Just because financial planning can seem complex doesn’t mean you have to fall into common traps that derail your progress. Without a clear strategy, you risk unnecessary debt, insufficient savings, and missed investment opportunities. By understanding and applying effective methods, you can take control of your finances, build a solid foundation, and work towards long-term financial success. This guide will walk you through six crucial ways to avoid these pitfalls and secure your financial future with confidence.

The Importance of Setting Clear Financial Goals

For effective financial planning, setting clear and realistic goals gives you a roadmap to follow, preventing aimless money management. Vague intentions like “saving more” often lead to inconsistent efforts and slow progress. By defining specific targets, you can track your journey, stay motivated, and adjust your actions as your income or priorities change, ensuring you avoid unnecessary debt and missed opportunities.

Understanding SMART Goals

About SMART goals, you need to focus on making your objectives specific, measurable, achievable, relevant, and time-bound. For example, stating “Save $10,000 for an emergency fund within two years” turns a general idea into a clear plan. This framework helps you create goals that are practical and trackable, increasing your chances of success and providing clarity in your financial decision-making.

Breaking Goals into Achievable Categories

Between short-term, mid-term, and long-term goals, you can organize your financial objectives so they don’t feel overwhelming. This way, you ensure steady progress by focusing on manageable steps instead of trying to tackle everything at once, which often leads to frustration and setbacks.

At the core of goal setting, dividing your plans into categories allows you to prioritize effectively and maintain motivation. Short-term goals might include building an emergency fund, while mid-term goals involve saving for a major purchase, and long-term goals prepare you for retirement. This structure gives you clarity and control, helping you adjust as your income or needs evolve to stay on course.

Budgeting: The Foundation of Financial Planning

If you want to take control of your financial future, budgeting is the important first step. Without a clear understanding of your income and expenses, it’s easy to overspend and miss out on saving opportunities. A well-planned budget helps you allocate money effectively toward your needs, wants, and savings goals, making it easier to avoid debt and build financial stability over time.

Tools and Techniques for Effective Budgeting

Budgeting becomes manageable when you use the right tools and techniques. From user-friendly apps to simple spreadsheets, these resources help you track every dollar you earn and spend. Applying methods like categorizing expenses or following preset budgeting rules allows you to adjust your spending habits, identify areas for cost-cutting, and ensure your budget aligns with your financial goals.

The 50/30/20 Rule Explained

Financial discipline often starts with the popular 50/30/20 rule, which helps you divide your income into clear segments: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This balanced approach guides your spending decisions, ensuring you cover important things while still enjoying life and working toward a secure financial future.

To use the 50/30/20 rule effectively, allocate half of your income to important expenses like housing and groceries, which lays a strong foundation for your budget. The next 30% is dedicated to discretionary spending that improves your lifestyle but can be adjusted if necessary. The most powerful aspect is the 20% reserved for debt repayment and savings this steady commitment can help you build an emergency fund, reduce high-interest debt, and invest for long-term growth, minimizing the risk of financial setbacks.

Building an Emergency Fund

Keep an emergency fund that covers unexpected expenses such as medical emergencies, job loss, or urgent repairs. This fund acts as your financial safety net, preventing you from going into debt or disrupting long-term investments. Aim to save consistently, even small amounts each month, and keep this money easily accessible. Maintaining an emergency fund ensures you can handle surprises without stress, giving you more control over your financial future.

How Much Should You Save?

For effective protection, aim to save at least three to six months’ worth of imperative living expenses in your emergency fund. The exact amount depends on your income stability, monthly costs, and personal circumstances. A well-funded emergency account gives you the room to breathe during tough times, reducing reliance on costly credit or loans.

Strategies for Establishing an Accessible Fund

Building your emergency fund means placing it in an account that is both easy to reach and offers a reasonable return. Choose a high-yield savings account to maximize growth without sacrificing liquidity. This keeps your money working for you while remaining available for urgent needs.

Fund accessibility is imperative to prevent difficulties during emergencies. Avoid accounts with withdrawal penalties or long processing times. Using a separate account from daily spending helps resist the temptation to dip into emergency savings for non-emergency expenses. Setting up automatic transfers can also help you build this fund consistently. These steps help protect your financial stability, ensuring funds are ready when you truly need them.

Debt Management Strategies

Now is the time to take control of your debt by adopting smart management strategies that protect your financial stability. Mismanaged debt can quickly escalate, affecting your credit and causing unnecessary stress. By focusing on repayment methods and avoiding new debts without clear plans, you ensure your path toward financial freedom is steady and effective. Proper debt management not only reduces interest costs but also frees up resources for savings and investments, helping you build a stronger financial future.

Prioritizing High-Interest Debts

One of the most effective ways to manage your debt is by tackling high-interest balances first, such as credit cards. These debts accumulate interest rapidly, increasing the total amount you owe and prolonging repayment. By focusing your payments on these high-interest debts, you prevent excessive interest charges from piling up, ultimately saving you money and shortening your debt timeline. This approach keeps your credit healthier and accelerates your journey to financial freedom.

Methods for Efficient Debt Repayment

Management of your repayments can follow structured methods like the debt snowball or debt avalanche approaches. The snowball method targets small debts first, boosting motivation with quick wins, while the avalanche method prioritizes high-interest debts, saving you money in the long run. Choosing the right strategy helps you stay focused and consistent, making it easier to reduce debt systematically and regain control over your finances.

Also, combining these repayment methods with paying more than the minimum required amounts on your credit cards can significantly reduce interest charges. Avoid taking on new debt during this period to maintain progress. Tracking your repayments and adjusting your strategy according to changes in income or expenses ensures you avoid falling back into financial traps, positioning you to rebuild savings and invest wisely.

