Over time, securing your retirement savings against market fluctuations and rising taxes becomes necessary. By choosing a tax-free gold IRA rollover, you can transfer your assets into a physical precious metals-backed account without facing immediate taxes or penalties. This strategy offers you inflation protection and the opportunity for tax-free growth and withdrawals when done with a Roth Gold IRA. Understanding how to properly execute this rollover allows you to maximize your retirement benefits while safeguarding your wealth in a stable, tangible asset.

>>>>>>>>>>Get Your Free Gold IRA Guide<<<<<<<<<<<<<

Types of Gold IRAs

Your Gold IRA options primarily include the following types, each catering to different retirement goals and tax strategies:

- Traditional Gold IRA

- Roth Gold IRA

- SEP and SIMPLE Gold IRAs

Recognizing these differences helps you select the best gold-backed retirement account to maximize your tax benefits and protect your savings.

| Gold IRA Type | Key Features |

|---|---|

| Traditional Gold IRA | Tax-deferred growth; taxes paid at withdrawal |

| Roth Gold IRA | Post-tax contributions; tax-free qualified withdrawals |

| SEP Gold IRA | Higher contribution limits for self-employed |

| SIMPLE Gold IRA | Employer and employee contributions allowed |

| Self-Directed IRA | Allows investment in physical precious metals |

Traditional Gold IRA

For your Traditional Gold IRA, contributions grow tax-deferred, meaning you pay no taxes on gains until you start withdrawing funds after age 59½. This option suits you if you prefer to reduce your taxable income today and anticipate being in a lower tax bracket during retirement.

Roth Gold IRA

While your contributions to a Roth Gold IRA are made with after-tax dollars, qualified withdrawals—both your initial investment and earnings—are completely tax-free. This makes it an attractive choice if you expect your tax rate to increase in the future.

Understanding the Roth Gold IRA means recognizing its powerful advantage: tax-free growth and withdrawals. Because you contribute post-tax dollars, your investment gains accumulate without future tax liability, making this an ideal option for long-term wealth accumulation. However, to enjoy these benefits, you must meet specific IRS conditions regarding withdrawal timing and account age. This IRA type also does not require minimum distributions during your lifetime, giving you greater control over your retirement income and legacy planning.

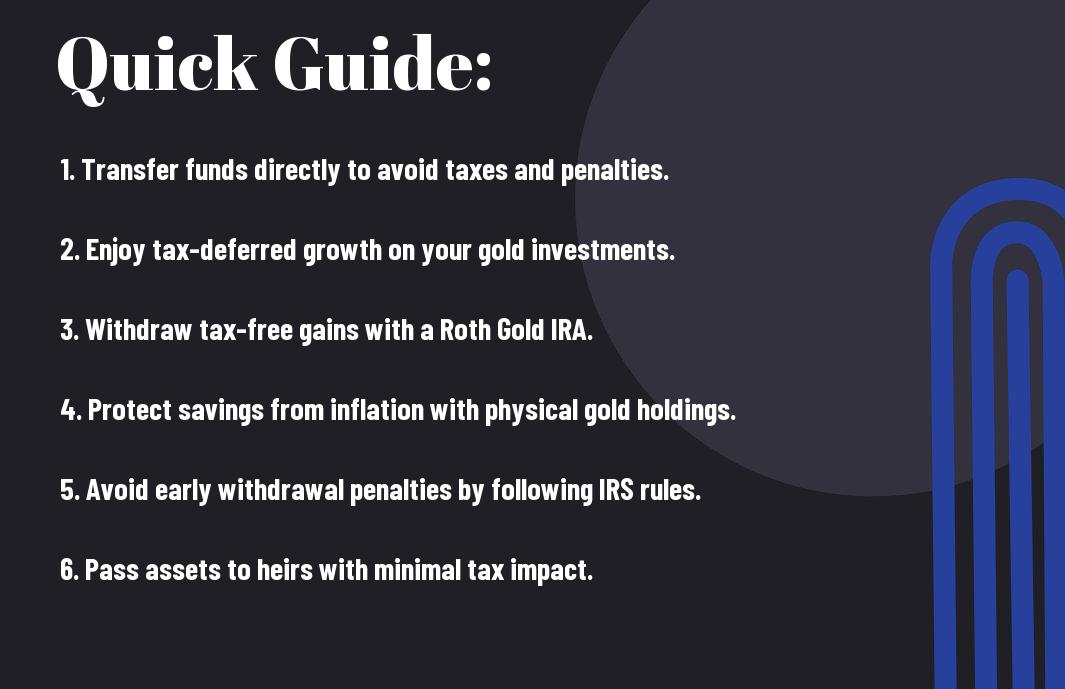

Benefits of a Gold IRA Rollover

Some of the key benefits of a Gold IRA rollover include the ability to protect your retirement savings from market volatility by investing in tangible precious metals, while also unlocking valuable tax advantages. By transferring your funds directly from an eligible retirement account, you can avoid penalties and enjoy the potential for inflation-resistant growth. Additionally, Gold IRAs offer flexible estate planning options, allowing you to pass wealth to your beneficiaries with limited tax consequences, strengthening your long-term financial security.

