Why Gold Keeps Popping Up in “Trump‑Era” Headlines

Before 2016, gold enjoyed a quiet reputation as a hedge for central banks, pension funds, and the occasional “prepper.” Then Donald Trump stepped onto the political stage with stark warnings about soaring deficits, a “tired” dollar, and global currency wars. Suddenly, gold was headline news again.

Fast‑forward to 2025:

- Inflation has run hotter than any 12‑month stretch since the 1970s.

- The U.S. national debt now towers above $35 trillion.

- The Federal Reserve toggles between tightening and emergency liquidity injections, spiking volatility in both stocks and bonds.

Uncertainty is no longer abstract; it’s an unavoidable part of every retirement projection. For passive‑profit seekers, people who value steady long‑term wealth over adrenaline-fueled day trading, the question becomes: How do you inoculate your nest egg against scenarios that Wall Street spreadsheets struggle to model?

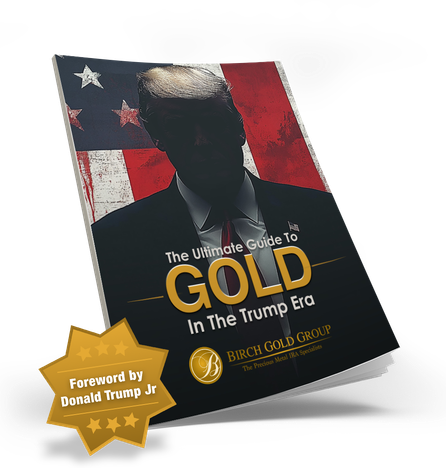

Physical gold, unencumbered by counterparty promises, offers one compelling answer. And that’s precisely where the Trump Gold Guide comes in. Branded “The Ultimate Guide to Gold in the Trump Era” and featuring a foreword by Donald Trump Jr., the free 12‑page booklet breaks down why tangible bullion can still punch above its 4,000‑year weight class, how a Gold IRA works, and what practical steps ordinary savers can take today.

Ready to see the details for yourself? Claim your FREE Trump Gold Guide here no strings attached, just solid facts delivered to your inbox.

Gold 101: The Asset Class That Outlived Empires

Zero Counter‑Party Risk

A physical gold coin stored in a secure vault doesn’t depend on a bank’s solvency, a CEO’s decisions, or a central banker’s credibility. It is wealth in its own right, universally recognized, border‑agnostic, and historically accepted as payment when fiat currencies falter.

Inflation Hedge (Mostly Here’s the Nuance)

Gold isn’t a perfect mirror of CPI charts, but across decades it has tended to retain purchasing power. A Roman centurion’s monthly pay could buy a fine leather belt; one ounce of gold today buys a designer belt and sometimes the jacket too. Over 50‑year horizons, that stability matters more than day‑to‑day price spikes.

Crisis Correlation

During the 2008–2009 financial crisis, the S&P 500 fell roughly 57 % peak‑to‑trough; gold rose about 25 % over the same timeline. Similar divergences appeared in 2020’s pandemic panic. Owning 5–15 % gold can buffer a portfolio’s worst months and help investors avoid “bail‑out-at‑the-bottom” mistakes.

Liquidity

Contrary to myth, bullion isn’t “dead money.” Global OTC dealers quote prices 23 hours a day. Premium Gold IRA custodians can liquidate holdings within 24–48 hours, wiring cash back into the IRA or shipping metals for in‑kind distribution.

Gold IRAs in Plain English – Marrying Hard Assets With Tax Advantages

The SDIRA Framework

A self‑directed IRA (SDIRA) expands the IRS rulebook beyond stocks and bonds, allowing alternative assets like real estate, cryptocurrency, and precious metals. Within that sandbox, a Gold IRA permits physical bullion bars or coins meeting specific purity rules to sit inside the same tax shelter as your index fund shares.

| IRA Type | Contribution Tax Treatment | Withdrawal Tax Treatment |

|---|---|---|

| Traditional Gold IRA | Potentially deductible now | Taxed as ordinary income in retirement |

| Roth Gold IRA | After‑tax now | Tax‑free withdrawals (principal + gains) later |

Eligible Metals

- Gold ≥ 99.5 % purity (American Gold Eagle, Canadian Maple Leaf, Australian Kangaroo, bars from LBMA‑approved refiners)

- Silver ≥ 99.9 %, Platinum & Palladium ≥ 99.95 %

Storage & Custodian Rules

The IRS requires an approved third‑party depository; no under‑the‑mattress hoarding if you want the tax perks. Segregated vaults store your specific coins; commingled vaults pool metal of equal type and weight. Reputable providers offer both, fully insured.

Fees to Expect

- One‑time setup ($50–$150).

- Annual custodian/admin (~$100–$150 flat).

- Annual storage (~$80–$110 flat for segregated).

Flat fees beat percentage‑of‑assets models once balances pass ~$30,000.

Inside the Trump Gold Guide: What You Actually Get

Unlike the 300‑page manifesto you’ll never read, the Trump Gold Guide is digestible in one coffee break. Here’s the chapter rundown:

| Page Range | Focus | Key Takeaways |

|---|---|---|

| 1–2 | Foreword by Donald Trump Jr. | Personal story of why he’s stacking physical gold, not just paper claims. |

| 3–4 | “Dollar in Decline” Infographic | Timeline of dollar purchasing‑power erosion vs. gold ounces. |

| 5–6 | How a Gold IRA Works | IRS eligibility checklist, rollover flowchart, tax‑saving scenarios. |

| 7–8 | Storage & Insurance Myths | Side‑by‑side of segregated vs. commingled vaults; Lloyd’s of London coverage summary. |

| 9 | Fee Transparency Worksheet | Blank form to compare providers encourages shopping around. |

| 10 | 5 Mistakes First‑Time Gold Buyers Make | From over‑concentrating to chasing collectible coins. |

| 11–12 | Action Plan & Resources | Links to free webinars, phone consult scheduling, and ongoing market commentary. |

The guide is education‑first. It explains what you could do, not what you “must” do. And yes, you’ll find Birch Gold’s phone number at the end because they co‑published it, but the pages are mercifully free of hard‑sell verbiage.

