coverage that can reach $1 billion, your metals are protected against unforeseen events, helping you avoid costly setbacks. Proper insurance combined with choice storage options ensures your IRA complies with IRS rules and keeps your investment secure throughout retirement.

Common Mistakes to Avoid

Once again, when rolling over to a gold IRA, you must proceed carefully to avoid costly errors. Skipping proper research, misunderstanding IRS rules, or neglecting fee structures can seriously undermine your returns. Avoid impulsive decisions driven by market hype, and instead rely on clear, evidence-based information like that found in a comprehensive kit. This approach helps you sidestep penalties, unexpected costs, and liquidity issues, keeping your retirement plan on track.

Misunderstanding Regulations

Misunderstanding IRS regulations around gold IRAs can lead to severe tax penalties and complications. You cannot store your metals at home, as self-delivery triggers taxes and penalties. Also, the rollover process requires adherence to strict timelines and proper paperwork, such as trustee-to-trustee transfers or 60-day rollovers. If you confuse these rules, you risk disqualifying your IRA or incurring immediate tax liabilities, which can diminish your investment benefits significantly.

Not Regularly Reviewing Investments

Common neglect in monitoring your gold IRA holdings can cause you to miss vital opportunities or hidden fees that chip away at your gains. The storage and admin fees, averaging around $180 annually, may appear minor but add up against your overall returns. Regularly reviewing your allocations and cost structures ensures your portfolio stays aligned with your risk tolerance and market conditions.

Indeed, consistent review of your gold IRA investments allows you to identify fee drags and rebalance your holdings strategically, such as maintaining a target allocation like 7% gold with annual rebalancing. Without this, you could overexpose yourself to volatile metals like silver or miss market shifts affecting your metals’ liquidity. By revisiting your portfolio yearly, you maintain control and keep your retirement strategy both adaptive and efficient.

Conclusion

Following this tax-free gold IRA rollover guide, you will better understand how to move your retirement funds into precious metals without incurring penalties or unexpected taxes. By carefully navigating the rollover process and selecting the right custodian and storage options, you protect and diversify your portfolio while enjoying tax benefits. Taking informed steps ensures your investment aligns with your long-term financial goals and provides a stable hedge against market uncertainties. With the right knowledge, your transition into a Gold IRA becomes a confident, strategic move toward securing your financial future.

>>>>>>>>>>>>Speak with a Gold IRA Specialist<<<<<<<<<<<

FAQ

Q: What is a tax-free rollover, and how does it apply to a Gold IRA?

A: A tax-free rollover allows you to transfer funds from an existing retirement account, such as a 401(k) or Traditional IRA, into a Gold IRA without triggering immediate tax consequences. This process typically involves a trustee-to-trustee transfer where the funds move directly between custodians. By completing a rollover within IRS guidelines, you maintain the tax-deferred status of your retirement assets while diversifying into physical precious metals.

Q: How long do I have to complete a rollover to avoid taxes and penalties?

A: The IRS permits a 60-day window to complete an indirect rollover, where you receive the funds and then deposit them into the Gold IRA. If you fail to redeposit within those 60 days, the amount counts as a distribution and may be subject to income taxes and potential early withdrawal penalties if you are under age 59½. To minimize risk, many investors prefer direct trustee-to-trustee rollovers, which do not involve this 60-day constraint.

Q: Are there any tax reporting requirements after completing a Gold IRA rollover?

A: Yes. When you complete a rollover, your current custodian will issue IRS Form 1099-R to report the distribution, noting that it was part of a rollover. Your new Gold IRA custodian will file Form 5498 to report the contribution. These forms ensure the IRS is aware of the transfer and help prevent misunderstandings about taxable events. It’s important to keep these documents for your records and tax filings.