Tax-Deferred Growth

To maximize your retirement savings, a traditional Gold IRA allows your investment gains to grow tax-deferred. This means you won’t owe taxes on earnings until you take distributions, enabling your account to potentially grow faster over time. This benefit is especially helpful if you expect to be in a lower tax bracket during retirement, giving you more control over your tax efficiency.

Tax-Free Withdrawals

Even though contributions to a Roth Gold IRA are made with after-tax dollars, your qualified withdrawals, including gains, are completely tax-free. This setup can be highly advantageous if you anticipate higher tax rates in the future or want to maximize your long-term savings without worrying about tax on withdrawals during retirement.

Withdrawals from a Roth Gold IRA offer significant tax advantages, as you won’t pay any taxes on qualified distributions. However, to benefit from this, you must adhere to the IRS rules regarding the account’s age and your age at withdrawal. Failure to meet these requirements can result in taxes and penalties. Taking advantage of tax-free withdrawals allows you to keep more of your investment gains, making the Roth Gold IRA an excellent tool for long-term, tax-efficient retirement planning.

Tips for a Successful Rollover

Keep these vital points in mind to ensure a smooth and beneficial gold IRA rollover:

- Choose a reputable custodian with experience in precious metals IRAs.

- Request a direct rollover to avoid taxes and penalties.

- Verify that your selected metals meet IRS purity standards.

- Maintain detailed records of all transactions for compliance.

Assuming that following these steps will help you protect your investments and maximize the tax benefits of your gold IRA rollover.

Choosing the Right Custodian

Successful gold IRA rollovers depend on selecting a knowledgeable custodian experienced with self-directed precious metals accounts. Look for low fees, IRS-approved storage options, and strong customer support. Birch Gold Group primarily works with Equity Trust, a trusted name in this space, but your choices aren’t limited. The right custodian safeguards your assets and assists with compliance, so choosing carefully impacts the long-term success of your tax-free rollover.

Understanding IRS Regulations

Regulations governing your gold IRA rollover directly affect your tax benefits and penalty avoidance. The IRS mandates strict rules on rollover timelines, eligible metals, and required minimum distributions starting at age 73 for traditional IRAs. Failure to comply may lead to steep penalties, including up to a 50% excise tax on shortfalls. Understanding these rules helps you retain maximum tax advantages.

It is vital you grasp IRS guidelines surrounding the gold IRA rollover process. Direct rollovers prevent funds from being treated as taxable distributions, while acceptable metals must meet specific purity standards to qualify. Additionally, you must be aware of contribution limits—$7,000 annually (or $8,000 if over 50)—and the differing rules for Roth versus traditional accounts. Missteps could trigger unwanted taxes or penalties, so staying informed and compliant ensures you fully benefit from your tax-free gold IRA rollover.

Step-by-Step Rollover Process

Not all rollovers are created equal; completing a Gold IRA rollover involves several key steps to safeguard your investments and maintain tax advantages. These steps ensure your funds move smoothly from your existing account to a self-directed Gold IRA without triggering penalties or taxes. Use the table below to understand each step clearly:

| Step | Description |

|---|---|

| Select a Custodian | Choose a self-directed IRA custodian experienced with precious metals and competitive fees. |

| Pick Eligible Metals | Select IRS-approved precious metals meeting purity standards like gold, silver, platinum, or palladium. |

| Initiate the Rollover | Contact your current IRA or 401(k) provider to request a direct rollover to avoid taxable events. |

| Purchase Metals | Instruct your custodian to buy the precious metals after funds transfer, stored in an IRS-approved depository. |

| Stay Compliant | Maintain thorough records and adhere to IRS rules to preserve tax benefits. |

Initiating the Rollover

While moving your retirement assets to a Gold IRA, it’s imperative to request a direct rollover from your current IRA or 401(k) custodian. This method ensures your funds transfer directly without passing through your hands, helping you avoid the 10% early withdrawal penalty and any taxable events. By working closely with your custodian, you maintain the tax-deferred or tax-free status of your investment, giving you peace of mind as you diversify your portfolio.

Purchasing Precious Metals

Rolling over funds into your new Gold IRA allows you to acquire IRS-approved precious metals such as gold, silver, platinum, or palladium. Your custodian will purchase these metals on your behalf, ensuring they meet strict purity standards, and store them securely in an IRS-approved depository. This step transforms your retirement savings into tangible, inflation-resistant assets that strengthen your portfolio’s stability.

