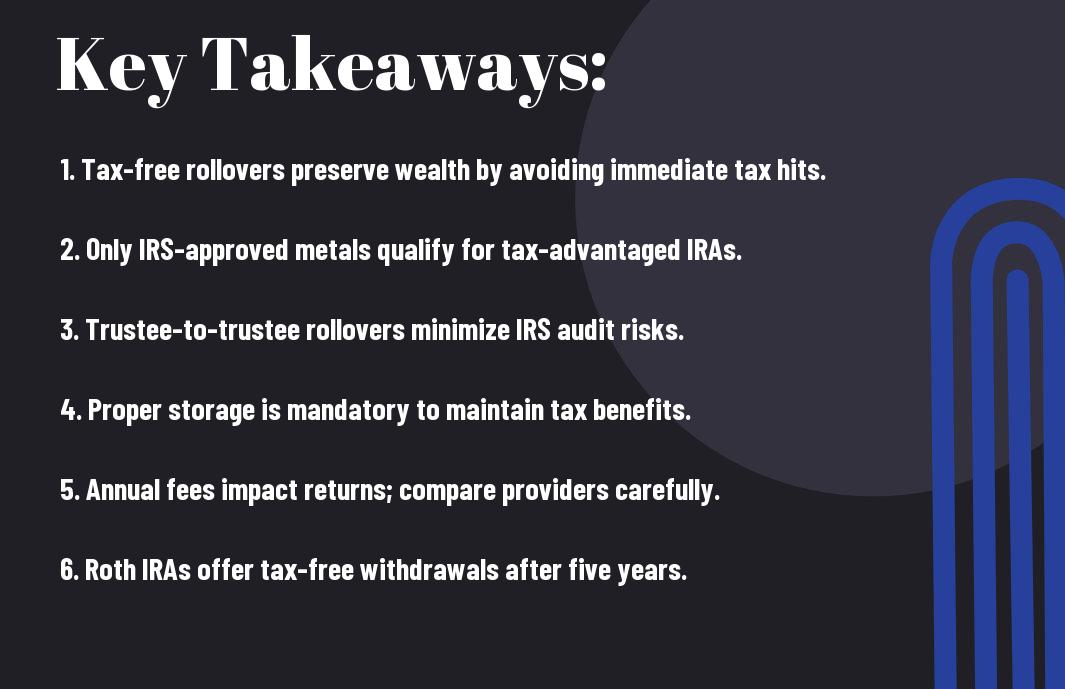

Over time, you may find that converting a portion of your retirement savings into a Gold IRA rollover can offer significant tax advantages while helping to protect your portfolio from market volatility and inflation. By executing a tax-free rollover, you avoid penalties and immediate taxes, allowing your investment in precious metals to grow more efficiently. Understanding the correct process and IRS regulations is vital to secure your retirement funds properly and maximizing the long-term benefits of adding physical gold to your IRA.

Understanding Gold IRAs

Before submerging into the benefits of a tax-free gold IRA rollover, you need to understand what a Gold IRA entails. This unique retirement account allows you to diversify beyond stocks and bonds by adding physical precious metals like gold. It offers protection against market volatility, inflation, and currency risks, all while maintaining tax advantages. Knowing the fundamentals will help you make informed decisions that align with your long-term financial goals.

What is a Gold IRA?

After opening a Gold IRA, your retirement account can hold IRS-approved physical metals such as gold, silver, platinum, or palladium, securely stored in a third-party depository. This self-directed IRA gives you control beyond traditional investments, allowing you to diversify with tangible assets that historically retain value during economic uncertainty. The process avoids tax penalties by adhering to strict IRS regulations on contributions, rollovers, and storage.