Birch Gold Group – Why Their Name Appears on the Cover

Two Decades of Niche Focus

Founded in 2003, Birch Gold Group chose a narrow mission: precious‑metal IRAs for everyday Americans. That specialization shows up in operational details dedicated rollover teams, long‑standing relationships with custodians like Equity Trust Company and STRATA Trust, and vault options spanning Delaware Depository, Brink’s Global Services, and Texas Precious Metals Depository.

Reputation Scorecard

| Platform | Rating | Notable Comment |

|---|---|---|

| BBB | A+ | Zero unresolved complaints in past 12 months. |

| BCA | AAA | “Exemplary track record” per 2024 audit. |

| TrustPilot | 4.6/5 (1,200+ reviews) | Top marks for “clarity” and “no pressure.” |

Fee Philosophy

Birch posts its fee matrix online rare transparency in a sector often shrouded in phone‑only quotes. Flat annual costs stay the same whether your account is $25k or $250k, which can save thousands over decades versus a 0.8 % asset‑based rival.

Minimums & Promotions

- $10,000 minimum to open a Gold IRA.

- Periodic promos: first‑year fees waived on $50k+ transfers; tiered bonus silver (up to $20k in metals) on large rollovers. Promotions change; ask your rep for the current terms.

Five Practical Ways to Use the Guide for Passive Profit

- Stress‑Test Your Current Allocation

Flip to page 3’s “Dollar Decline” chart. Overlay your own retirement projections. How sensitive is your plan to a 20 % spike in living costs? - Audit Provider Fees

Use page 9’s worksheet to request quotes from at least three Gold IRA custodians: Birch Gold, a percentage‑based rival, and one hybrid provider. Compare apples to apples. - Clarify Rollover Logistics

Pages 5–6 include a flowchart for trustee‑to‑trustee transfers. Identify which of your current 401(k)/IRA custodians allow partial rollovers, so you can start small if desired. - Plan Liquid‑Gold “Rainy‑Day” Reserves

Page 8 debunks storage myths. Decide whether segregated or commingled suits you, how insurance interacts with your personal risk tolerance, and whether you want an in‑kind distribution option at age 59½. - Integrate Gold Into a Broader Passive‑Profit Framework

The last two pages outline how small, periodic gold purchases (dollar‑cost averaging) can mirror the low‑maintenance index‑fund approach you already use only with bullion. Schedule standing instructions if your provider offers auto‑buy programs.

Answering the Big Objections (Before You Download)

“Isn’t gold a political statement?”

Gold is apolitical. From Ancient Egypt to modern Singapore, cultures view it as a store of value. The Trump branding here is marketing useful shorthand for an era of fiscal uncertainty, but the metal doesn’t care who’s in the Oval Office.

“Won’t storage fees eat my returns?”

A typical segregated vault fee of $110 per year on a $50,000 Gold IRA equals 0.22 % lower than many bond‑fund expense ratios. And unlike fund fees, it covers physical insurance.

“What if I need cash fast?”

Reputable custodians complete wire transfers within two business days. Some even offer ACH the same day of trade. You’re not locked in for decades unless you choose to be.

“Does buying now mean I missed the low?”

Gold isn’t a tech stock chasing all‑time highs; it’s a store of value. Dollar‑cost averaging over quarters or years minimizes regret risk about entry points.

Balanced Risk‑Reward Checklist

| Question | Yes | No | Mitigation if “No” |

|---|---|---|---|

| Do I have at least 5 years until needing these funds? | □ | □ | Use a smaller allocation; prioritize liquidity. |

| Am I comfortable with 10–15 % portfolio volatility? | □ | □ | Cap gold exposure at 5 %; revisit annually. |

| Do I understand fixed storage fees vs. asset‑based fees? | □ | □ | Re‑read page 9 of the guide; call Birch Gold for clarification. |

| Have I compared at least two custodians? | □ | □ | Obtain quotes; the guide supplies question prompts. |

Bottom line: If you can tick 3 of the 4 “Yes” boxes, a modest Gold IRA slice can enhance portfolio resilience without derailing passive‑profit simplicity.

Conclusion – Turning Information Into Action

You don’t need to be a political die‑hard, a currency hawk, or a Wall Street veteran to appreciate the logic of hard‑asset diversification. You do need reliable information, transparent fees, and a step‑by‑step playbook tailored for everyday savers.

The Trump Gold Guide supplies exactly that without a paywall, and without an army of telemarketers badgering you for a credit‑card number. It offers:

- A concise refresher on gold’s historical role.

- Clear visuals linking fiscal policy to metal demand.

- A nuts‑and‑bolts primer on Gold IRAs.

- Self‑assessment worksheets to keep decisions objective, not emotional.

Whether you ultimately roll over $10,000, $100,000, or nothing at all, the 12 pages will leave you better informed, and that alone can compound returns by preventing costly mistakes.

Claim Your FREE Trump Gold Guide Now

One click. Zero obligation. Lifelong financial insight.

(You’ll also receive Birch Gold’s more detailed 20‑page Info Kit on Gold IRAs as a bonus.)

Final Thought

In an age when algorithms trade microseconds and headlines jolt markets overnight, patience and preparation remain rare competitive edges. Gold is nothing if not patient wealth. The Trump Gold Guide shows how to weave that patience into a modern retirement portfolio quietly, confidently, and, if you wish, passively.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.