To complete your metals purchase successfully, you need to carefully choose the coins or bars that comply fully with IRS guidelines. Your custodian will facilitate the transaction, and the metals are stored with options such as segregated or non-segregated storage at approved facilities in locations like Delaware or California. Ensuring proper storage protects your investment and maintains your IRA’s tax advantages. Additionally, your metals are insured up to $1 billion, providing you with added security and confidence in your Gold IRA investment.

Factors to Consider Before Rolling Over

To ensure a successful gold IRA rollover, you should evaluate several factors. Consider your current retirement account type, IRS guidelines, fees involved, and eligible custodians. Understand the tax implications and whether you want a traditional or Roth Gold IRA. Also, check the list of IRS-approved metals and storage options. Key points to review include:

- Account eligibility for rollover

- Custodian fees and storage costs

- Contribution limits

- Required Minimum Distributions (RMDs)

Knowing these will help you avoid penalties and maximize your tax benefits.

>>>>>>>>>>>>>>>Compare Top Gold IRA Companies<<<<<<<<<<<<<<<

Contribution Limits

Contribution limits affect how much you can add annually to your Gold IRA. In 2025, you may contribute up to $7,000, or $8,000 if you’re 50 or older. If using a SEP IRA, limits can be as high as 25% of your compensation or $66,000, whichever is less. Staying within these boundaries protects your rollover’s tax-deferred status and helps you make the most of your investment potential.

Timing Your Rollover

Now is the time to consider when to perform your gold IRA rollover. Rolling over during a year when your taxable income is lower can reduce taxes if you convert to a Roth IRA. Additionally, timely action avoids early withdrawal penalties and ensures continuous tax-deferred growth. Careful timing can strengthen your retirement plan’s tax efficiency and inflation protection.

Consider the impact of your current income level and tax bracket before initiating a rollover. Performing a rollover during a low-income year may minimize immediate tax obligations, particularly when converting to a Roth Gold IRA, where withdrawals become tax-free. Conversely, delaying might expose you to higher tax rates or missing out on inflation protection. Also, ensure your rollover is completed as a direct transfer to avoid the 10% early withdrawal penalty and preserve your tax advantages. Your timing can significantly influence the overall benefit of the rollover, so plan accordingly.

Pros and Cons of Gold IRAs

After considering a Gold IRA rollover, you should weigh its benefits against potential downsides. This overview helps you understand how investing in physical precious metals like gold can protect your savings while also involving certain costs and restrictions.

| Pros | Cons |

|---|---|

| Provides inflation protection through tangible assets | Higher fees including setup, storage, and management costs |

| Offers tax-deferred or tax-free growth depending on IRA type | Limited liquidity compared to stocks and mutual funds |

| Safeguards your portfolio from market volatility | Required minimum distributions (RMDs) apply to traditional Gold IRAs |

| Allows diversification beyond conventional investments | Metal purity and storage must meet IRS standards |

| Supports estate planning with beneficiary options | Minimum investment often starts at $10,000 |

Advantages of Gold IRAs

If you’re looking to shield your retirement savings from inflation and stock market fluctuations, Gold IRAs provide an excellent way to diversify. You benefit from tax-deferred or even tax-free growth, depending on whether you choose a traditional or Roth IRA. Plus, by investing in physical gold and other precious metals, your portfolio gains a tangible asset with a long history of value preservation, empowering your retirement planning with added security.

Potential Drawbacks

For many investors, the higher fees related to the setup, storage, and management of Gold IRAs can be challenging. Additionally, Gold IRAs require a minimum investment—often $10,000—and investing in physical metals might limit your liquidity compared to more conventional assets. Understanding these factors helps you balance the benefits with the practical aspects of managing your retirement account.

The most important consideration is that Gold IRAs carry ongoing costs, including approximately $50 setup fees plus annual $100 storage and $100 management fees. This can impact your overall returns, especially with smaller accounts. Furthermore, your metals must meet strict IRS purity standards and be stored securely in approved depositories, which requires careful custodial oversight. Limited liquidity means you can’t quickly access your investment like stocks or ETFs, so you should plan accordingly. By weighing these factors, you ensure your Gold IRA aligns with your long-term financial goals.

Final Words

Now, by taking advantage of a tax-free Gold IRA rollover, you can secure your retirement savings with the benefits of tax-deferred or tax-free growth while protecting your assets from market instability and inflation. This strategy allows you to diversify your portfolio with tangible, inflation-resistant metals, potentially lowering your taxable income and avoiding early withdrawal penalties. With proper planning and adherence to IRS rules, you have the opportunity to enhance your long-term financial security and enjoy greater control over your retirement future.

>>>>>>>>>>Speak with a Gold IRA Specialist<<<<<<<<<<<<<

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.