Types of Gold IRAs

Along with understanding what a Gold IRA is, you should know the primary types available: Traditional and Roth Gold IRAs. Both allow investment in physical metals but differ in tax treatment. Traditional IRAs offer potential tax deductions upfront, with taxes due upon withdrawal, while Roth IRAs require after-tax contributions and allow tax-free withdrawals after age 59½. Choosing the right type depends on your current tax situation and retirement strategy.

| IRA Type | Key Features |

|---|---|

| Traditional Gold IRA | Tax-deductible contributions; taxable withdrawals |

| Roth Gold IRA | After-tax contributions, tax-free withdrawals |

| Self-Directed IRA | Allows investments beyond stocks, including physical metals |

| SEP Gold IRA | Designed for the self-employed with higher contribution limits |

| SIMPLE Gold IRA | For small businesses with simplified plan rules |

The right Gold IRA type will align with your retirement objectives and tax planning, ensuring your precious metals investment works efficiently for you.

But beyond the basic tax differences, you should consider how each Gold IRA type impacts your overall portfolio volatility and growth potential. For instance, while Traditional IRAs offer immediate tax relief, Roth IRAs provide tax-free compounding growth, making them attractive if you expect to be in a higher tax bracket at retirement. Additionally, self-directed Gold IRAs empower you to diversify into gold bullion with purity standards (≥ 99.5%), contributing to portfolio stability against inflation and inflation-driven currency risks.

- Traditional vs. Roth: Understand contribution and withdrawal tax mechanics

- Self-Directed IRAs: Greater flexibility with physical gold holdings

- Purity Standards: IRS requires 99.5 %+ gold for IRA eligibility

- Storage: Metals must be held in approved depositories, not at home

- Tax Benefits: Gains compound tax-deferred or tax-free, depending on account type

| Aspect | Details |

|---|---|

| Contribution Limits | Based on IRS annual IRA limits |

| Tax Treatment | Traditional: taxed on withdrawals; Roth: tax-free withdrawals |

| Storage Rules | Mandatory IRS-approved vault storage |

| Asset Eligibility | Must be IRS-approved bullion, no numismatic coins |

| Fees | Setup, storage, admin, spreads affect net returns |

The decision between Gold IRA types impacts your retirement savings growth, tax liability, and compliance requirements, making it vital you choose the option that best suits your financial situation while adhering to IRS rules.

Tax Benefits of Gold IRAs

Now is an excellent time to understand how Gold IRAs can enhance your retirement strategy with tax advantages. These accounts allow you to diversify your portfolio while enjoying tax-deferred or even tax-free growth. You Might Not Know These Gold IRA Tax Benefits that could help your investments grow more efficiently and shield you from taxes that could otherwise erode your returns over time.

Traditional vs. Roth Gold IRAs

Above all, knowing the differences between Traditional and Roth Gold IRAs helps you optimize tax outcomes. A Traditional Gold IRA offers potential tax-deductible contributions now but results in taxable withdrawals later. In contrast, a Roth Gold IRA requires after-tax contributions, but your withdrawals, both principal and gains, are tax-free after age 59½ and meeting the five-year rule. Choosing the right type depends on your current tax bracket and retirement goals.

Tax-Free Growth and Withdrawals

At the core of Gold IRAs’ appeal is their ability to let your investment grow without annual capital gains taxes. Whether you opt for Traditional or Roth, your metals’ gains compound uninterrupted, enabling you to ride out long metal cycles more efficiently than a taxable account. This setup preserves more of your wealth over time and can provide substantial tax relief as you approach retirement.

Growth in your Gold IRA happens without the drag of annual taxes on capital gains, which typically reduce your investment’s long-term value. By deferring or eliminating taxes on growth and withdrawals, you maximize the compounding effect, important when dealing with metals that can have extended price cycles. However, be aware that withdrawals from a Traditional Gold IRA are taxed as ordinary income, while Roth distributions are completely tax-free if the rules are met. These distinctions significantly impact your retirement cash flow and should guide your choice.

The Rollover Process

To complete a tax-free Gold IRA rollover, you must transfer funds from your existing retirement account into a self-directed IRA that permits physical precious metals. This involves moving money through a trustee-to-trustee rollover or a 60-day rollover, each with specific IRS rules. Following the proper steps ensures you avoid penalties and taxes, allowing your investments in IRS-approved bullion to grow tax-deferred or tax-free, depending on your IRA type.

