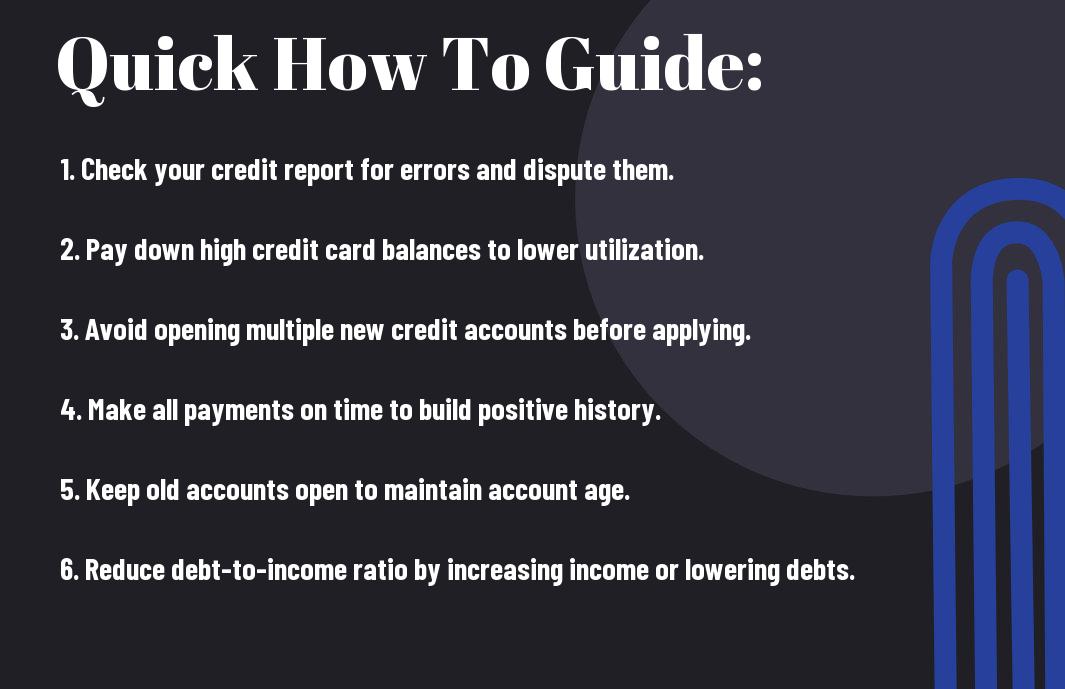

Credit plays a major role in securing favorable loan terms, so enhancing your score before applying can save you thousands. If your credit has recent dips or high utilization, addressing these issues can boost your approval chances and lower your interest rates. You should focus on paying down balances, correcting errors, and avoiding new inquiries in the weeks leading up to your application. By taking these deliberate steps, you put yourself in a stronger financial position and increase lenders’ confidence in your ability to repay.

Understanding Credit Scores

The credit score measures your creditworthiness based on your financial history. It influences how lenders view your loan applications, affecting your ability to secure favorable terms like low interest rates. Improving your credit score before applying gives you a stronger position in the borrowing process, potentially allowing access to online personal loans with better APRs. Knowing what impacts your score and how it’s calculated helps you take targeted actions for improvement.

What is a Credit Score?

With a range typically between 300 and 850, your credit score is a number that summarizes your credit history, including payment punctuality and debt levels. It acts as a quick reference for lenders assessing your risk, influencing the cost and availability of personal loans. A higher score often means better terms and faster approvals, supporting your goal of securing funding swiftly for investment opportunities.

Factors That Influence Your Score

To improve your credit score, focus on several key areas:

- Payment history: On-time payments boost your score, while late or missed payments damage it.

- Credit utilization: Keeping balances below 30% of your available credit shows responsible management.

- Length of credit history: Older accounts generally strengthen your score.

- New credit inquiries: Frequent hard pulls can lower your score temporarily.