Strategic Investing and Diversification

Unlike impulsive investing or concentrating all your funds in one asset, strategic investing involves a thoughtful approach to spreading your investments across various options. By diversifying across stocks, bonds, real estate, and retirement accounts, you minimize risks and protect your portfolio from market volatility. Starting early enables you to leverage compound interest for greater growth. Avoid making emotional decisions during market swings and consider seeking professional advice to align investments with your financial goals for long-term success.

Importance of Asset Allocation

Before choosing individual investments, focus on asset allocation, dividing your portfolio among different asset classes based on your risk tolerance, timeline, and goals. This strategy helps you balance risk and reward effectively, reducing exposure to any single market downturn and keeping your financial plan on track over time.

Research and Continuous Education in Investing

Investing wisely requires that you stay informed and continuously educate yourself about changing market conditions and new opportunities. Thorough research allows you to make confident decisions, reduce unnecessary risks, and avoid costly mistakes that can impede your financial progress.

Strategic investing depends heavily on your commitment to ongoing learning and analysis. By regularly updating your knowledge and monitoring your portfolio’s performance, you can adapt to economic shifts and maximize returns. This proactive approach helps you avoid pitfalls like impulsive decisions or overexposure to high-risk assets, ensuring your investments align with your evolving financial priorities.

The Necessity of Early Retirement Planning

To secure a comfortable retirement, you need to start planning early. The more time your money has to grow, the greater the benefits from compound interest. Starting early allows you to contribute smaller amounts over a longer period, reducing financial pressure later. Delaying retirement planning can limit your options and increase the amount you must save each year. By taking action now, you set the foundation for financial freedom and can better navigate unexpected changes in your income or expenses.

Retirement Accounts and Contribution Strategies

Accounts like 401(k)s, IRAs, and Roth IRAs offer valuable tax advantages that can boost your retirement savings. You should prioritize maximizing employer-matching contributions when available, as this is important free money. As your income grows, consider increasing your contribution percentage to accelerate your savings. Developing a disciplined contribution strategy early ensures you take full advantage of compound growth and reduces your reliance on social security or other uncertain income sources in retirement.

Adjusting Plans for Inflation and Healthcare Costs

An effective retirement plan factors in rising costs due to inflation and healthcare expenses, which often increase faster than general inflation. Without adjustments, your savings may fall short of covering your needs. It’s important to regularly review your retirement projections to include these variables, ensuring your financial goals remain realistic and achievable over time.

Costs related to inflation and healthcare can significantly erode your retirement savings if left unmanaged. Healthcare costs, in particular, can rise sharply, impacting your budget more than expected. By including an inflation rate in your financial models and setting aside extra funds for medical expenses, you protect your purchasing power and maintain your lifestyle. Failing to plan for these factors is one of the most dangerous pitfalls that may force you to withdraw funds prematurely or reduce your retirement quality. Staying proactive with these adjustments strengthens your financial stability.

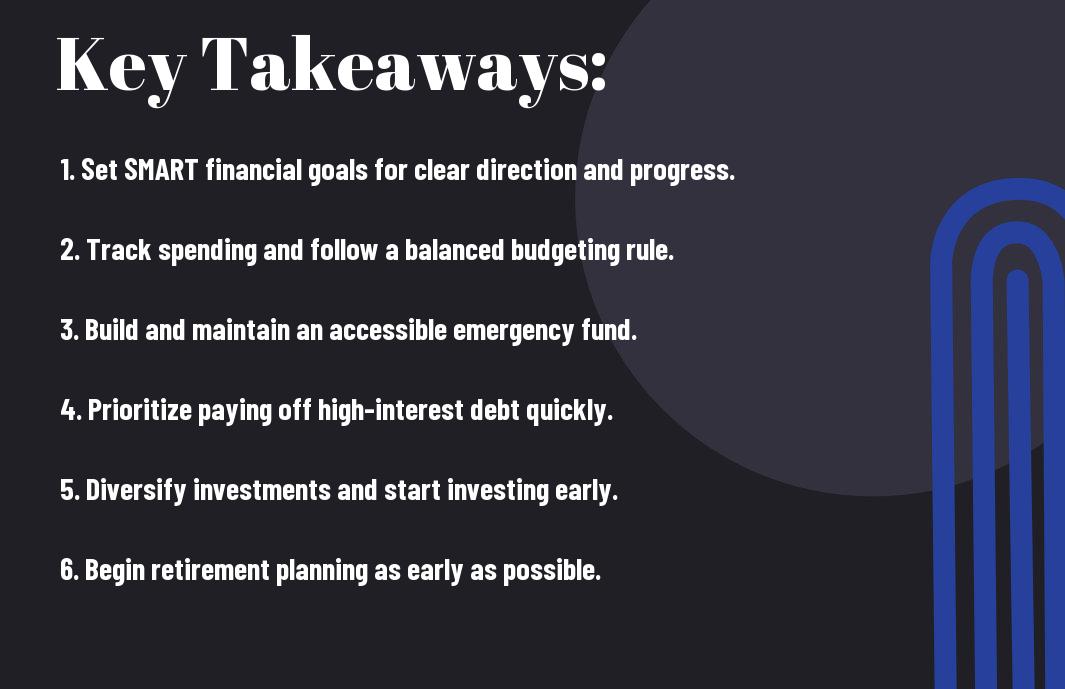

Conclusion

As a reminder, avoiding common financial planning pitfalls requires you to set clear goals, stick to a budget, prioritize an emergency fund, manage debt effectively, invest strategically, and plan for retirement early. By taking these deliberate steps, you enhance your ability to secure your financial future and build lasting stability. Consistent effort and smart choices put you in control of your finances, helping you navigate challenges and capitalize on growth opportunities. Start applying these practices today to create a stronger foundation for your long-term financial success.