Steps to Execute a Tax-Free Rollover

Rollover begins by contacting your current IRA or 401(k) custodian to initiate a trustee-to-trustee transfer or a 60-day rollover. Then, open a Gold IRA with a qualified custodian who facilitates buying and storing IRS-approved metals in an insured depository. Submit required IRS forms, such as Form 5498 or 1099-R, through the custodian. Staying diligent with paperwork and timelines protects your rollover’s tax advantages and keeps your investments compliant.

Common Mistakes to Avoid

Common errors include attempting self-storage of metals, which triggers taxes and penalties, skipping segregated storage, leading to difficulty trading bullion, and ignoring ongoing fees even after retirement. You should also avoid over-allocating to volatile metals like silver or neglecting the required minimum distributions on Traditional IRAs holding physical gold. Proper planning reduces risk and preserves your retirement assets.

Execute your rollover carefully by steering clear of pitfalls such as self-delivery of metals, which the IRS classifies as a distribution, resulting in immediate taxation and potential penalties. Avoid confusing storage options. Segregated storage guarantees your specific metals, while commingled storage pools assets but may complicate quick liquidation. Additionally, assess all fees displayed transparently, like annual storage costs averaging 0.36% on $50,000 balances, so you understand how costs impact returns. Avoiding these mistakes safeguards your investment’s growth and ensures compliance with IRS regulations.

Storage and Security of Precious Metals

Unlike storing your metals at home, holding precious metals in a Gold IRA requires secure, IRS-approved depositories. These facilities offer insured storage, often up to $1 billion, and undergo regular audits to protect your investment. Proper storage ensures your metals are safeguarded against theft, damage, and loss, providing you peace of mind while preserving your tax benefits.

IRS Requirements for Storage

On IRS mandate, you cannot personally hold the physical metals in your Gold IRA; they must be stored in an approved third-party depository. Whether metals are kept segregated, stored separately to your specifications, or commingled in a pooled inventory, these facilities must meet strict insurance and auditing standards. This ensures your investment retains its tax-advantaged status and complies with all regulatory safeguards.

Choosing a Secure Custodian

Against the risks of poor management or lack of transparency, selecting a reputable custodian is key. A trustworthy custodian handles all administrative tasks, reports to the IRS accurately, and coordinates secure storage and insurance. By partnering with well-established firms like Equity Trust or STRATA Trust, you reduce the chance of costly errors and ensure your assets remain compliant and well-protected.

A strong custodian not only provides consistent, audited reporting, such as filing Form 5498 annually, but also facilitates smooth distribution processes, whether you choose to liquidate inside the IRA or take in-kind distributions. Your custodian’s efficiency directly impacts your experience and the safety of your metals, so you should evaluate their fees, reputation, and service quality before committing.

Costs and Fees

Despite the appeal of investing in a Gold IRA, being aware of the associated costs and fees is crucial to protect your long-term returns. Fees can include setup charges, annual administration and storage fees, as well as spreads or commissions on bullion purchases. Understanding these expenses helps you avoid unexpected surprises and maintain the integrity of your portfolio’s growth potential over time.

Understanding Fee Structures

Besides flat fees, many providers charge a percentage-based fee on your assets under management. For example, annual admin and storage fees range from around $180 to $230 or 0.4% to 1% asset-based. Knowing whether your provider uses flat or percentage fees, and the markup on bullion purchases, allows you to evaluate which arrangement best suits your investment size and goals.

Comparing Different Providers

To make informed decisions, you should compare fees and services across providers. Below is a simplified comparison of key aspects from leading Gold IRA companies.

| Provider | Fee Structure & Notable Features |

|---|---|

| Birch Gold | Flat $50 setup, $180–$200 annual fees; fee worksheet included for transparency |

| Goldco | 0.79% asset-based fee; suitable for larger accounts |

| Augusta Precious Metals | Hybrid fee model; includes video explainer and inflation booklet |

And when comparing providers more deeply, consider factors beyond fees, such as fee clarity, educational support, and storage insurance. Birch Gold, for instance, offers a detailed fee-comparison worksheet and transparent storage cost breakdowns, while other providers may emphasize promotional content or offer percentage-based pricing that benefits higher balances. Weighing these elements alongside fees helps you choose a provider that fits your unique needs without hiding potential cost pitfalls.