Assume that consistently managing these factors positively impacts your chances of instant loan approval and better financing offers.

Another layer influencing your score includes:

- Credit mix: A variety of credit types can enhance your score.

- Debt-to-income ratio (DTI): Though not directly in the score, lenders use this metric to evaluate your repayment capacity.

- Recent credit activity: Opening multiple new accounts in a short time can signal risk.

Assume that balancing these elements, along with on-time payments, builds stable credit that supports fast, favorable lending decisions when you apply for loans.

How to Check Your Credit Report

If you plan to apply for a loan, you should first check your credit report to understand your financial standing. Your credit report reveals your credit score, payment history, and any outstanding debts, helping you identify areas to improve. Accessing it early lets you address issues before lenders see them, increasing your chances of securing a better loan offer with lower APRs. Keep in mind, some credit pulls affect your score, so choose methods that use soft inquiries when possible.

Requesting Your Credit Report

To get your credit report, use official sources like AnnualCreditReport.com, where you can access reports from the three major bureaus, Equifax, Experian, and TransUnion, once per year for free. Requesting these reports involves minimal information and typically triggers a soft credit pull, which doesn’t impact your score. Reviewing multiple bureaus ensures you catch all entries, as some lenders report selectively. Timely retrieval helps you create a plan before applying for fast, online funding options.

Reviewing for Errors

To improve your credit, carefully review every section of your report for inaccuracies such as wrong balances, outdated accounts, or unrecognized inquiries. Errors can drag your score down or misrepresent your risk to lenders, possibly leading to higher APRs or outright denial. Highlight anything suspicious or outdated, and dispute errors promptly with the bureau. Keeping your credit report accurate supports your effort to lock a low fixed APR and enhances your borrowing power.

Plus, disputes typically take 30 days to resolve, during which time your score can improve if errors are corrected. Pay special attention to late payments, incorrect debt amounts, and fraudulent accounts, as these are the most damaging mistakes lenders flag. Ensuring your report reflects only accurate, positive information means you present your best financial profile. This step directly impacts your ability to access fast online funding with competitive terms and protects you from surprises during the formal loan application process.

Tips for Paying Down Debt

Your journey to a better credit score starts with managing your debt effectively. Focus on reducing balances, paying more than the minimum when possible, and avoiding new debt.

- Make consistent on-time payments

- Keep balances low relative to credit limits

- Consider consolidating high-cost debt

Recognizing these habits strengthens your financial profile and makes lenders more confident when you apply for a loan.

Prioritize High-Interest Debt

With high-interest debt burning through your payments, target these balances first to cut down overall costs fast. Lowering expensive debts like credit cards or payday loans reduces the interest you pay monthly and improves your credit utilization ratio, which lenders closely monitor.

Create a Payment Plan

Even a simple payment plan helps you maintain steady progress and prevents missed payments. Map out your debts, set realistic goals, and automate payments where possible to avoid delays and penalties that hurt your credit.

Down your debt list by prioritizing payments based on balances and interest rates. Missed or late payments can cause credit score drops of 30+ points, so automating payments reduces risk. Allocating extra funds to higher-interest debts lowers total interest costs, freeing cash flow faster. A clear, organized plan also boosts your confidence, helping you stay disciplined and on track toward loan approval with favorable terms.

Establishing a Positive Payment History

Now, building a strong credit profile starts with showing lenders that you can handle debt responsibly. By consistently making payments on time and in full, you demonstrate reliability, which directly improves your credit score. Even small loans or credit cards can help establish this positive payment record. The more dependable your payment history, the higher your chances of securing favorable loan terms when you apply for fast online funding or other financial products.

Set Up Automatic Payments

Establishing automatic payments is a simple way to avoid missed due dates and late fees. By automating your loan or credit card payments, you ensure your bills are paid on time every month, protecting your credit from unnecessary dips. This method supports maintaining a stable, positive payment history with minimal effort, helping you maintain the spread between your asset returns and loan costs when pursuing leveraged investments.

Make Payments on Time

Now, making payments by the due date every month protects your credit score and keeps interest costs manageable. Late payments can cause your FICO score to drop by 60–110 points or more, delaying your ability to access affordable credit. Staying punctual also signals financial responsibility to lenders, which can result in lower APRs and better loan offers.

History shows that payment timeliness is the single most influential factor in your credit score. Even a single missed or late payment can remain on your report for up to seven years, making it harder to qualify for loans with competitive rates. Conversely, a flawless payment record builds trust and can lead to lower APR, sometimes below 15%, which is key to maintaining a positive spread and profitable leverage as outlined in fast funding strategies.

Reducing Credit Utilization

For improving your credit before applying for a loan, focus on reducing your credit utilization ratio, the percentage of your available credit you’re using. Keeping this ratio low signals responsible borrowing to lenders and can boost your FICO score. Aim to use less than 30% of your credit limit, as higher utilization may lower your score and raise your loan APR. By managing your credit utilization effectively, you position yourself for better loan offers with competitive interest rates.

Maintaining Low Balances

Assuming you keep your credit card balances consistently low, ideally under 30% of your credit limit, you demonstrate strong financial discipline. This practice not only improves your credit utilization but also helps prevent your FICO score from dipping by 3–5 points that hard inquiries cause during loan applications. Regularly paying down balances reduces your interest expenses and keeps your credit profile attractive to lenders.

Strategically Increasing Credit Limits

On the other hand, increasing your credit limits without increasing your spending can lower your credit utilization ratio, enhancing your creditworthiness. Higher limits spread out your balances, which lenders see as positive risk management. However, you must avoid the temptation to rack up higher debt, as that would erode the benefit and increase your loan costs.

To strategically increase your credit limits, contact your card issuers to request limit raises after demonstrating consistent on-time payments. Higher limits can instantly improve your credit utilization ratio, but if you increase spending alongside, you risk higher debt and potential credit damage. Use new limits wisely by keeping balances low; this tactic helps your loan applications qualify for better APRs and faster approvals.

Building Credit with New Accounts

All new credit accounts can help you build your credit profile, but managing them responsibly is key. Opening the right type of accounts and making on-time payments shows lenders you’re trustworthy. Focus on accounts with fixed payments and clear reporting to credit bureaus, as these create a positive payment history. Avoid overextending yourself, and start small with manageable limits to steadily improve your credit score before applying for larger loans.

Using Secured Credit Cards

With secured credit cards, you deposit money upfront that typically acts as your credit limit, minimizing risk to the lender. Using one regularly for small purchases and fully paying the balance on time builds payment history and improves your credit utilization ratio. Because these cards are easier to obtain with lower credit scores, they provide a practical way for you to demonstrate creditworthiness while controlling potential debt.

Consider Credit-Builder Loans

To build credit steadily, you can take out a credit-builder loan designed specifically for credit improvement. These loans report your monthly payments to credit bureaus, allowing you to develop a strong repayment record. They often come in modest amounts, making them easier to manage and helping you establish a positive credit history without immediate risk.

Loans of this type work by holding the borrowed amount in a secured account until you’ve fully repaid it, so you actually build savings while building credit. The regular, on-time payments reported to bureaus improve your score over time, but missing payments can immediately hurt it. These loans suit you if you want a disciplined, low-risk way to show lenders you can handle debt responsibly, especially if your current credit is limited or poor.

To wrap up

Hence, before applying for an instant-approval loan, you can enhance your credit profile by paying down existing debts, correcting errors on your credit report, and avoiding new hard inquiries. Maintaining on-time payments and keeping your credit utilization low signals financial responsibility to lenders. Taking these steps can improve your loan offers, secure lower interest rates, and increase the likelihood of approval, ultimately strengthening your position in fast-paced investment opportunities.