| Provider | Highlights & Considerations |

|---|---|

| Birch Gold | Comprehensive kits with fee transparency; flat fees beneficial for accounts under $75k |

| Goldco | Higher percentile fees; attractive for balances over $75k, but may cost more for smaller investments |

| Augusta Precious Metals | Strong educational focus; fee model blends flat and percentage elements |

Market Considerations

Once again, understanding the market dynamics behind Gold IRAs helps you make informed decisions. You face challenges like inflation eroding purchasing power, market volatility rattling traditional stocks, and currency risks stemming from global economic shifts. By carefully analyzing these factors, you can position your portfolio to better withstand uncertainty and enhance your retirement security. A well-planned Gold IRA rollover isn’t just about owning precious metals; it’s about strategically balancing risk and reward with clear data guiding your moves.

Historical Performance of Gold

Besides its status as a tangible asset, gold has shown resilience through decades of economic cycles. Over the past 50 years, gold prices have often outpaced inflation, particularly shining during periods when stock markets suffered major drawdowns. These trends illustrate why including gold in your IRA can offer diversification and long-term growth potential, supporting your retirement goals amid fluctuating markets.

Gold as a Hedge Against Inflation

By nature, gold tends to retain value even when inflation rises, protecting your purchasing power. Unlike bonds or cash, whose real returns can be eroded, gold’s price movements often correlate with inflation spikes. As you plan your tax-free rollover, leveraging gold’s inflation-hedging properties can help safeguard your nest egg in uncertain economic environments.

Performance data shows that during high inflation periods, gold has outperformed many traditional assets, offering a safe haven when currency values decline. However, you should be aware of gold’s price volatility, which can cause short-term fluctuations. Balancing your allocation, such as the recommended 7%, and reviewing fees like storage and commissions carefully helps you benefit from gold’s stability without undue risk. This strategic approach enhances your portfolio’s resilience against inflationary pressures.

Final Words

The ability to execute a tax-free Gold IRA rollover offers you a powerful way to diversify your retirement portfolio while preserving your wealth against market uncertainty and inflation. By understanding the process and adhering to IRS guidelines, you can confidently transfer assets without triggering taxes or penalties. This strategic move enhances your financial flexibility and positions your investments for long-term growth in physical precious metals. With informed planning, your Gold IRA rollover becomes a smart step toward securing a more resilient retirement future.

FAQ

Q: What is a tax-free gold IRA rollover, and how does it work?

A: A tax-free gold IRA rollover allows you to transfer funds from an existing qualified retirement account, such as a 401(k) or traditional IRA, into a self-directed IRA that holds physical gold or other IRS-approved precious metals. This process is done without incurring taxes or penalties, provided the rollover is completed within the IRS’s 60-day window and follows trustee-to-trustee transfer rules. The new IRA will then hold gold bullion or coins stored in an approved depository, preserving the tax advantages of retirement accounts while gaining exposure to precious metals.

Q: Are there any tax implications I should be aware of during a gold IRA rollover?

A: If executed correctly as a trustee-to-trustee transfer, a gold IRA rollover does not trigger immediate tax consequences because the funds move directly between custodians without you taking possession. However, if you withdraw the funds personally and fail to redeposit them into a qualifying retirement account within 60 days, the distribution may be treated as taxable income and could be subject to early withdrawal penalties if you’re under age 59½. It’s important to work closely with custodians familiar with IRS rules and to complete required paperwork accurately to maintain the tax-deferred or tax-free status of your account.

Q: What advantages does a tax-free gold IRA rollover offer compared to a standard IRA investment?

A: A tax-free gold IRA rollover expands your retirement portfolio by enabling ownership of physical, IRS-approved precious metals, which are generally uncorrelated with traditional asset classes like stocks and bonds. This diversification can help hedge against market volatility, inflation, and currency risks over the long term. Additionally, the tax-advantaged status of the IRA means your gains in gold can grow tax-deferred (Traditional IRA) or tax-free (Roth IRA), enhancing the compounding potential without the drag of capital gains taxes during the accumulation phase.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.